Get the free Central Audit and Compliance for State Entities

Show details

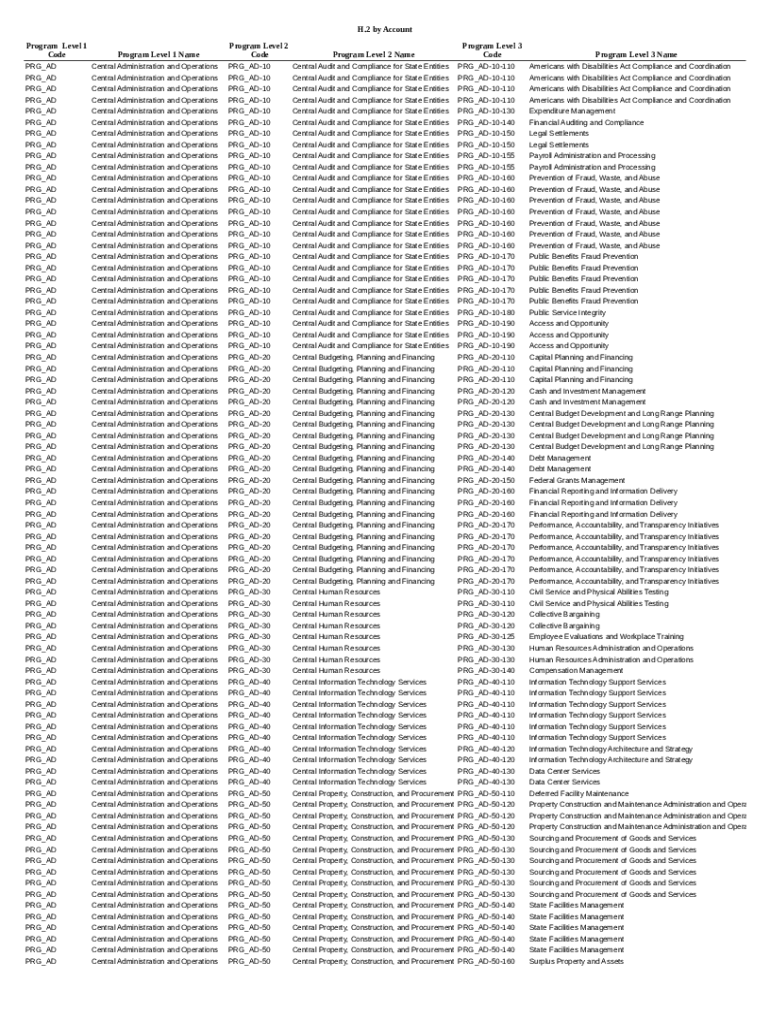

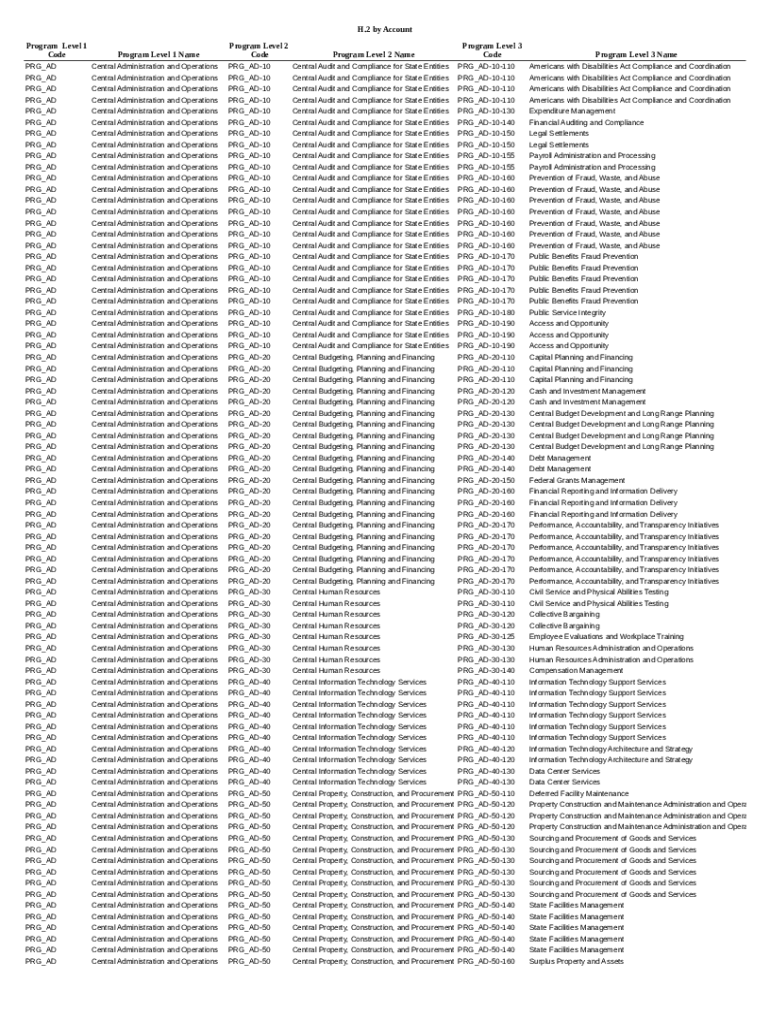

H.2 by Account

Program Level 1

Code

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD

PRG_AD...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign central audit and compliance

Edit your central audit and compliance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your central audit and compliance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing central audit and compliance online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit central audit and compliance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out central audit and compliance

How to fill out central audit and compliance

01

To fill out central audit and compliance, follow these steps:

02

Gather all relevant information and documents related to the audit and compliance process.

03

Familiarize yourself with the audit guidelines and compliance requirements specific to your organization or industry.

04

Assess the current state of audit and compliance within your organization and identify any gaps or areas for improvement.

05

Develop a comprehensive plan to address the audit and compliance requirements, including assigning responsibilities and setting timelines.

06

Conduct a thorough review of internal processes, policies, and procedures to ensure they align with the audit and compliance standards.

07

Implement necessary changes and updates to achieve compliance and address any identified gaps.

08

Regularly monitor and assess the effectiveness of the audit and compliance measures implemented.

09

Keep records and documentation of all audit and compliance activities for future reference and external/internal audits.

10

Stay updated with any new regulations or changes in audit and compliance standards that may impact your organization.

11

Continuously improve the audit and compliance processes based on feedback, lessons learned, and industry best practices.

Who needs central audit and compliance?

01

Central audit and compliance is needed by organizations across various industries that aim to ensure adherence to internal policies, regulations, and industry standards.

02

Common examples of those who need central audit and compliance include:

03

- Financial institutions that must comply with banking and financial regulations

04

- Healthcare organizations that need to adhere to patient privacy laws

05

- Government agencies that require compliance with specific regulations and guidelines

06

