Get the free Revenues: Assumptions

Show details

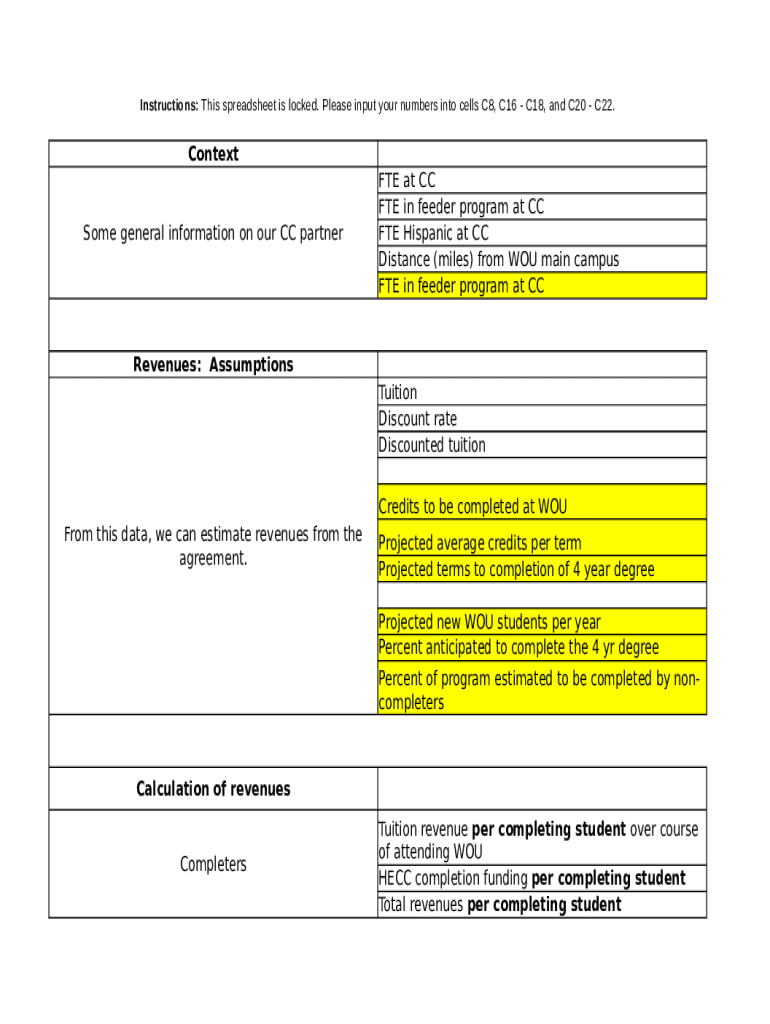

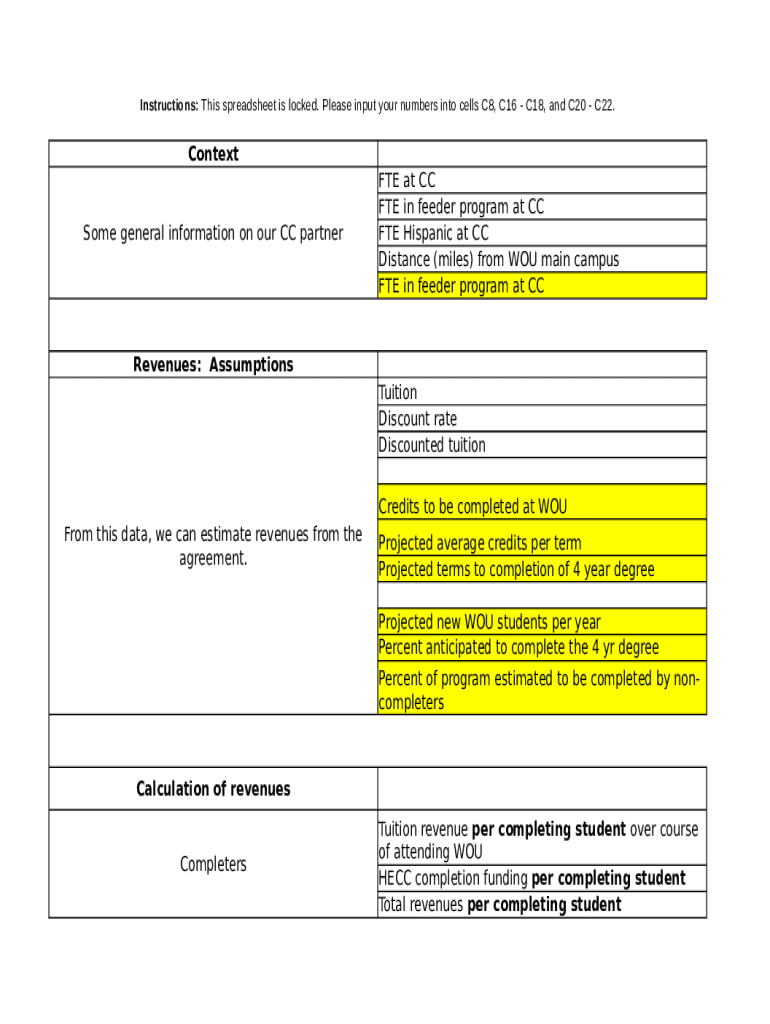

Instructions: This spreadsheet is locked. Please input your numbers into cells C8, C16 C18, and C20 C22. Contexts general information on our CC partner at CC FTE in feeder program at CC FTE Hispanic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenues assumptions

Edit your revenues assumptions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenues assumptions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing revenues assumptions online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit revenues assumptions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenues assumptions

How to fill out revenues assumptions

01

Start by gathering data on your current revenues. This can include sales figures, contract values, and any other sources of income.

02

Identify any trends or patterns in your revenues. This could include seasonality, customer preferences, or changes in market conditions.

03

Consider any external factors that may impact your revenues. This can include changes in regulations, new competitors entering the market, or economic conditions.

04

Use historical data and industry benchmarks to forecast future revenues. This can involve projecting revenue growth rates, adjusting for market trends, and considering any planned initiatives or investments.

05

Break down your revenue assumptions by product or service line, customer segment, or geographical region. This can help you identify potential areas of growth or areas that may need additional focus.

06

Validate your revenue assumptions by testing them against different scenarios or conducting sensitivity analysis. This can help you understand the potential impact of different factors on your revenues.

07

Document your revenue assumptions and keep them updated on a regular basis. This can help you track your performance, make informed decisions, and communicate your revenue forecast to stakeholders.

Who needs revenues assumptions?

01

Businesses of all sizes and industries need revenue assumptions. These assumptions are crucial for financial planning, budgeting, and decision-making.

02

