Get the free CREDIT APPLICATION AND ACCOUNT AGREEMENT Publishers ...

Show details

Please fax or mail completed application and addendum to CREDIT APPLICATION AND ACCOUNT AGREEMENT BUSINESS INFORMATION: 140 Della Court Carol Stream, IL 60188 Tel: 630.221.1850 Fax: 630.221.1870 Publishers'

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit application and account

Edit your credit application and account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application and account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit application and account online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit application and account. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit application and account

How to fill out credit application and account:

01

Start by gathering all necessary documentation, such as personal identification, proof of income, and any relevant financial statements.

02

Fill out the credit application form accurately and completely. Provide all required information, including your name, contact details, social security number, employment history, and financial information.

03

Be sure to read and understand all terms and conditions associated with the credit application and account. This includes interest rates, fees, repayment terms, and any penalties.

04

If you have any doubts or questions, don't hesitate to reach out to the credit provider or financial institution for clarification. It's essential to have a clear understanding of the terms before proceeding.

05

Once the credit application is complete, submit it along with the required documentation to the appropriate credit provider or financial institution. This can typically be done online, by mail, or in-person at a branch location.

Who needs credit application and account:

01

Individuals who need to borrow money or access credit to finance purchases or cover expenses may require a credit application and account. This includes individuals seeking loans, credit cards, mortgages, or other forms of credit.

02

Businesses also frequently need credit applications and accounts to establish lines of credit, secure financing for operations or expansions, or manage cash flow.

03

Students and young adults may need to apply for credit accounts to start building their credit history and establish financial independence.

Overall, anyone who requires financial assistance or wants to establish creditworthiness may need to fill out a credit application and open an account.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit application and account for eSignature?

credit application and account is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in credit application and account without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your credit application and account, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit credit application and account on an Android device?

The pdfFiller app for Android allows you to edit PDF files like credit application and account. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

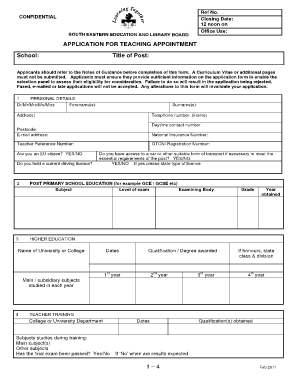

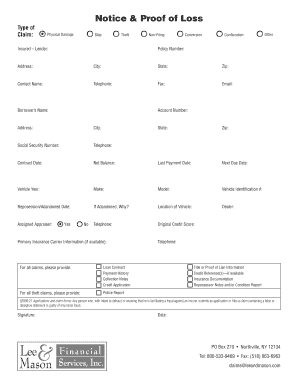

What is credit application and account?

A credit application is a form that a person or a business completes to apply for credit. It provides information about the applicant's financial history, income, and creditworthiness. An account, on the other hand, refers to a record of financial transactions related to a particular individual or business.

Who is required to file credit application and account?

Any individual or business that wishes to apply for credit from a lender or financial institution is required to file a credit application. Similarly, any individual or business that engages in financial transactions and needs to keep track of them is required to maintain an account.

How to fill out credit application and account?

To fill out a credit application, an applicant needs to provide personal and financial information such as name, address, employment details, income, and any existing debts or liabilities. Filling out an account involves recording and organizing financial transactions, including income, expenses, and balances.

What is the purpose of credit application and account?

The purpose of a credit application is to provide the lender with information necessary to make a decision regarding the applicant's creditworthiness and ability to repay the loan. An account, on the other hand, serves the purpose of keeping track of financial transactions and maintaining an accurate record of an individual's or business's financial activities.

What information must be reported on credit application and account?

A credit application typically requires information such as the applicant's personal details, financial history, employment status, income, and current debts. An account should report detailed information about financial transactions, including dates, amounts, and descriptions of the transactions.

Fill out your credit application and account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Application And Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.