Get the free Saudi Tax and Zakat - TaxConnections

Show details

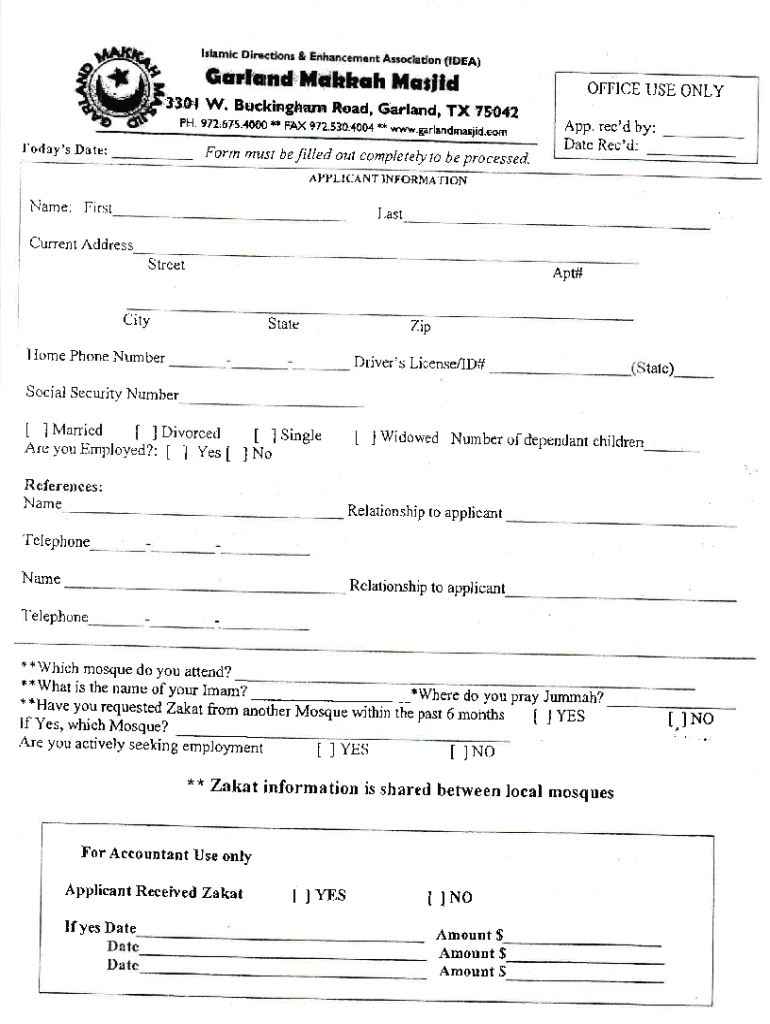

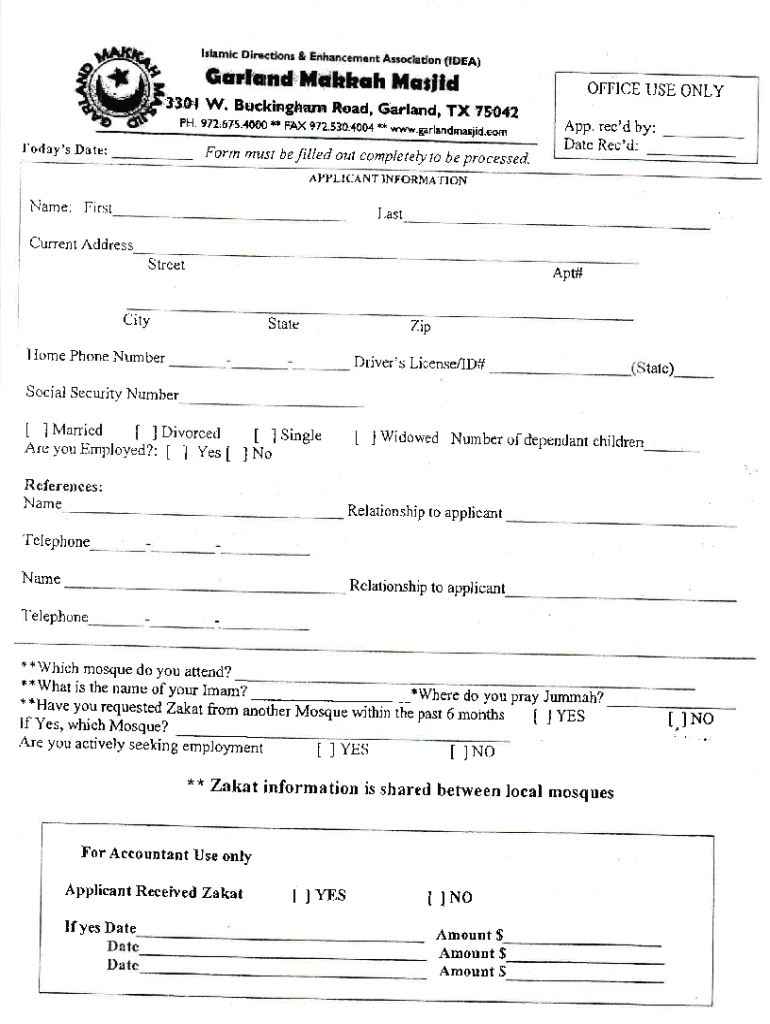

, o) 33OW. BuekiaghamPH. 972,675.4000 r4Today's Date:Form mustOFFICE USE Unload, Garland, EX 972. S30j004be×TX Z$O42www.garlandrnasiid;filled out completely to be processed. App. Rec CD by: Date

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign saudi tax and zakat

Edit your saudi tax and zakat form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your saudi tax and zakat form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit saudi tax and zakat online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit saudi tax and zakat. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out saudi tax and zakat

How to fill out saudi tax and zakat

01

To fill out Saudi tax and zakat, follow these steps:

02

Gather all necessary financial information such as income, expenses, assets, and liabilities.

03

Determine the applicable tax and zakat laws and regulations in Saudi Arabia.

04

Prepare the relevant tax and zakat forms, such as the income tax return form and the zakat declaration form.

05

Calculate the taxable income and zakat liability based on the prescribed rates and rules.

06

Fill out the forms accurately and provide all required information, including details of income sources, deductions, and exemptions.

07

Ensure that all calculations are correct and supported by appropriate documentation.

08

Submit the completed forms and any required supporting documentation to the relevant tax and zakat authorities within the specified deadlines.

09

Pay any taxes and zakat due based on the assessed liability.

10

Keep copies of all submitted forms and supporting documents for future reference and audit purposes.

11

Comply with any requests for additional information or clarifications from the tax and zakat authorities as needed.

Who needs saudi tax and zakat?

01

Saudi tax and zakat are important for certain individuals and entities in Saudi Arabia. The following may need to fulfill their obligations:

02

- Saudi residents who earn taxable income or have zakatable assets

03

- Companies and businesses operating in Saudi Arabia, including foreign companies with a permanent establishment

04

