Get the free DEPARTMENTAL REVENUE DEBIT/CREDIT MEMO DETAIL REPORT - financialservices wvu

Show details

WSU

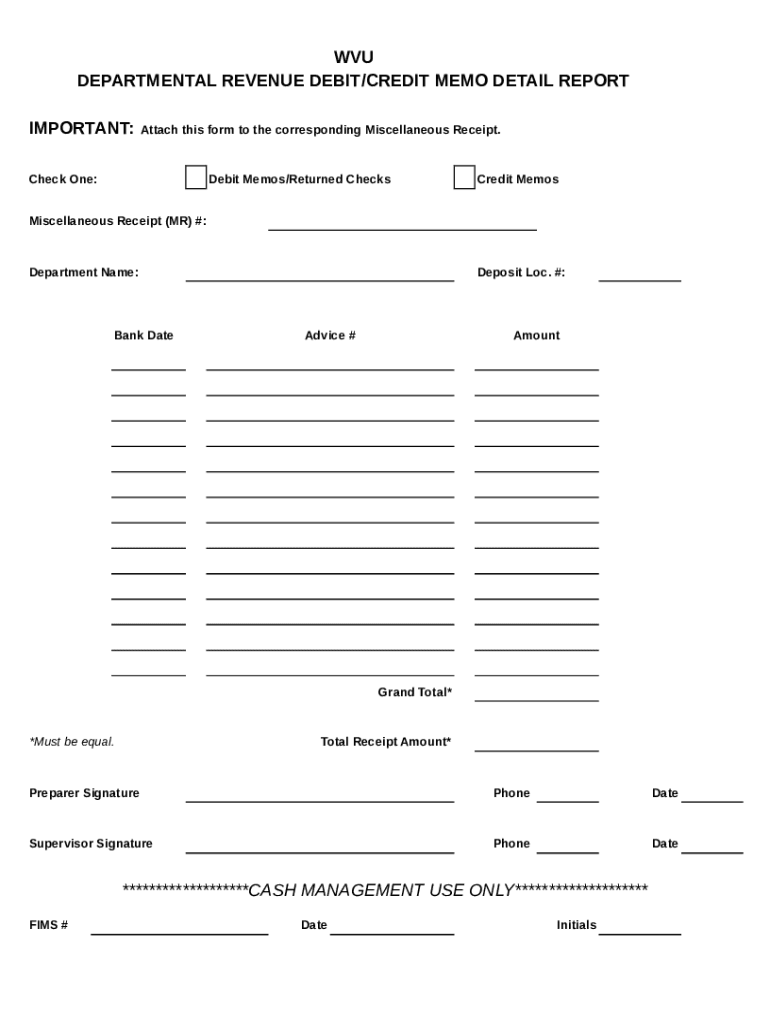

DEPARTMENTAL REVENUE DEBIT/CREDIT MEMO DETAIL REPORT

IMPORTANT:Attach this form to the corresponding Miscellaneous Receipt. Check One:Debit Memos/Returned ChecksCredit MemosMiscellaneous Receipt

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign departmental revenue debitcredit memo

Edit your departmental revenue debitcredit memo form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your departmental revenue debitcredit memo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing departmental revenue debitcredit memo online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit departmental revenue debitcredit memo. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out departmental revenue debitcredit memo

How to fill out departmental revenue debitcredit memo

01

Gather all the necessary information about the departmental revenue.

02

Identify the specific debit and credit transactions to be recorded in the memo.

03

Create a table with columns for the relevant information, such as date, description, debit amount, credit amount, and balance.

04

Start filling out the memo by entering the date of the transaction in the first column.

05

Provide a brief description of the transaction in the second column.

06

Determine whether the transaction is a debit or credit and enter the corresponding amount in the third or fourth column.

07

Calculate the balance by adding the previous transactions' balance to the current transaction's amount.

08

Repeat steps 4-7 for each transaction, ensuring the balances are correctly updated.

09

Once all transactions are recorded, review the memo for accuracy and completeness.

10

Double-check all calculations and cross-reference the memo with supporting documentation.

11

Make any necessary adjustments or corrections before finalizing the memo.

12

Safely store the filled-out departmental revenue debit/credit memo for future reference and audit purposes.

Who needs departmental revenue debitcredit memo?

01

Departments within an organization that track and document internal revenue transactions require departmental revenue debit/credit memos.

02

This includes accounting departments, financial teams, and administrative units responsible for managing revenue and expenses at departmental levels.

03

These memos serve as official records of the financial activities within a specific department.

04

They are often used for internal bookkeeping, financial reporting, management analysis, and auditing purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit departmental revenue debitcredit memo online?

With pdfFiller, the editing process is straightforward. Open your departmental revenue debitcredit memo in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I make edits in departmental revenue debitcredit memo without leaving Chrome?

departmental revenue debitcredit memo can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete departmental revenue debitcredit memo on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your departmental revenue debitcredit memo by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is departmental revenue debitcredit memo?

A departmental revenue debit/credit memo is a document used to adjust or correct revenue transactions in accounting, often reflecting changes in amounts billed or adjustments due to returns.

Who is required to file departmental revenue debitcredit memo?

Departments that handle revenue transactions that need adjustments or corrections are required to file a departmental revenue debit/credit memo.

How to fill out departmental revenue debitcredit memo?

To fill out a departmental revenue debit/credit memo, include the entity's information, the specific transaction being adjusted, amount being debited or credited, reason for adjustment, and relevant signatures.

What is the purpose of departmental revenue debitcredit memo?

The purpose of the departmental revenue debit/credit memo is to provide a clear record of adjustments made to revenue accounts, ensuring accurate financial reporting and accountability.

What information must be reported on departmental revenue debitcredit memo?

The memo must report the transaction date, description of the adjustment, amount of the debit or credit, account numbers affected, and authorization by an approver.

Fill out your departmental revenue debitcredit memo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Departmental Revenue Debitcredit Memo is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.