Get the free Annual Tax Credit Review

Show details

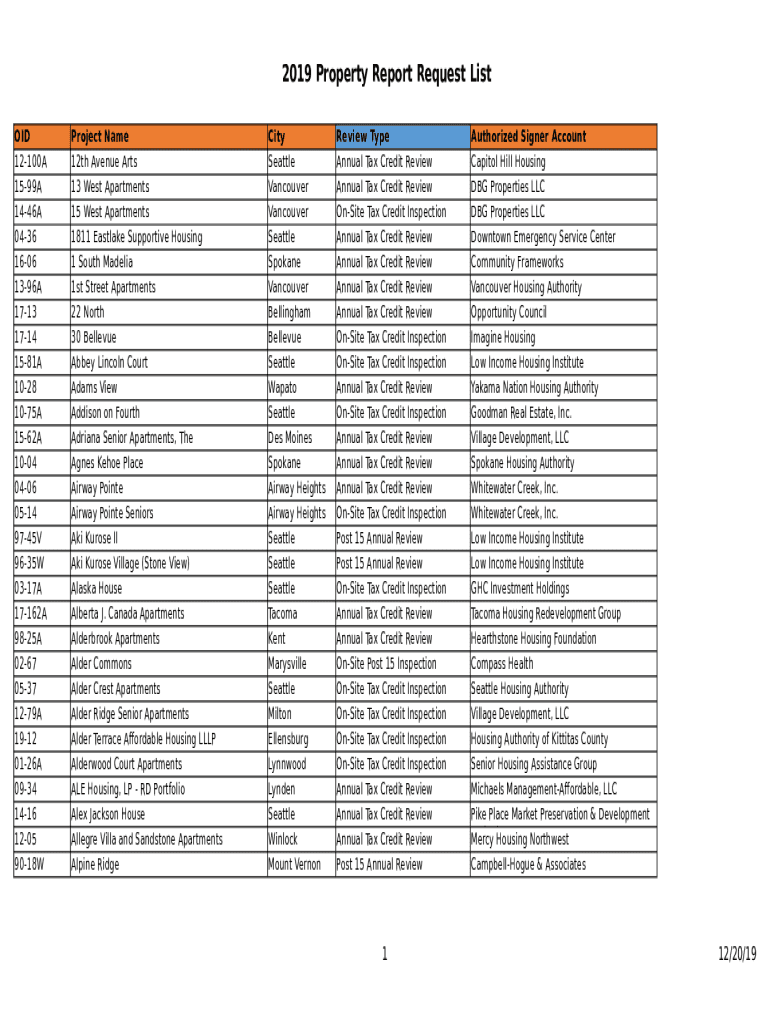

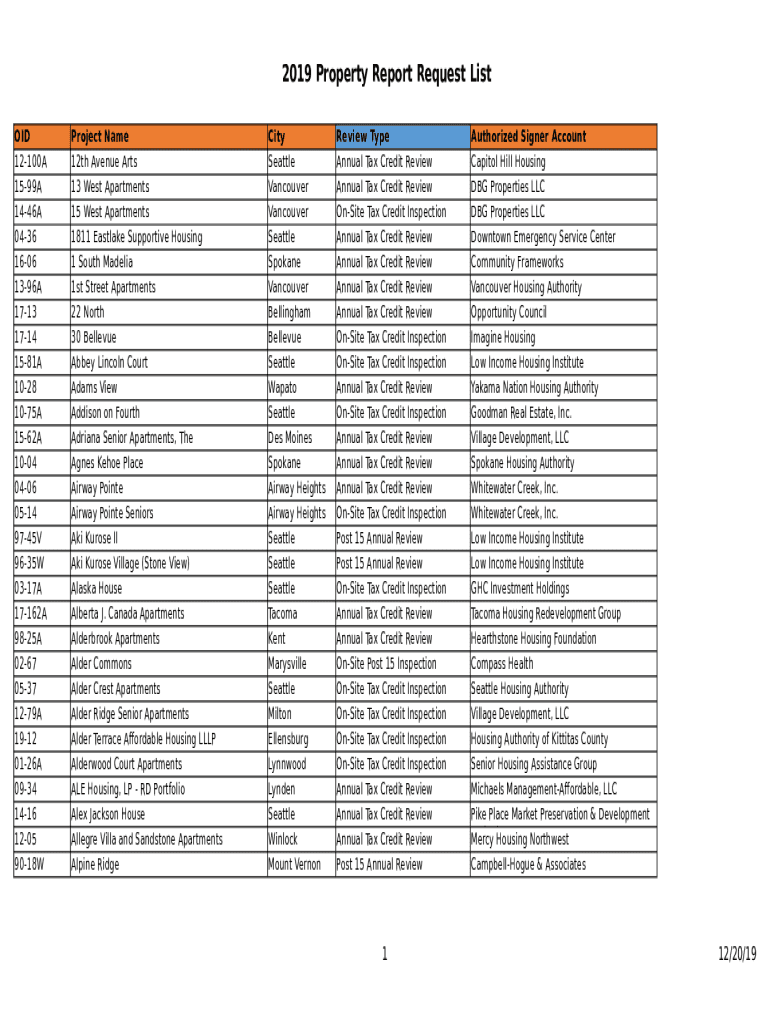

2019 Property Report Request List

DID

12100A

1599A

1446A

0436

1606

1396A

1713

1714

1581A

1028

1075A

1562A

1004

0406

0514

9745V

9635W

0317A

17162A

9825A

0267

0537

1279A

1912

0126A

0934

1416

1205

9018WProject

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual tax credit review

Edit your annual tax credit review form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual tax credit review form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual tax credit review online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit annual tax credit review. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual tax credit review

How to fill out annual tax credit review

01

Step 1: Gather all your tax documents such as W-2 forms, 1099 forms, and any other relevant documents related to your income and expenses.

02

Step 2: Review the instructions provided by the tax credit review form. Understand the eligibility criteria and any specific requirements for filling out the form.

03

Step 3: Fill out the basic information section of the form, which includes your name, address, Social Security number, and other personal details.

04

Step 4: Provide details about your income sources, such as wages, dividends, and interest. Attach the necessary supporting documents if required.

05

Step 5: Deduct eligible expenses, such as mortgage interest, educational expenses, medical expenses, and contributions to retirement accounts.

06

Step 6: Calculate the total tax credits you are eligible for based on your income, expenses, and any other applicable factors.

07

Step 7: Double-check all the information you have provided on the form to ensure accuracy. Make any necessary corrections or additions.

08

Step 8: Submit the completed tax credit review form along with any supporting documents to the designated tax authority or department.

09

Step 9: Keep a copy of the filled-out form and all supporting documents for your records in case of future audits or inquiries.

10

Step 10: Review any correspondence or follow-up communication from the tax authority regarding your tax credit review. Respond promptly if required.

Who needs annual tax credit review?

01

Anyone who wants to ensure they are receiving all the tax credits they are eligible for needs to complete an annual tax credit review.