Entrepreneurs and start-ups need revenue assumptions to create realistic financial projections and attract investors.

03

Financial analysts and investors need revenue assumptions to analyze the performance and value of companies.

04

Government agencies and non-profit organizations need revenue assumptions to plan and allocate resources effectively.

05

Sales and marketing teams need revenue assumptions to set targets, develop strategies, and evaluate the success of their initiatives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my revenues assumptions in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your revenues assumptions as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find revenues assumptions?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific revenues assumptions and other forms. Find the template you need and change it using powerful tools.

How do I fill out the revenues assumptions form on my smartphone?

Use the pdfFiller mobile app to fill out and sign revenues assumptions. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is revenues assumptions?

Revenue assumptions are estimates or projections related to expected income generated through business operations, typically used for financial planning and budgeting.

Who is required to file revenues assumptions?

Businesses, especially those seeking investment or loans, are required to file revenue assumptions. This is often the case for startups and companies preparing financial statements.

How to fill out revenues assumptions?

To fill out revenue assumptions, gather historical financial data, market analysis, and forecasts. Use this information to project future revenue streams, adjusting for factors like seasonality and market trends.

What is the purpose of revenues assumptions?

The purpose of revenue assumptions is to provide a framework for estimating future income, which aids in budgeting, financial analysis, and strategic planning.

What information must be reported on revenues assumptions?

Key information that must be reported includes projected sales volumes, pricing strategies, market share expectations, and the basis for the assumptions made.

Fill out your revenues assumptions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenues Assumptions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.