Get the free Intra-Entity Revenue - sites krieger jhu

Show details

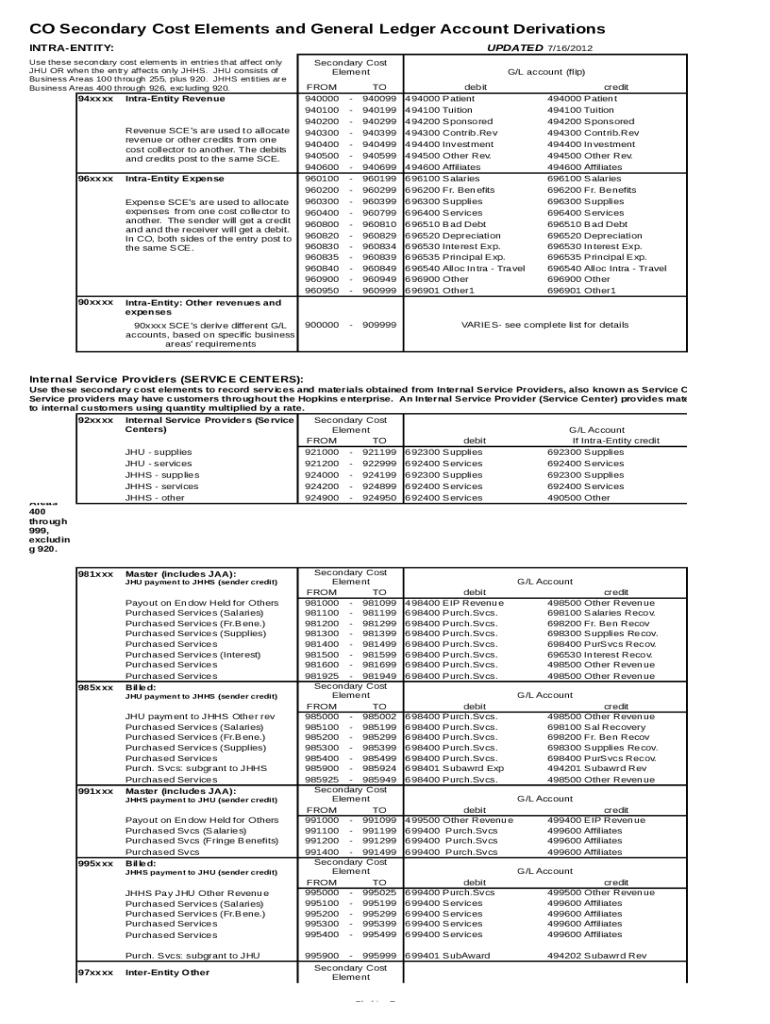

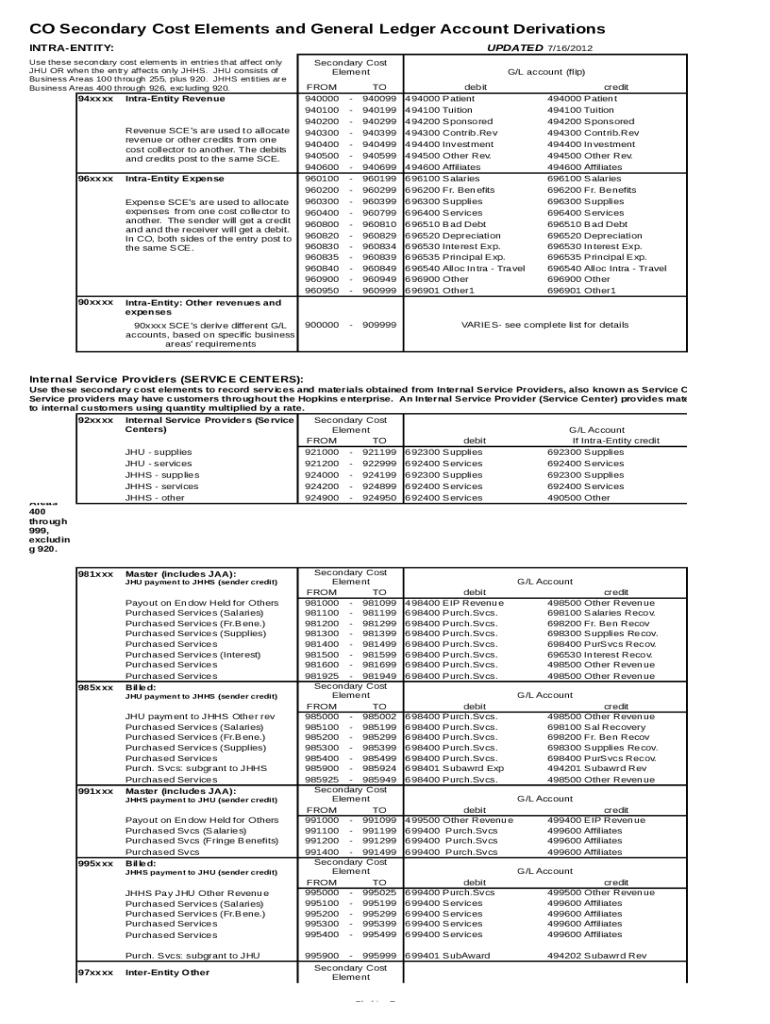

CO Secondary Cost Elements and General Ledger Account Derivations

INTENSITY:UPDATED 7/16/2012Use these secondary cost elements in entries that affect only

JHU OR when the entry affects only HHS. JHU

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign intra-entity revenue - sites

Edit your intra-entity revenue - sites form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your intra-entity revenue - sites form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit intra-entity revenue - sites online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit intra-entity revenue - sites. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out intra-entity revenue - sites

How to fill out intra-entity revenue

01

Identify the intra-entity revenue: This refers to revenue generated from transactions between entities within the same organization.

02

Determine the nature of the revenue: Understand the type of transactions that result in intra-entity revenue, such as intercompany sales, service fees, or shared costs.

03

Gather the necessary information: Collect all relevant financial data, including invoices, receipts, and any supporting documentation related to the intra-entity revenue.

04

Record the revenue: Input the intra-entity revenue information into the appropriate accounting system or software.

05

Allocate the revenue: Allocate the revenue to the respective entities involved in the transaction based on their ownership percentage or any predetermined allocation method.

06

Verify accuracy: Double-check the recorded revenue amounts and allocations to ensure accuracy.

07

Reconcile with other accounts: Compare the recorded intra-entity revenue with other related accounts, such as intercompany payables or receivables, to ensure consistency.

08

Prepare financial statements: Use the recorded intra-entity revenue to prepare accurate financial statements for the organization.

09

Seek professional assistance if needed: If you encounter complex transactions or challenges in filling out intra-entity revenue, consider seeking assistance from accounting professionals or consultants.

Who needs intra-entity revenue?

01

Multinational corporations: Companies with subsidiaries or entities in multiple countries often need to track and report intra-entity revenue to understand the financial performance of individual entities and the overall organization.

02

Holding companies: Organizations that own multiple subsidiaries or entities require intra-entity revenue information to consolidate financial statements and make strategic decisions based on the performance of each entity.

