Get the free Forbearance Plan Request Forbearance Plan Set-up

Show details

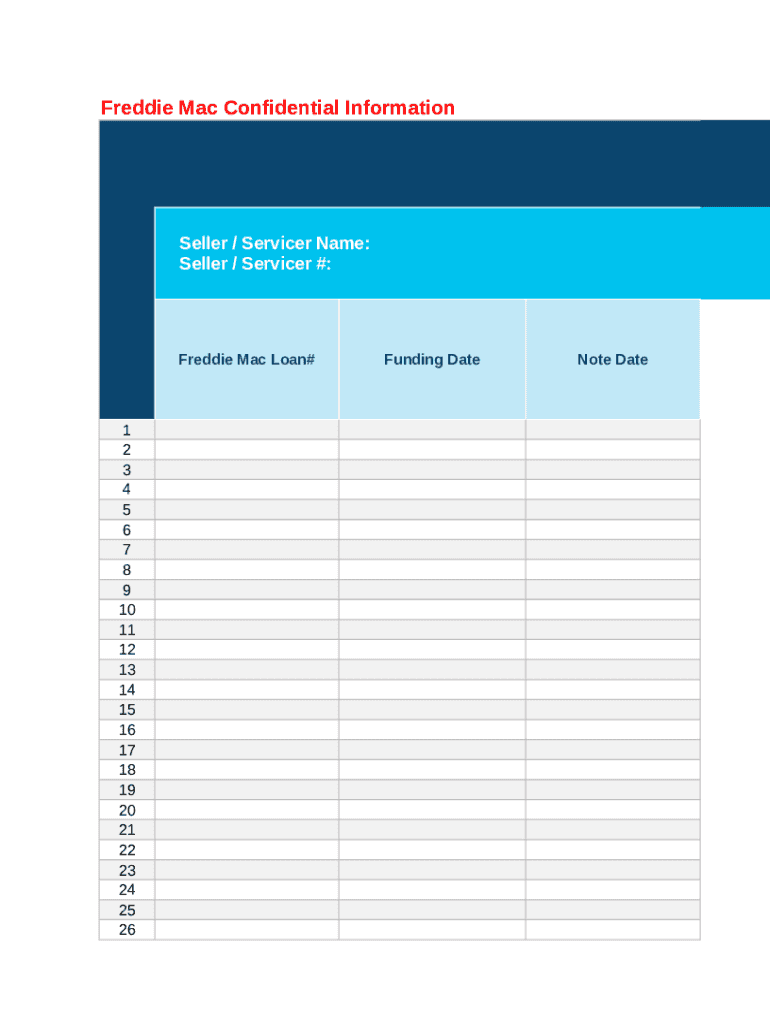

Freddie Mac Confidential InformationSeller / Service Name: Seller / Service #:Freddie Mac Loan#1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26Funding Denote Date27 28 29 30 31

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign forbearance plan request forbearance

Edit your forbearance plan request forbearance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your forbearance plan request forbearance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit forbearance plan request forbearance online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit forbearance plan request forbearance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out forbearance plan request forbearance

How to fill out forbearance plan request forbearance

01

To fill out a forbearance plan request, follow these steps:

02

Contact your loan servicer: Get in touch with the organization or company that handles your loan. They will provide you with the necessary forms and guidance on how to proceed.

03

Understand the terms and conditions: Read the forbearance plan agreement carefully to understand the terms and conditions. It's essential to be aware of the repayment options and any interest that may accrue during the forbearance period.

04

Fill out the request form: Complete the provided forbearance plan request form accurately. Make sure to provide all the required information, including personal details, loan details, and the reason for seeking forbearance.

05

Attach supporting documents: Depending on the specific requirements, you may need to include supporting documents such as proof of financial hardship, income statements, or medical records.

06

Submit the form: Once you have filled out the form and gathered all the necessary documents, submit the request to your loan servicer. Ensure that you keep a copy of the completed form for your records.

07

Follow up: After submitting the forbearance plan request, stay in touch with your loan servicer to track the progress. They may require additional information or documentation, so it's important to be responsive and proactive throughout the process.

08

Review the plan: Once your request is approved, carefully review the terms of the forbearance plan. Understand the duration of the forbearance period, any revised payment schedule, and how interest will be handled during this time.

09

Fulfill the agreement: During the forbearance period, make sure to adhere to the terms of the agreement. Make any necessary payments as agreed or follow the revised payment schedule.

10

Communicate any changes: If your financial situation changes during the forbearance period, inform your loan servicer promptly. They can guide you on any potential adjustments to the plan or alternative assistance options.

11

Complete the forbearance period: Once the forbearance period ends, resume regular payments as per the original loan terms. If you are still facing financial difficulties, explore other assistance programs or options available.

Who needs forbearance plan request forbearance?

01

Individuals who are experiencing temporary financial hardships and struggling to make their loan payments may need to request forbearance plan forbearance.

02

Common situations that may warrant forbearance include unexpected medical expenses, job loss, natural disasters, or any other circumstances that affect your ability to meet your loan obligations.

03

Forbearance can provide temporary relief by allowing you to pause or reduce loan payments for a specified period, giving you time to stabilize your financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify forbearance plan request forbearance without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your forbearance plan request forbearance into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find forbearance plan request forbearance?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the forbearance plan request forbearance in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How can I edit forbearance plan request forbearance on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing forbearance plan request forbearance, you need to install and log in to the app.

What is forbearance plan request forbearance?

A forbearance plan request forbearance is a formal request made by a borrower to temporarily pause or reduce their mortgage or loan payments due to financial hardship.

Who is required to file forbearance plan request forbearance?

Borrowers facing financial difficulties that affect their ability to make regular payments are required to file a forbearance plan request.

How to fill out forbearance plan request forbearance?

To fill out a forbearance plan request, borrowers should gather relevant financial information, complete the request form provided by their lender, and submit it along with any required documentation.

What is the purpose of forbearance plan request forbearance?

The purpose of a forbearance plan request forbearance is to provide temporary relief to borrowers who are experiencing financial challenges, allowing them time to recover without falling behind on their loan obligations.

What information must be reported on forbearance plan request forbearance?

The information generally required includes borrower identification details, loan account information, current financial situation, reasons for the request, and any supporting documentation.

Fill out your forbearance plan request forbearance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Forbearance Plan Request Forbearance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.