- Non-resident individuals and businesses with certain types of income sourced in Saudi Arabia

05

- Specific industries and sectors that fall under special tax and zakat regulations

06

It is advisable to consult with a tax professional or the Saudi tax and zakat authorities to determine specific obligations based on individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send saudi tax and zakat for eSignature?

Once your saudi tax and zakat is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get saudi tax and zakat?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the saudi tax and zakat in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out saudi tax and zakat using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign saudi tax and zakat and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is saudi tax and zakat?

Saudi tax refers to the various taxes levied by the Saudi government on individuals and businesses, including income tax and value-added tax (VAT). Zakat is a form of almsgiving and religious tax in Islam, where a portion of a Muslim's wealth is given to those in need.

Who is required to file saudi tax and zakat?

Individuals and businesses with taxable income in Saudi Arabia are required to file Saudi tax. Additionally, all Muslim entities that meet the prescribed wealth thresholds must file zakat.

How to fill out saudi tax and zakat?

To fill out Saudi tax and zakat, individuals and businesses need to gather financial documents, complete the appropriate tax forms provided by the Saudi tax authority, and submit them online or in person by the filing deadline.

What is the purpose of saudi tax and zakat?

The purpose of Saudi tax is to generate revenue for the government to fund public services and development projects. Zakat serves as a means of wealth redistribution and helping the less fortunate in accordance with Islamic principles.

What information must be reported on saudi tax and zakat?

Taxable income, deductions, expenses, assets, liabilities, and any other relevant financial information must be reported on Saudi tax filings. For zakat, details about the individual's or organization's wealth and the calculation method used must be included.

Fill out your saudi tax and zakat online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Saudi Tax And Zakat is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.