Get the free Debt Service Reserve Fund

Show details

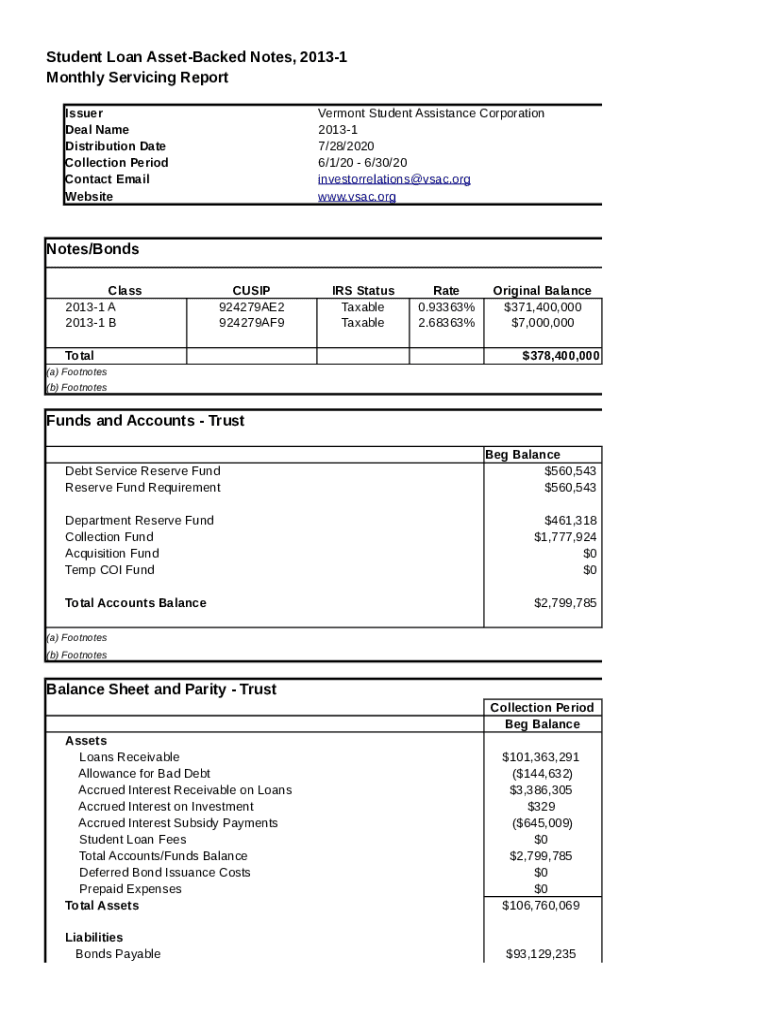

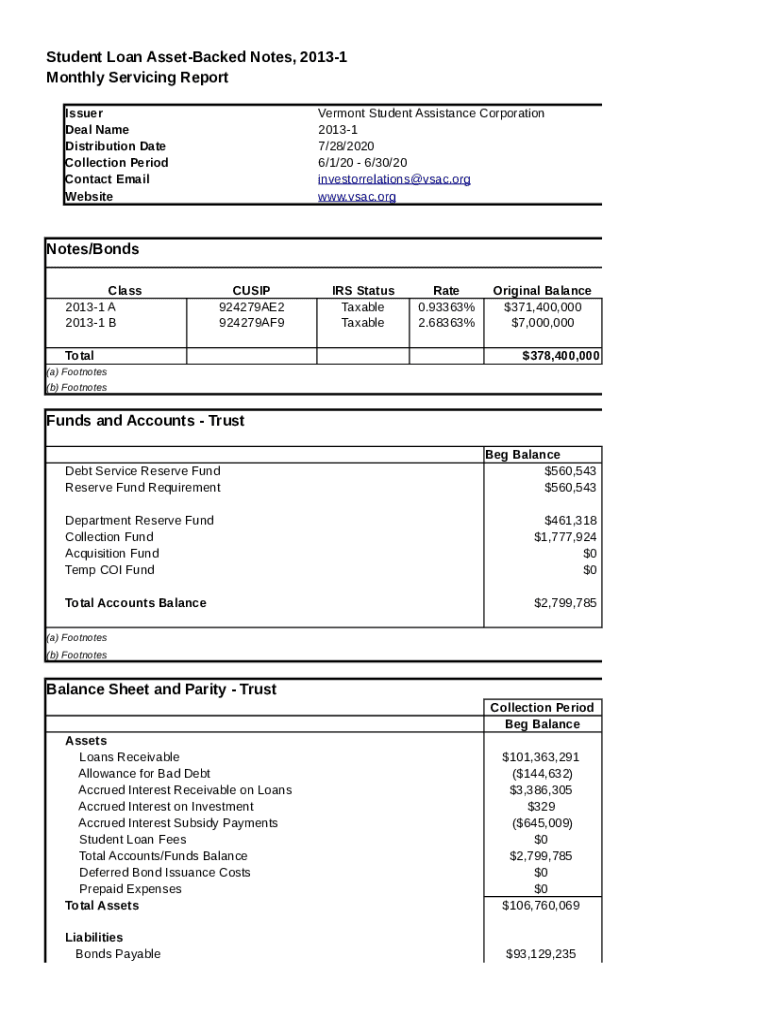

Student Loan AssetBacked Notes, 20131 Monthly Servicing Report Issuer Deal Name Distribution Date Collection Period Contact Email Website Vermont Student Assistance Corporation 20131 7/28/2020 6/1/20

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt service reserve fund

Edit your debt service reserve fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt service reserve fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing debt service reserve fund online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit debt service reserve fund. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debt service reserve fund

How to fill out debt service reserve fund

01

To fill out a debt service reserve fund, follow these steps:

02

Determine the required reserve fund amount: Review the terms and conditions of the debt agreement or bond issuance to identify the specific reserve fund requirements. This information will outline the minimum amount that needs to be maintained in the fund.

03

Allocate funds: Set aside the necessary funds from operating cash flows or allocate a portion of the project budget specifically for the debt service reserve fund.

04

Open a separate account: Establish a separate bank account for the debt service reserve fund. This account should be titled appropriately to indicate its purpose.

05

Deposit funds: Transfer or deposit the allocated funds into the reserve account, ensuring that the amount meets or exceeds the minimum required reserve fund amount.

06

Maintain the fund: Regularly monitor the reserve fund balance to ensure it remains at or above the required minimum. If any withdrawals from the fund are made, replenish the amount as soon as possible to maintain compliance with the debt agreement.

07

Document transactions: Maintain accurate records of all deposits, withdrawals, and any interest earned on the reserve fund. These records will be necessary for reporting and audit purposes.

08

Remember to consult with legal and financial professionals to ensure compliance with applicable laws and regulations while filling out the debt service reserve fund.

Who needs debt service reserve fund?

01

Various entities may require a debt service reserve fund, including:

02

- Municipalities: Cities, towns, or local government agencies may establish a debt service reserve fund to support the repayment of municipal bonds or loans.

