Get the free John Hancock Retirement Plan Services Codes

Show details

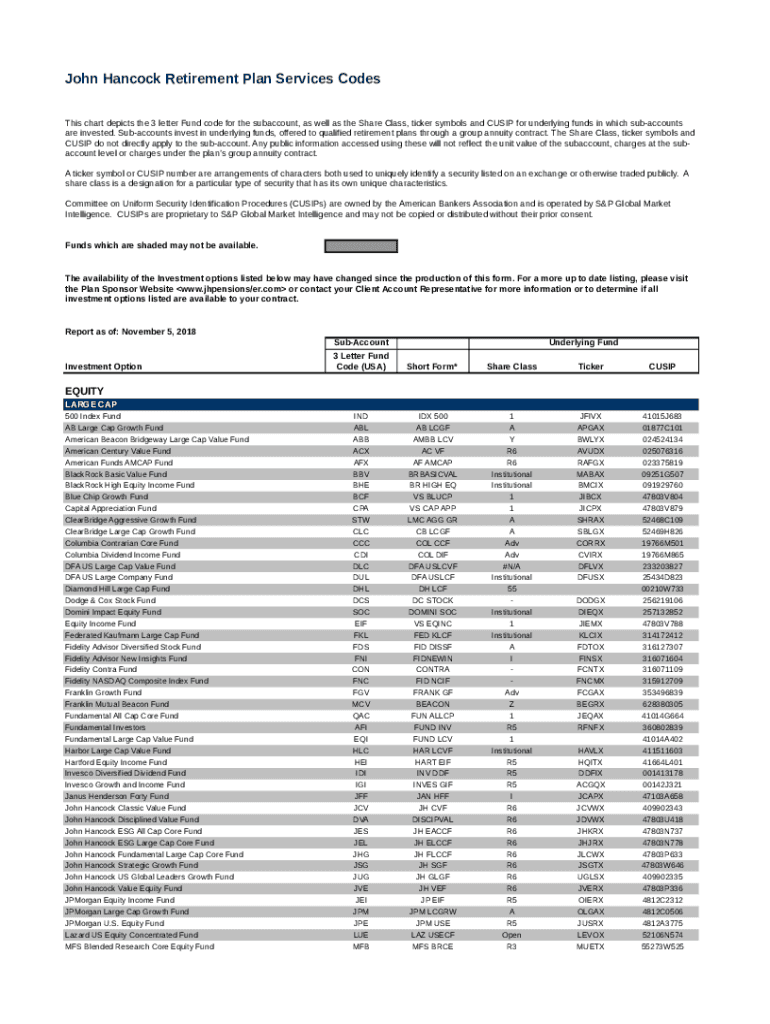

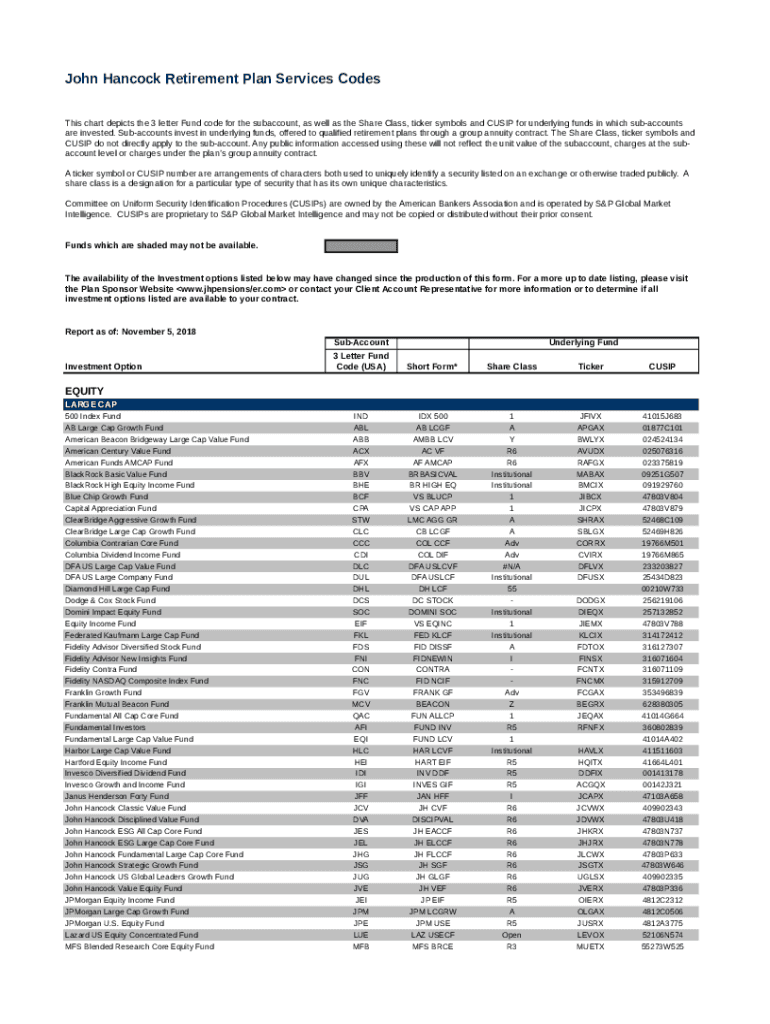

John Hancock Retirement Plan Services Codes

This chart depicts the 3 letter Fund code for the subaccount, as well as the Share Class, ticker symbols and CUSP for underlying funds in which subaccounts

are

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign john hancock retirement plan

Edit your john hancock retirement plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your john hancock retirement plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing john hancock retirement plan online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit john hancock retirement plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out john hancock retirement plan

How to fill out john hancock retirement plan

01

Start by reviewing the information provided by John Hancock regarding their retirement plan. This may include brochures, documents, or online resources.

02

Familiarize yourself with the different investment options available within the retirement plan. Understand the risks, potential returns, and fees associated with each option.

03

Determine your retirement goals and risk tolerance. Consider factors such as your age, financial situation, and retirement timeline.

04

Use the provided tools or consult a financial advisor to assess your current financial situation and estimate how much you need to save for retirement.

05

Decide on your contribution amount and frequency. You may choose to contribute a fixed percentage of your income or a specific dollar amount.

06

Fill out the necessary forms or use online tools to enroll in the John Hancock retirement plan. Provide accurate personal and financial information.

07

Select your desired investment options and allocate your contributions accordingly. Consider diversifying your investments to mitigate risk.

08

Review your retirement plan periodically and make adjustments as needed. Reassess your goals, investment performance, and changing circumstances.

09

Familiarize yourself with any employer matching contributions or other incentives offered by your employer through the John Hancock retirement plan.

10

Continually educate yourself about retirement planning and monitor the performance of your investments. Stay informed about any updates or changes to the John Hancock retirement plan.

Who needs john hancock retirement plan?

01

