Get the free Sales and Revenues

Show details

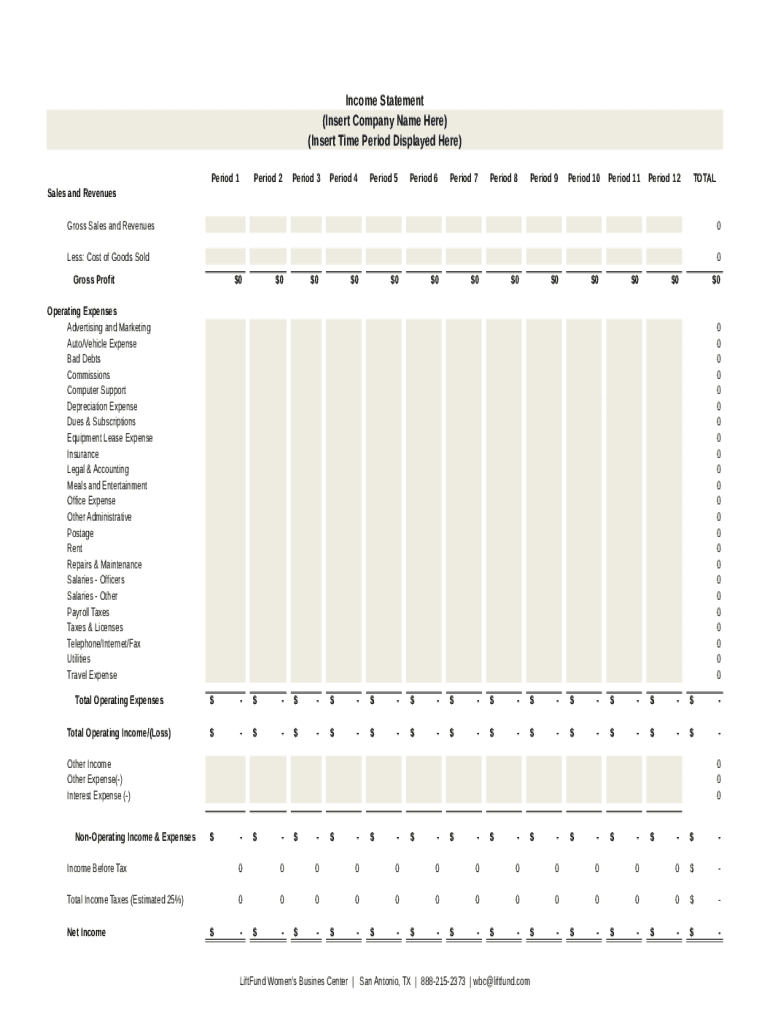

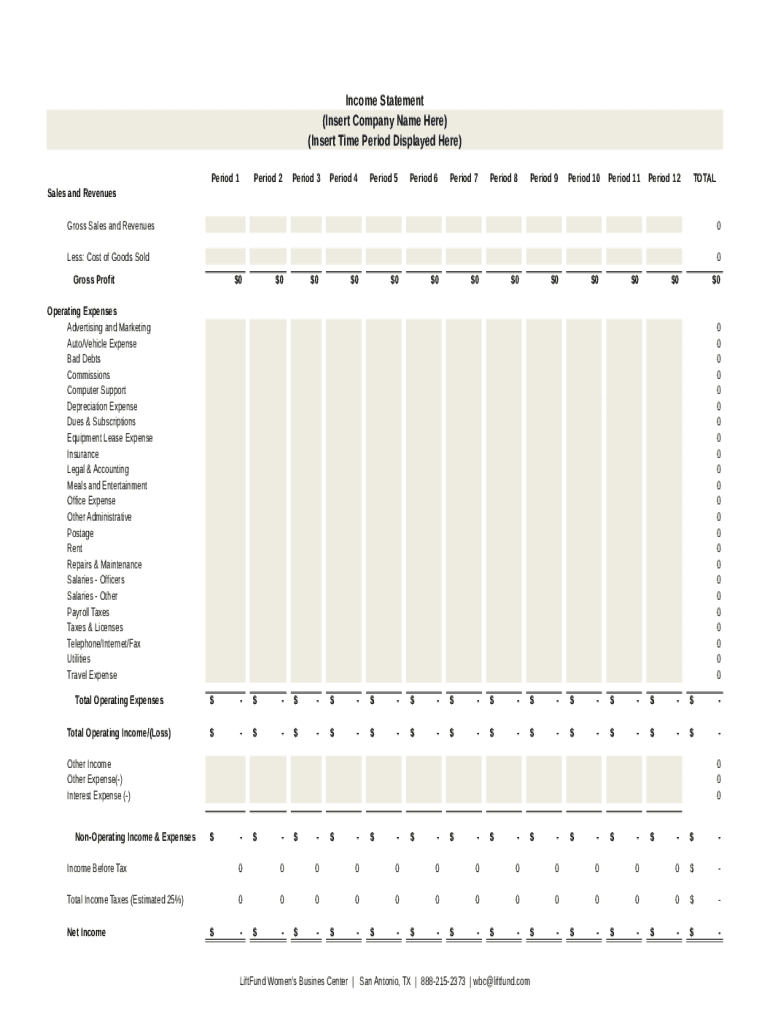

Income Statement (Insert Company Name Here) (Insert Time Period Displayed Here) Period 1Period 2Period 3Period 4Period 5Period 6Period 7Period 8Period 9Period 10Period 11Period 12TOTALSales and Revenues

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales and revenues

Edit your sales and revenues form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales and revenues form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sales and revenues online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sales and revenues. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales and revenues

How to fill out sales and revenues

01

To fill out sales and revenues, follow these steps:

02

Gather all relevant financial documents, such as invoices, receipts, and bank statements.

03

Create a spreadsheet or use accounting software to record your sales and revenues.

04

Enter the date of each transaction, along with the customer or client's name.

05

Specify the type of sale, such as product sales or service revenues.

06

Record the amount of each sale or revenue, including any taxes or discounts.

07

Calculate the total sales and revenues for a specific period, such as monthly, quarterly, or annually.

08

Compare the sales and revenues to previous periods to track growth or decline.

09

Use the sales and revenue data to analyze your business performance and make informed decisions.

10

Ensure accurate and up-to-date record-keeping by regularly reviewing and updating your sales and revenue information.

11

Consider consulting with a professional accountant or bookkeeper to ensure compliance with financial regulations and best practices.

Who needs sales and revenues?

01

Sales and revenues are critical for various stakeholders, including:

02

- Business owners: They need to monitor sales and revenues to assess the financial health of their company, make informed business decisions, and set realistic targets.

03

- Investors: They rely on sales and revenues to evaluate the profitability and growth potential of a business before investing their money.

04

- Financial institutions: Banks and lenders use sales and revenue data to assess the creditworthiness of a business when deciding whether to provide loans or credit.

