AZ DoR 140NR 2020 free printable template

Show details

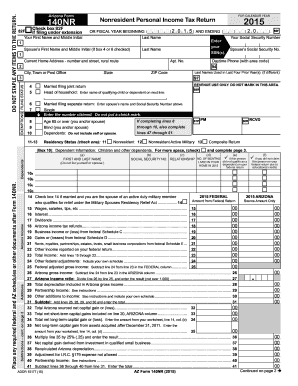

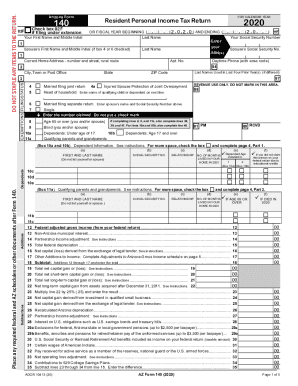

2 20Arizona Form140NRNonresident Personal Income Tax Booklets Booklet Contains: Form 140NR Nonresident Personal Income Tax Return must use Arizona Form 140NR? Schedule A(NR) Itemized DeductionFile

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ DoR 140NR

How to edit AZ DoR 140NR

How to fill out AZ DoR 140NR

Instructions and Help about AZ DoR 140NR

How to edit AZ DoR 140NR

To edit the AZ DoR 140NR form, begin by downloading the form from the Arizona Department of Revenue website or accessing it through an online form service such as pdfFiller. You can edit details directly on the PDF using the editing tools available in pdfFiller. Ensure that all pre-filled information is accurate and update any sections that require change. Finally, save the revised document to maintain an updated version for your records.

How to fill out AZ DoR 140NR

Filling out the AZ DoR 140NR requires following a systematic approach:

01

Start by entering your personal information, including your name, address, and Social Security number.

02

Complete the sections concerning your income and any applicable deductions.

03

Review your figures for accuracy before proceeding to the signature section.

It is essential to reference the instructions provided with the form to confirm all entries align with reporting requirements. After completing the form, double-check for any omissions or errors that could affect processing.

About AZ DoR 140NR 2020 previous version

What is AZ DoR 140NR?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ DoR 140NR 2020 previous version

What is AZ DoR 140NR?

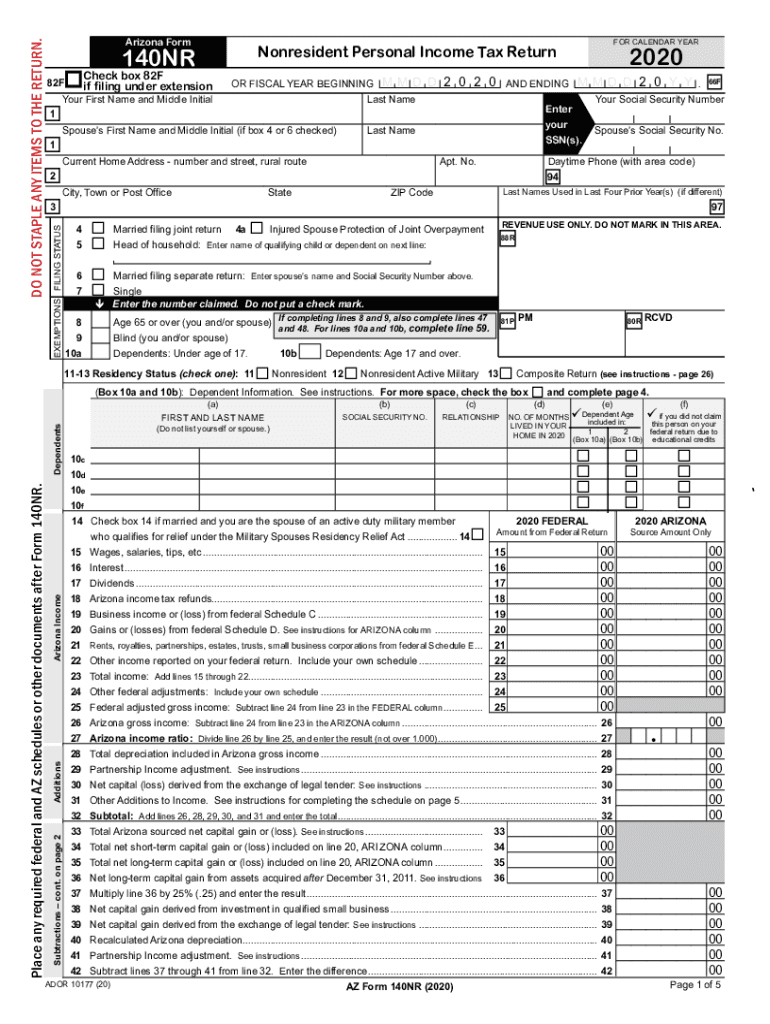

AZ DoR 140NR refers to the Arizona Non-Resident Individual Income Tax Return form. This form is utilized by individuals who earn income sourced from Arizona but do not reside in the state. The return ensures that individuals appropriately report any income subject to Arizona state taxes even if they are not permanent residents.

What is the purpose of this form?

The primary purpose of AZ DoR 140NR is to facilitate the reporting and taxation of income generated in Arizona by non-residents. This form allows the Arizona Department of Revenue to assess the tax liability of these individuals based on the income they earned from within the state.

Who needs the form?

Individuals who earn income from Arizona sources while maintaining residency in another state are required to file AZ DoR 140NR. This includes non-residents who have received wages, rental income, business profits, or any other income subject to Arizona taxation. If you fall into this category, it is critical to complete this form to remain compliant with state tax laws.

When am I exempt from filling out this form?

You may be exempt from filing the AZ DoR 140NR if your total income from Arizona sources is below a specific threshold set by the state. Additionally, if you can prove that the income is not subject to Arizona tax—such as certain retirement payments—filing may not be necessary. Always confirm your exemption status based on current tax laws or consult a tax professional.

Components of the form

The AZ DoR 140NR consists of several critical components, including personal identification information, income details, and deductions applicable to non-residents. Sections require taxpayers to declare all income earned from Arizona sources and may include credits for taxes paid to other states in certain situations. Understanding these components is vital for accurate reporting.

What are the penalties for not issuing the form?

Failure to file the AZ DoR 140NR when required may result in penalties imposed by the Arizona Department of Revenue. These penalties can include financial fines and interest on any unpaid taxes. Additionally, not filing can lead to complications in future filing periods and potentially impact your rights to claim refunds or credits.

What information do you need when you file the form?

When preparing to file the AZ DoR 140NR, gather the following essential information:

01

Your social security number and address.

02

Details of your income earned from Arizona sources.

03

Any relevant tax credits or deductions.

Having this information on hand ensures a smoother filing process and helps avoid delays or errors.

Is the form accompanied by other forms?

The AZ DoR 140NR may need to be filed alongside additional forms depending on your specific tax situation. For example, if you are claiming tax credits or pay certain types of income, supplemental schedules may be required. Refer to the Arizona Department of Revenue guidelines to determine any necessary accompanying documentation.

Where do I send the form?

The completed AZ DoR 140NR must be mailed to the appropriate address as specified by the Arizona Department of Revenue. Usually, this is addressed to a designated processing center based on whether you are expecting a refund or have tax due. Ensure you verify the correct mailing address in current guidelines to avoid misdirecting your filing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I am currently reviewing how much I would actually have to use the PC Filler to see whether I need to subscribe. Thank you.

Very easy to use. Enjoy using this program.

See what our users say