Anyone who is planning for retirement and is looking for a comprehensive retirement plan can benefit from the John Hancock retirement plan.

02

Individuals who want to take advantage of tax benefits associated with retirement savings can consider this plan.

03

Employees who work for companies that offer the John Hancock retirement plan as part of their benefits package should consider enrolling in the plan.

04

Self-employed individuals or freelancers who do not have access to employer-sponsored retirement plans can also opt for the John Hancock retirement plan.

05

People who want professional assistance and guidance in managing their retirement savings may find the resources provided by John Hancock valuable.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my john hancock retirement plan in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your john hancock retirement plan and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make edits in john hancock retirement plan without leaving Chrome?

john hancock retirement plan can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the john hancock retirement plan form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign john hancock retirement plan. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is john hancock retirement plan?

The John Hancock Retirement Plan is a retirement savings plan offered to employees, which allows them to save for retirement through various investment options managed by John Hancock.

Who is required to file john hancock retirement plan?

Employers who offer the John Hancock Retirement Plan to their employees are required to file the necessary documentation and reports associated with the plan.

How to fill out john hancock retirement plan?

To fill out the John Hancock Retirement Plan, participants typically need to complete an enrollment form, select investment options, and provide personal and employment information as directed by the plan administrator.

What is the purpose of john hancock retirement plan?

The purpose of the John Hancock Retirement Plan is to help employees save and invest for their retirement, ensuring they have funds available when they retire.

What information must be reported on john hancock retirement plan?

The information that must be reported includes employee contributions, employer matching contributions, investment performance, and account balances, among others.

Fill out your john hancock retirement plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

John Hancock Retirement Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.