05

- Government agencies: Tax authorities and regulatory bodies require sales and revenue information to ensure compliance with tax laws and financial regulations.

06

- Market analysts: They analyze sales and revenue data to understand market trends, identify potential opportunities, and make forecasts.

07

- Competitors: Sales and revenue information can provide insights into a competitor's performance, market share, and pricing strategies.

08

- Employees: Sales and revenue figures can influence performance-related incentives, bonuses, and overall job security.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sales and revenues to be eSigned by others?

Once your sales and revenues is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my sales and revenues in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your sales and revenues and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit sales and revenues straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing sales and revenues right away.

What is sales and revenues?

Sales and revenues refer to the total income generated by a business from its operations, particularly from selling goods or services before any expenses are deducted.

Who is required to file sales and revenues?

Typically, businesses and individuals engaged in commercial activities or that earn revenue from sales are required to file sales and revenues, depending on jurisdiction and specific tax regulations.

How to fill out sales and revenues?

Filling out sales and revenues generally involves reporting total sales figures, categorizing the types of products or services sold, calculating cost of goods sold, and detailing any taxes collected that are applicable.

What is the purpose of sales and revenues?

The purpose of sales and revenues is to provide an overview of a business's financial performance, help determine profitability, and ensure compliance with tax obligations.

What information must be reported on sales and revenues?

Information that must be reported typically includes total sales amounts, revenue sources, refunds or returns, and relevant tax collected on sales.

Fill out your sales and revenues online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales And Revenues is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.