- Manufacturing companies that aim to maintain quality standards and safety regulations

07

- Technology companies that deal with customer data and need to ensure data protection and privacy compliance

08

- Non-profit organizations that must meet legal and financial compliance requirements

09

Ultimately, any organization that wants to minimize risks, maintain transparency, and demonstrate accountability can benefit from central audit and compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit central audit and compliance from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your central audit and compliance into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I get central audit and compliance?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific central audit and compliance and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit central audit and compliance online?

The editing procedure is simple with pdfFiller. Open your central audit and compliance in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

What is central audit and compliance?

Central audit and compliance refers to the systematic processes and regulations that organizations follow to ensure that they are meeting legal and regulatory standards in their financial reporting and operations.

Who is required to file central audit and compliance?

Entities that operate under certain regulatory frameworks, such as publicly traded companies, financial institutions, and organizations receiving federal funds, are typically required to file central audit and compliance reports.

How to fill out central audit and compliance?

Filling out central audit and compliance involves gathering necessary financial data, assessing compliance with applicable laws and regulations, completing the required forms, and submitting them to the appropriate regulatory body by the specified deadline.

What is the purpose of central audit and compliance?

The purpose of central audit and compliance is to provide transparency, ensure accountability, protect stakeholders' interests, and mitigate the risk of fraud by verifying that an organization adheres to relevant laws and regulations.

What information must be reported on central audit and compliance?

The information typically reported includes financial statements, internal control assessments, compliance with specific regulations, and any identified risks or issues that may affect the organization’s operations.

Fill out your central audit and compliance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Central Audit And Compliance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.