03

- Public institutions: Educational institutions, hospitals, or public utility companies may create a reserve fund to ensure they can meet their debt obligations.

04

- Private companies: Corporations or organizations that issue bonds or take loans may establish a reserve fund to provide a safety net for debt repayments.

05

Overall, any entity that has outstanding debt and wishes to enhance its creditworthiness or comply with bond covenants may consider setting up a debt service reserve fund.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find debt service reserve fund?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific debt service reserve fund and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit debt service reserve fund online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your debt service reserve fund to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I edit debt service reserve fund on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing debt service reserve fund.

What is debt service reserve fund?

A debt service reserve fund is a reserve account set up by an issuer of bonds, typically to ensure there are sufficient funds available to make debt service payments in the event of revenue shortfalls.

Who is required to file debt service reserve fund?

Entities that issue bonds and are required to maintain a debt service reserve fund as part of their financial management and compliance obligations are usually required to file for the fund.

How to fill out debt service reserve fund?

To fill out the debt service reserve fund, one typically needs to provide detailed information about the fund's balance, sources of funding, management details, and a breakdown of how the funds will be used for debt service obligations.

What is the purpose of debt service reserve fund?

The purpose of a debt service reserve fund is to provide a financial safety net to ensure that debt obligations can be met even when anticipated revenues are insufficient.

What information must be reported on debt service reserve fund?

Information that must be reported includes the current balance of the reserve fund, contributions made, expenditures, and any shortfalls or excesses related to the fund's purposes.

Fill out your debt service reserve fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt Service Reserve Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.