Get the free Loss to Lease

Show details

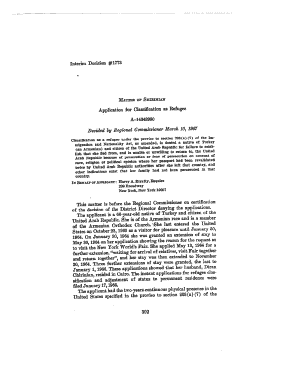

Click for support from multifamily. Constraining 12 Month P&L Month, Year Month, Yarmouth, Yarmouth, Year INCOME Gross Potential Rent (GPR): Loss to Lease Less Vacancy Less Bad Debt Less Concessions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loss to lease

Edit your loss to lease form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loss to lease form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loss to lease online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit loss to lease. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loss to lease

How to fill out loss to lease

01

Gather information about the vacant units or spaces that are causing the loss to lease.

02

Calculate the potential rental income for each vacant unit or space based on market rates.

03

Identify any factors that may be contributing to the loss to lease, such as delayed repairs or lack of amenities.

04

Develop a strategy to attract new tenants or negotiate higher rents with existing tenants.

05

Implement the strategy by marketing the vacant units or spaces, making necessary improvements, and negotiating lease agreements.

06

Track and monitor progress by regularly reviewing rental income and comparing it to the potential rental income.

07

Adjust the strategy if needed based on the results and continue to work towards reducing the loss to lease.

Who needs loss to lease?

01

Real estate owners and property managers who have vacancies or underperforming rental units or spaces.

02

Investors or financial institutions who want to assess the potential income from a property.

03

Market analysts or consultants who need to evaluate the financial performance of a real estate portfolio.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my loss to lease directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your loss to lease and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I modify loss to lease without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your loss to lease into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I edit loss to lease on an iOS device?

Use the pdfFiller mobile app to create, edit, and share loss to lease from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is loss to lease?

Loss to lease refers to the financial impact of rental spaces being leased at below market value, showing a difference between the potential income and the actual income received from rental properties.

Who is required to file loss to lease?

Typically, property owners, landlords, or property managers who manage rental properties are required to file loss to lease.

How to fill out loss to lease?

To fill out loss to lease, begin by gathering data on the property's potential rental income compared to the actual rental income, then complete the required forms, detailing the differences in amounts and any supporting documentation.

What is the purpose of loss to lease?

The purpose of loss to lease is to assess the financial impact of under-leasing and to provide property owners and stakeholders with insights on revenue potential and rental pricing strategies.

What information must be reported on loss to lease?

Information that must be reported includes the property's address, the total potential rental income, actual income received, the difference (loss), and any relevant details to explain the discrepancies.

Fill out your loss to lease online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loss To Lease is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.