AZ DoR 140ES 2021 free printable template

Show details

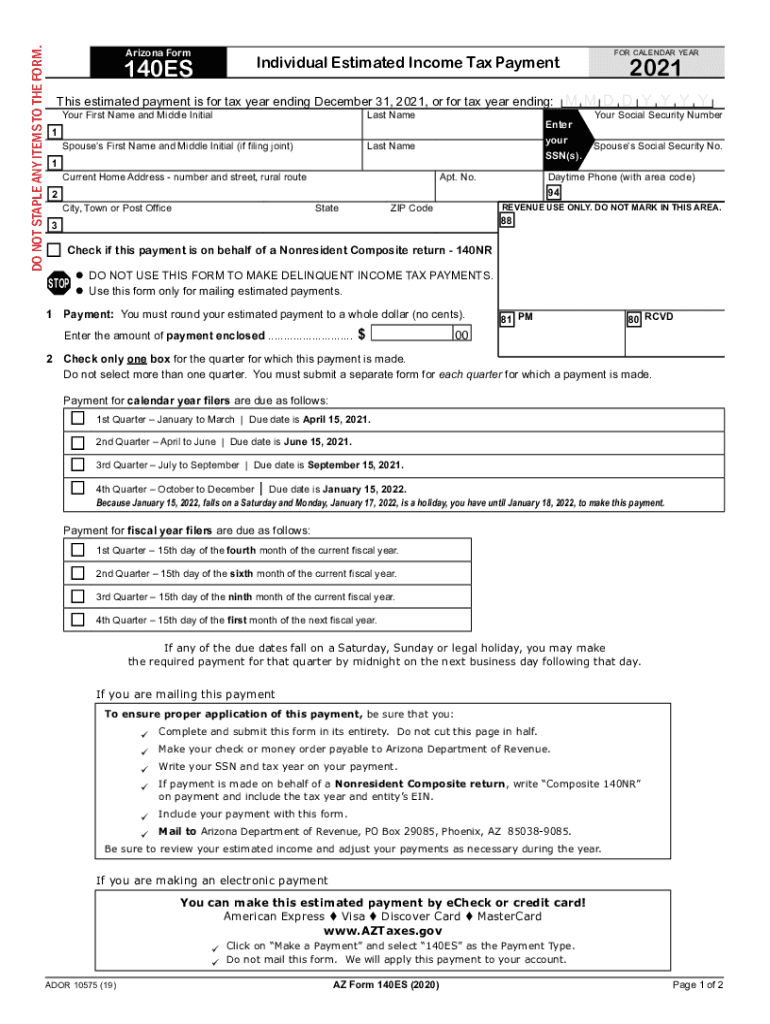

DO NOT STAPLE ANY ITEMS TO THE FORM. Worksheet Arizona Form140ESThis estimated payment is for tax year ending December 31, 2021, or for tax year ending: 1 1 2FOR CALENDAR YEARIndividual Estimated

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ DoR 140ES

How to edit AZ DoR 140ES

How to fill out AZ DoR 140ES

Instructions and Help about AZ DoR 140ES

How to edit AZ DoR 140ES

To edit the AZ DoR 140ES Tax Form, you can use a PDF editor like pdfFiller. This online tool allows you to upload the form and make the necessary changes easily. After editing, ensure that all information is accurate before saving or printing the document.

How to fill out AZ DoR 140ES

Filling out the AZ DoR 140ES Tax Form involves several steps to ensure compliance with Arizona tax laws. Follow these instructions:

01

Gather necessary information, including your tax identification numbers, payment amounts, and other required details.

02

Open the AZ DoR 140ES form and begin by entering your personal information in the designated fields.

03

Complete each section as instructed, ensuring all payment information is accurate.

04

Review the form for any errors before submission.

About AZ DoR 140ES 2021 previous version

What is AZ DoR 140ES?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ DoR 140ES 2021 previous version

What is AZ DoR 140ES?

AZ DoR 140ES is a tax form used by businesses and organizations to report certain payments made to individuals, including independent contractors and other non-employees, for services rendered. It is part of Arizona's efforts to track income reported to the state.

What is the purpose of this form?

The purpose of the AZ DoR 140ES form is to report payments to individuals that may be subject to Arizona state income tax. This form ensures that the Arizona Department of Revenue receives accurate information for tax assessment and compliance purposes.

Who needs the form?

Businesses and organizations that make payments to independent contractors or non-employees in amounts that require reporting must fill out the AZ DoR 140ES form. This includes payments for services rendered that exceed the reporting threshold set by the Arizona Department of Revenue.

When am I exempt from filling out this form?

Exemptions from filling out the AZ DoR 140ES form apply to certain payment types, such as those made for specific goods rather than services or to individuals who do not meet the reporting thresholds. It is important to consult the Arizona Department of Revenue website for detailed criteria on exemptions.

Components of the form

The AZ DoR 140ES form consists of several key components, including sections for the payer's information, recipient's information, payment amounts, and the nature of the services provided. These elements are crucial for accurate reporting and tax processing.

What are the penalties for not issuing the form?

Not issuing the AZ DoR 140ES form as required can result in penalties imposed by the Arizona Department of Revenue. These penalties may include fines and additional scrutiny of the payer’s tax filings, which can lead to further complications in tax compliance.

What information do you need when you file the form?

When filing the AZ DoR 140ES form, you will need the following information:

01

Payer’s name and tax identification number.

02

Recipient’s name, address, and tax identification number.

03

Total payment amounts made during the reporting period.

04

A description of the services provided by the recipient.

Is the form accompanied by other forms?

The AZ DoR 140ES form may need to be accompanied by other forms depending on the specific situation and type of payments reported. It is essential to check the guidelines provided by the Arizona Department of Revenue to understand if additional documentation is required.

Where do I send the form?

After completing the AZ DoR 140ES form, it should be sent to the Arizona Department of Revenue. Specific mailing addresses may vary based on how the form is submitted, whether electronically or via mail. Always refer to the latest instructions from the Arizona Department of Revenue for accurate submission methods.

See what our users say