Get the free Section 501(c)(3) Tax-Exempt Entities Forming Affiliations ...

Show details

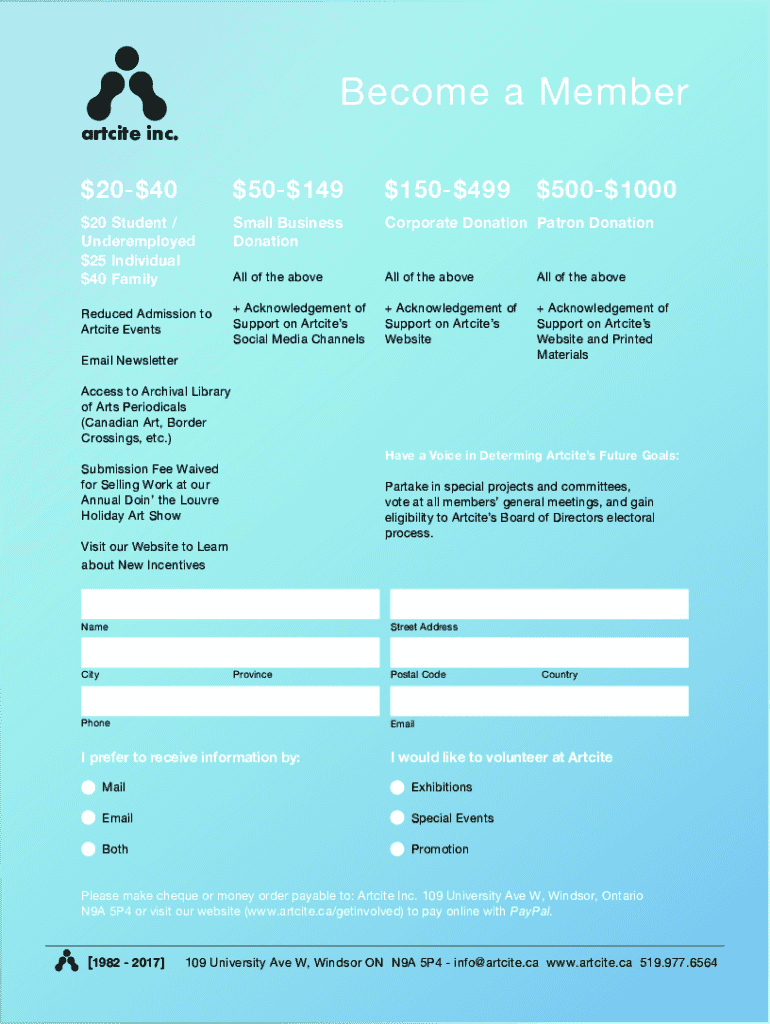

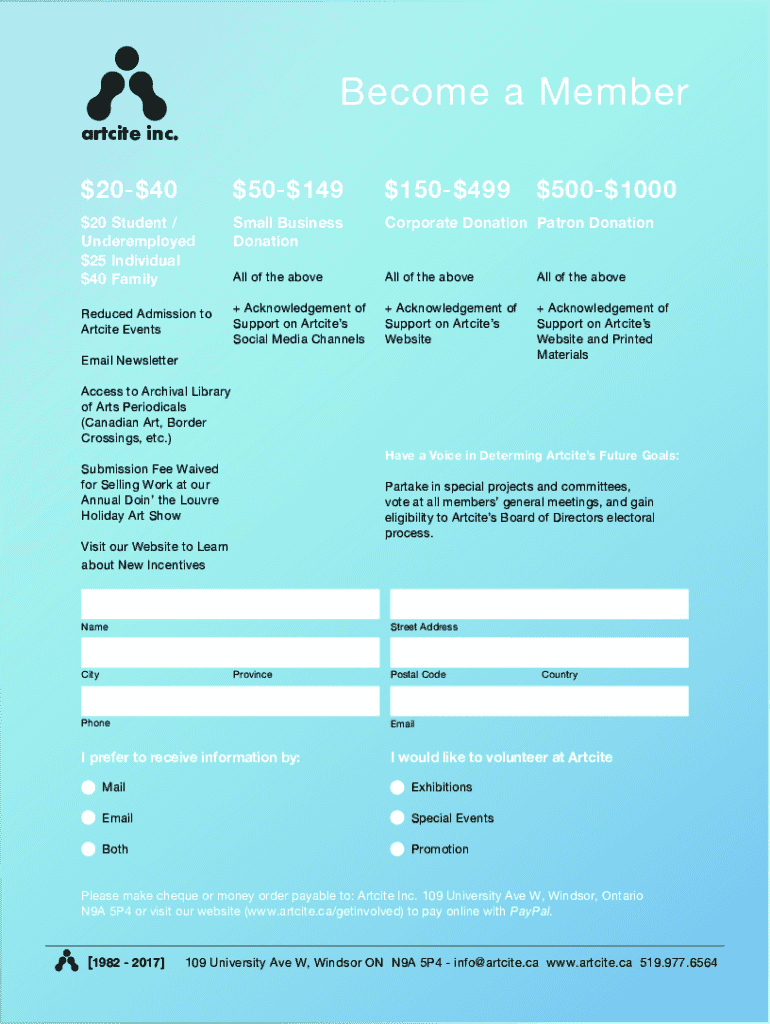

Become a Member

art cite inc.$$$$$$$20405014915049920 Student /

Underemployed

$25 Individual

$40 Family Small Business

DonationCorporate Donation Patron National of the above of the above of the aboveReduced

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign section 501c3 tax-exempt entities

Edit your section 501c3 tax-exempt entities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your section 501c3 tax-exempt entities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit section 501c3 tax-exempt entities online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit section 501c3 tax-exempt entities. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out section 501c3 tax-exempt entities

How to fill out section 501c3 tax-exempt entities

01

Gather all the necessary information and documents required for the application, including the organization's purpose and activities, financial records, and governing documents.

02

Complete Form 1023 or Form 1023-EZ depending on the organization's eligibility. Provide detailed information about the organization, its structure, and its activities.

03

Include any required schedules or attachments, such as financial statements, compensation information, or additional information about specific activities.

04

Pay the appropriate filing fee. As of 2021, the fee varies depending on the organization's expected gross receipts.

05

Submit the completed application and supporting documents to the IRS either electronically or by mail. Once submitted, the IRS will review the application and may request additional information or clarification.

06

Wait for the IRS to issue a determination letter. This letter will confirm whether the organization qualifies for tax-exempt status under section 501(c)(3). If approved, the organization can then operate as a tax-exempt entity and enjoy certain tax benefits.

Who needs section 501c3 tax-exempt entities?

01

Charitable organizations that want to solicit tax-deductible donations from individuals and corporations.

02

Religious, educational, and scientific organizations that want to be recognized as tax-exempt and receive tax-deductible contributions.

03

