Get the free LeasePlan-Post Tax Refund

Show details

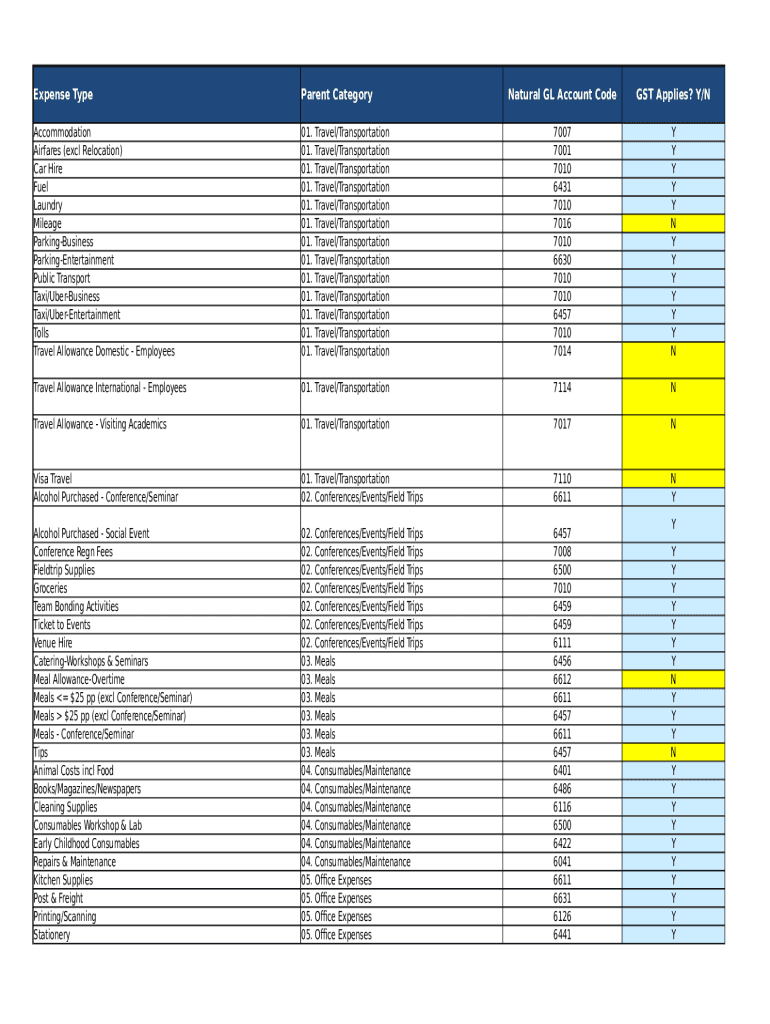

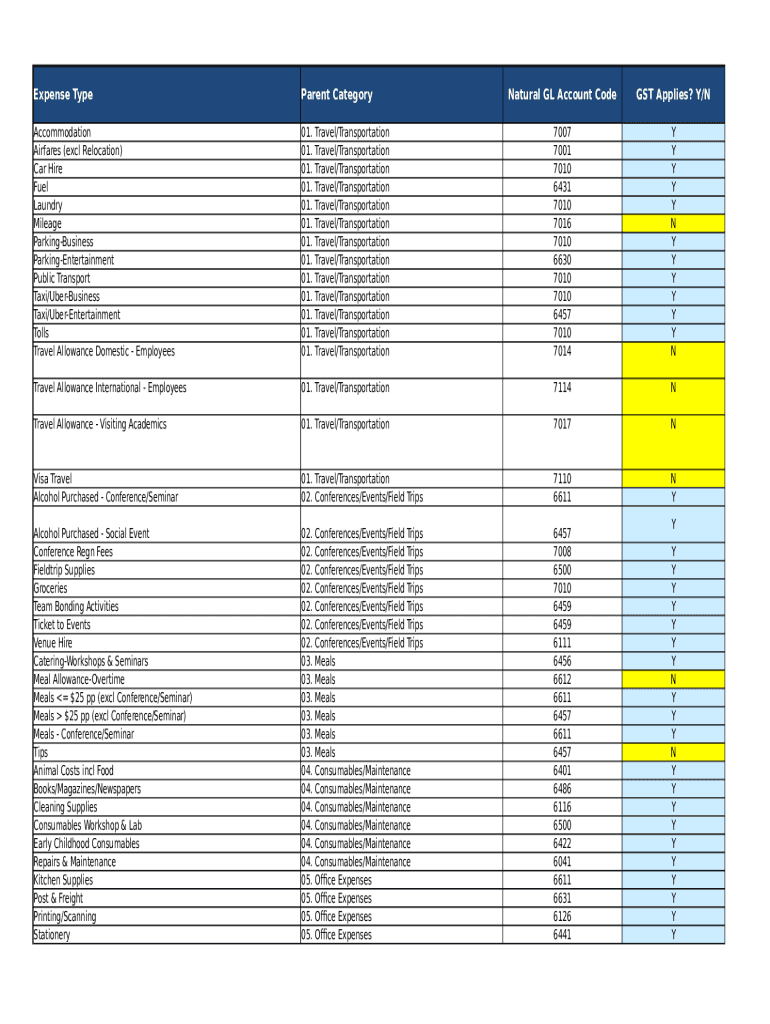

Expense Apparent CategoryNatural GL Account Codes Applies? Y/Accommodation Airfares (excl Relocation) Car Hire Fuel Laundry Mileage ParkingBusiness ParkingEntertainment Public Transport Taxi/UberBusiness

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign leaseplan-post tax refund

Edit your leaseplan-post tax refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your leaseplan-post tax refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing leaseplan-post tax refund online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit leaseplan-post tax refund. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out leaseplan-post tax refund

How to fill out leaseplan-post tax refund

01

To fill out the LeasePlan-Post Tax Refund form, follow these steps:

02

Start by entering your personal information such as name, address, and contact details in the designated sections of the form.

03

Next, provide details of your vehicle leasing contract, including the lease agreement number, the date of the lease, and the duration of the lease.

04

Specify the reason for claiming a tax refund, such as the end of the lease term or termination of the contract.

05

Attach supporting documents to validate your claim, such as lease termination documentation, proof of lease payments, and any other relevant proofs.

06

Review the completed form and ensure that all information provided is accurate and up to date.

07

Sign and date the form to certify that the information provided is true and accurate.

08

Submit the filled-out form along with the supporting documents to the relevant tax authority or the designated agency responsible for tax refunds.

09

Keep a copy of the submitted form and supporting documents for your records.

10

Wait for the processing of your claim and follow up with the tax authority if necessary.

Who needs leaseplan-post tax refund?

01

Anyone who has leased a vehicle through LeasePlan and is eligible for a tax refund can benefit from the LeasePlan-Post Tax Refund.

02

