Get the free Enhanced Coverage Loan Short Form Policy subject to Reissue

Show details

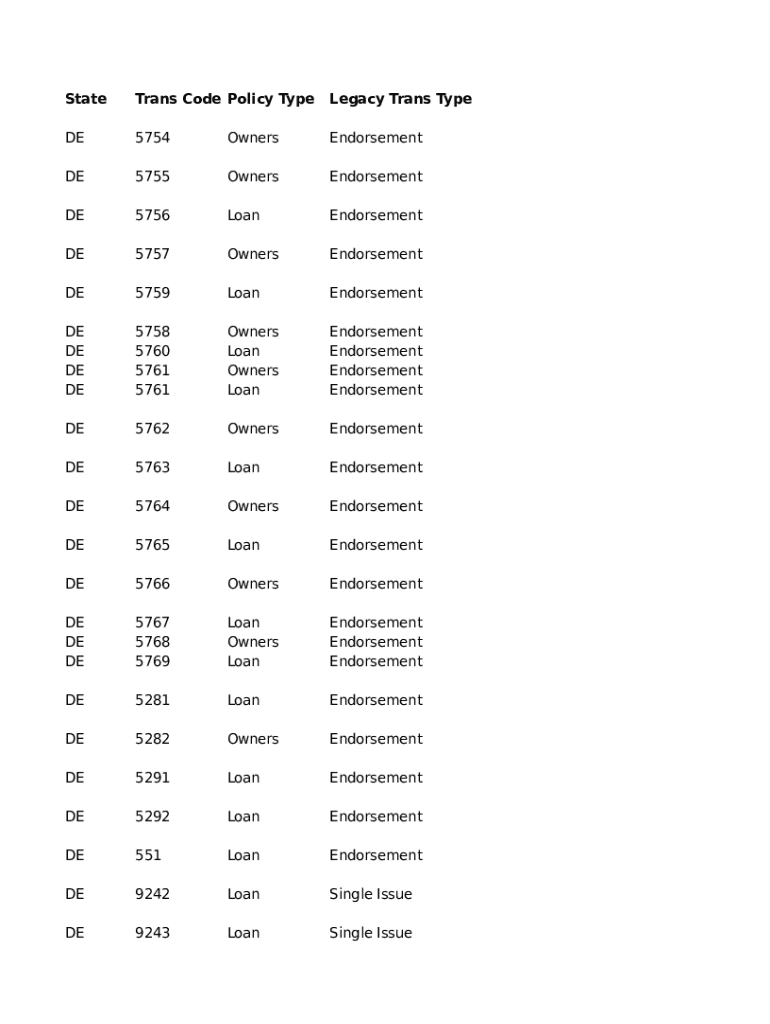

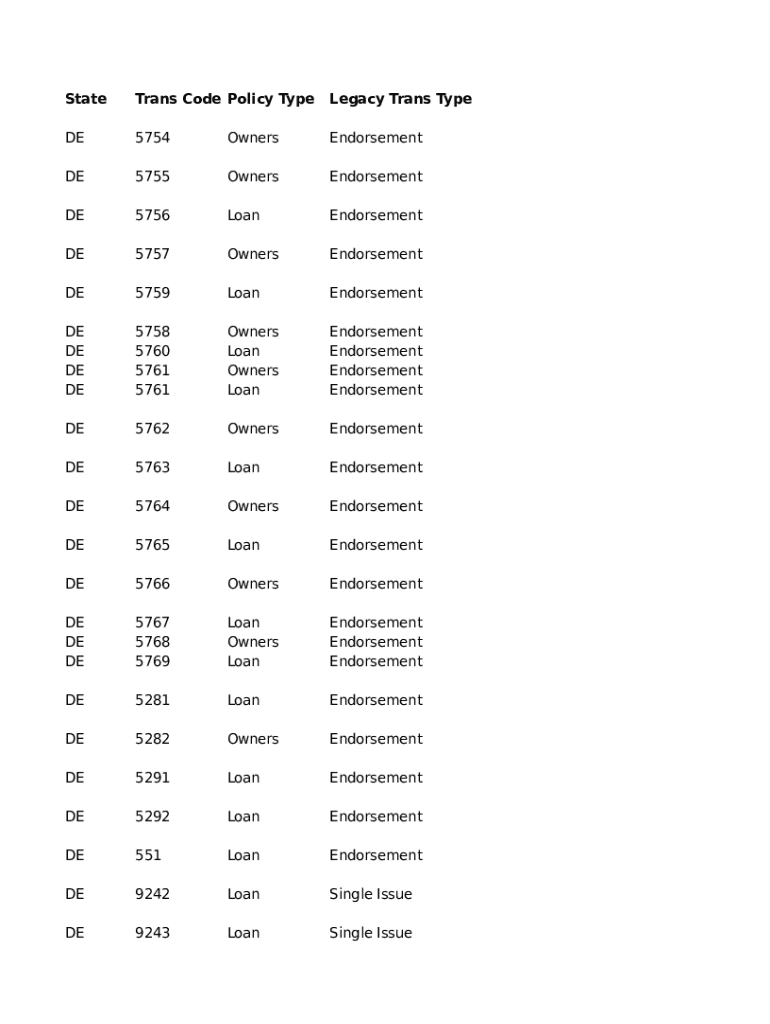

Statesman Code Policy TypeLegacy Trans TypeDE5754OwnersEndorsementDE5755OwnersEndorsementDE5756LoanEndorsementDE5757OwnersEndorsementDE5759LoanEndorsementDE DE DE5758 5760 5761 5761Owners Loan Owners

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign enhanced coverage loan short

Edit your enhanced coverage loan short form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your enhanced coverage loan short form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing enhanced coverage loan short online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit enhanced coverage loan short. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out enhanced coverage loan short

How to fill out enhanced coverage loan short

01

Begin by gathering all the necessary documents required to fill out the enhanced coverage loan short. These documents may include your identification proof, income documents, bank statements, and other relevant financial information.

02

Read the loan application form carefully and ensure you understand all the sections and requirements. Pay close attention to the enhanced coverage options provided and select the ones that suit your needs.

03

Start filling out the form by providing your personal information such as name, address, contact details, and social security number. Ensure accuracy and double-check for any errors.

04

Move on to the income section where you will be required to provide details about your current employment and income sources. Attach supporting documents such as pay stubs or income tax returns.

05

Fill in the details regarding the loan amount you require, the purpose of the loan, and the desired repayment term. Be transparent and provide accurate information.

06

If opting for enhanced coverage options, carefully review the options available and select the ones that align with your needs and preferences.

07

Once you have completed filling out the form, review it thoroughly to make sure all the information is correct and complete. Make any necessary corrections before submitting.

08

Submit the filled-out enhanced coverage loan short form along with the required documents to the designated authority or financial institution.

09

Wait for the approval process to be completed. It may take some time for the authorities to review your application and make a decision.

10

If your enhanced coverage loan short application is approved, carefully go through the terms and conditions provided by the lender. Seek clarification if needed before signing the loan agreement.

11

Sign the loan agreement and make sure to adhere to the agreed-upon repayment schedule.

