Get the free tennessee hotel tax exempt form

Show details

Metropolitan Government of Nashville and Davidson County Hotel 6% Occupancy Tax Davidson County Clerk Ordinance 76-143 523 Mainstream Drive 700 2nd Ave South P.O. Box 196333 Nashville, TN 37219-6333

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tennessee hotel tax exempt

Edit your tennessee hotel tax exempt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tennessee hotel tax exempt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

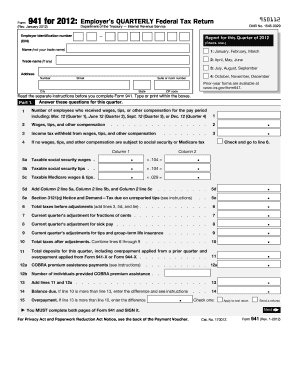

Editing tennessee hotel tax exempt online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tennessee hotel tax exempt. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tennessee hotel tax exempt

How to fill out Tennessee hotel tax exempt:

01

Start by obtaining the necessary forms. You can typically find the Tennessee hotel tax exempt form on the official website of the Tennessee Department of Revenue or request it from the hotel directly.

02

Fill in your personal information accurately. This includes your name, address, phone number, and any other required contact details.

03

Provide your tax exempt identification number. If you qualify for a tax exemption, you will have a unique identification number provided by the state or federal government. Make sure to enter this number correctly on the form.

04

Indicate the purpose of your stay. Specify whether it is for business, personal, government, or any other exempt purpose. This helps determine if you are eligible for the tax exemption.

05

Attach any required supporting documentation. In some cases, you may need to submit additional documents to validate your tax-exempt status, such as a copy of your organization's tax exemption certificate or a letter of authorization.

06

Sign and date the form. By signing, you confirm that the information provided is accurate to the best of your knowledge and that you understand the consequences of providing false information.

Who needs Tennessee hotel tax exempt:

01

Organizations with tax-exempt status. Non-profit organizations such as charities, religious entities, and educational institutions may qualify for tax-exempt status in Tennessee. They need the hotel tax exemption to avoid paying state and local taxes on their lodging expenses.

02

Government agencies. Federal, state, and local government entities are generally exempt from taxes. They may require the hotel tax exemption to ensure they are not charged taxes on their hotel accommodations.

03

Certain individuals or groups on official business. Some individuals or groups, such as government officials, may be exempt from taxes when traveling for official business. The hotel tax exempt form allows them to claim this exemption and avoid paying taxes on their hotel stays.

It is important to note that eligibility for the Tennessee hotel tax exemption may vary based on specific circumstances and the type of organization or individual. It is recommended to consult with the Tennessee Department of Revenue or a tax professional for further guidance.

Fill

form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tennessee hotel tax exempt online?

pdfFiller has made it easy to fill out and sign tennessee hotel tax exempt. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit tennessee hotel tax exempt on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing tennessee hotel tax exempt.

How do I fill out tennessee hotel tax exempt using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign tennessee hotel tax exempt and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is tennessee hotel tax exempt?

Tennessee hotel tax exempt refers to the exemption from paying certain hotel occupancy taxes for qualifying organizations, such as educational, religious, or governmental entities.

Who is required to file tennessee hotel tax exempt?

Organizations that qualify for tax exemption, including non-profit organizations, government entities, and schools, are required to file for Tennessee hotel tax exempt.

How to fill out tennessee hotel tax exempt?

To fill out the Tennessee hotel tax exempt form, one must provide details such as the organization's name, address, type of exemption, and supporting documentation that proves eligibility for the exemption.

What is the purpose of tennessee hotel tax exempt?

The purpose of Tennessee hotel tax exempt is to provide financial relief to qualifying organizations by waiving certain hotel taxes, thereby reducing lodging costs for their activities.

What information must be reported on tennessee hotel tax exempt?

The information that must be reported includes the organization's name, address, type of exemption, dates of stay, and the name of the hotel, along with any relevant identification numbers.

Fill out your tennessee hotel tax exempt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tennessee Hotel Tax Exempt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.