03

Joint ventures: Entities engaged in joint ventures or partnerships need to record and report intra-entity revenue to accurately assess the financial results of collaborative projects.

04

Organizations with shared services: Companies that centralize certain functions, such as IT or HR services, and charge fees for those services among various entities within the organization need to track and report intra-entity revenue.

05

Compliance and regulatory bodies: Authorities responsible for financial regulation and oversight may require organizations to provide details of intra-entity revenue to ensure compliance with accounting standards and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify intra-entity revenue - sites without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your intra-entity revenue - sites into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get intra-entity revenue - sites?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific intra-entity revenue - sites and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute intra-entity revenue - sites online?

Easy online intra-entity revenue - sites completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is intra-entity revenue?

Intra-entity revenue refers to the income generated from transactions between different entities that are part of the same corporate group or consolidated financial statements. It typically includes sales, services, or transfers of assets conducted between affiliated companies.

Who is required to file intra-entity revenue?

Entities that are part of a consolidated group or affiliated companies are generally required to file intra-entity revenue, particularly if they must report consolidated financial results for tax or regulatory purposes.

How to fill out intra-entity revenue?

Filling out intra-entity revenue typically involves disclosing all transactions between affiliated entities on financial reports, ensuring that intercompany revenues and expenses are properly eliminated for accurate reporting.

What is the purpose of intra-entity revenue?

The purpose of reporting intra-entity revenue is to provide a clearer picture of the financial performance of the overall corporate group by eliminating duplication of revenue and expenses that occur within the group.

What information must be reported on intra-entity revenue?

Information that must be reported includes the nature of the transactions, amounts earned or incurred, the entities involved, and any adjustments made to eliminate intercompany transactions.

Fill out your intra-entity revenue - sites online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Intra-Entity Revenue - Sites is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.