12

Monitor your loan account regularly and ensure timely repayment to avoid any penalties or complications.

13

If you face any difficulties or have any concerns regarding the enhanced coverage loan short, reach out to the lender or financial institution for assistance. They will guide you accordingly.

Who needs enhanced coverage loan short?

01

Enhanced coverage loan short is suitable for individuals or businesses in need of additional financial protection and security. It is especially beneficial for those who require loan coverage for a specific short-term purpose like medical expenses, home repairs, unexpected bills, or temporary cash flow difficulties. Additionally, individuals who value the peace of mind provided by enhanced coverage options can also benefit from this type of loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify enhanced coverage loan short without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your enhanced coverage loan short into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute enhanced coverage loan short online?

Easy online enhanced coverage loan short completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out enhanced coverage loan short using my mobile device?

Use the pdfFiller mobile app to fill out and sign enhanced coverage loan short on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is enhanced coverage loan short?

Enhanced coverage loan short is a specific type of loan application or reporting form that provides additional assurances or protections for lenders and borrowers related to loan agreements.

Who is required to file enhanced coverage loan short?

Entities that engage in certain types of lending activities that fall under regulations requiring enhanced safeguards must file the enhanced coverage loan short.

How to fill out enhanced coverage loan short?

To fill out an enhanced coverage loan short, one must accurately complete the required sections of the form, including borrower information, loan details, and any supplementary documentation that supports the application.

What is the purpose of enhanced coverage loan short?

The purpose of an enhanced coverage loan short is to provide additional information and context surrounding a loan's terms, ensuring compliance with lending regulations and protecting both lenders and borrowers.

What information must be reported on enhanced coverage loan short?

The enhanced coverage loan short typically requires reporting of loan amount, terms, borrower details, risk assessments, and any relevant financial information pertinent to the lending process.

Fill out your enhanced coverage loan short online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Enhanced Coverage Loan Short is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.