02

Individuals or families with multiple income sources, self-employed individuals, homeowners with mortgage interest deductions, parents with eligible dependents, and people with significant medical expenses are some examples of who might benefit from an annual tax credit review.

03

Additionally, those who have experienced major life events such as marriage, divorce, birth of a child, or significant changes in income should also consider conducting a tax credit review to reassess their eligibility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify annual tax credit review without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your annual tax credit review into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete annual tax credit review online?

pdfFiller makes it easy to finish and sign annual tax credit review online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my annual tax credit review in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your annual tax credit review and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is annual tax credit review?

An annual tax credit review is a process conducted by taxpayers to assess their eligibility for tax credits and to ensure compliance with tax regulations related to those credits.

Who is required to file annual tax credit review?

Individuals or businesses that have claimed tax credits in the previous tax year are generally required to file an annual tax credit review.

How to fill out annual tax credit review?

To fill out an annual tax credit review, gather necessary financial documents, complete the required forms typically provided by tax authorities, and ensure all relevant income and credit information is accurately reported.

What is the purpose of annual tax credit review?

The purpose of the annual tax credit review is to verify that taxpayers are maintaining eligibility for the credits claimed and to prevent fraud or misuse of tax benefits.

What information must be reported on annual tax credit review?

Information that must be reported includes identification details, income levels, the type and amount of tax credits claimed, and any changes in circumstances that may affect eligibility.

Fill out your annual tax credit review online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Tax Credit Review is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.