Typically, individuals who have completed their lease term, terminated their lease contract, or experienced a change in their tax liability may need to claim a tax refund.

03

This form is designed to cater to the needs of individuals who meet the specific criteria for claiming a tax refund on their LeasePlan vehicle lease.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify leaseplan-post tax refund without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your leaseplan-post tax refund into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the leaseplan-post tax refund in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your leaseplan-post tax refund right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete leaseplan-post tax refund on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your leaseplan-post tax refund. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is leaseplan-post tax refund?

LeasePlan post tax refund refers to the reimbursement process for employees who have incurred taxes related to vehicle leases provided by the company, allowing them to recover certain post-tax costs.

Who is required to file leaseplan-post tax refund?

Employees who have incurred post-tax expenses related to a vehicle lease through LeasePlan are required to file for a post tax refund.

How to fill out leaseplan-post tax refund?

To fill out the LeasePlan post tax refund, employees should gather necessary documentation, complete the designated refund form provided by LeasePlan, and submit all supporting materials as per the instructions given.

What is the purpose of leaseplan-post tax refund?

The purpose of the LeasePlan post tax refund is to reimburse employees for taxes they have paid on vehicle leases that are considered post-tax benefits.

What information must be reported on leaseplan-post tax refund?

The information that must be reported includes employee identification details, amount of taxes paid, vehicle lease details, and any supporting documentation for the incurred expenses.

Fill out your leaseplan-post tax refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Leaseplan-Post Tax Refund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.