Public charities and private foundations that want to avoid paying federal income tax on their earnings.

04

Organizations that want to be eligible for grants and funding opportunities specifically available for tax-exempt entities.

05

Non-profit organizations that want to provide certain benefits to their members or stakeholders, such as tax deductions for donors or exemption from certain state taxes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the section 501c3 tax-exempt entities electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit section 501c3 tax-exempt entities on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share section 501c3 tax-exempt entities on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete section 501c3 tax-exempt entities on an Android device?

Complete your section 501c3 tax-exempt entities and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is section 501c3 tax-exempt entities?

Section 501(c)(3) tax-exempt entities are nonprofit organizations in the United States that are exempt from federal income tax because they operate for charitable, religious, educational, scientific, or literary purposes, among others.

Who is required to file section 501c3 tax-exempt entities?

Organizations that operate under section 501(c)(3) and seek tax-exempt status must file Form 1023 or Form 1023-EZ with the IRS to obtain recognition of their tax-exempt status.

How to fill out section 501c3 tax-exempt entities?

To fill out section 501(c)(3) forms, applicants must provide detailed information about their organization, including its mission, activities, financial information, and governance structure using IRS Form 1023 or Form 1023-EZ.

What is the purpose of section 501c3 tax-exempt entities?

The purpose of section 501(c)(3) tax-exempt entities is to promote public good by providing charitable services, reducing the burden of government, and fostering social welfare.

What information must be reported on section 501c3 tax-exempt entities?

Entities must report information such as mission statement, program descriptions, financial statements, governance details, and compliance with public support tests when filing applications or annual returns.

Fill out your section 501c3 tax-exempt entities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Section 501C3 Tax-Exempt Entities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.