Get the free 2019 Tax Sale Listings - Baltimore City Comptroller

Show details

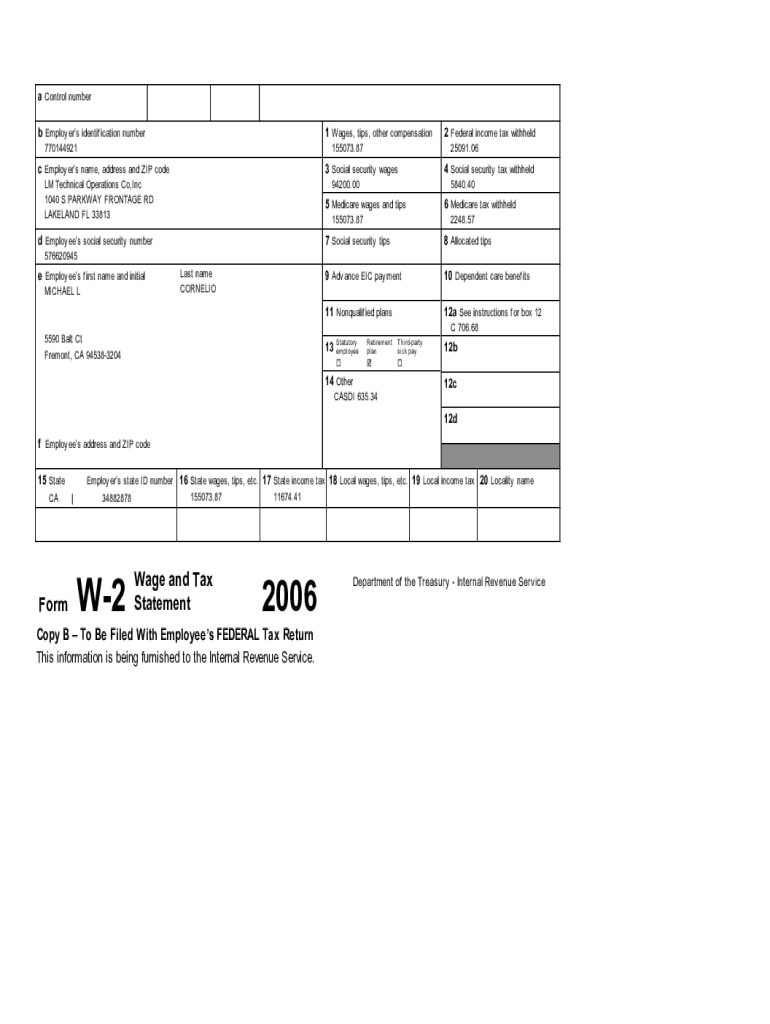

A Control number

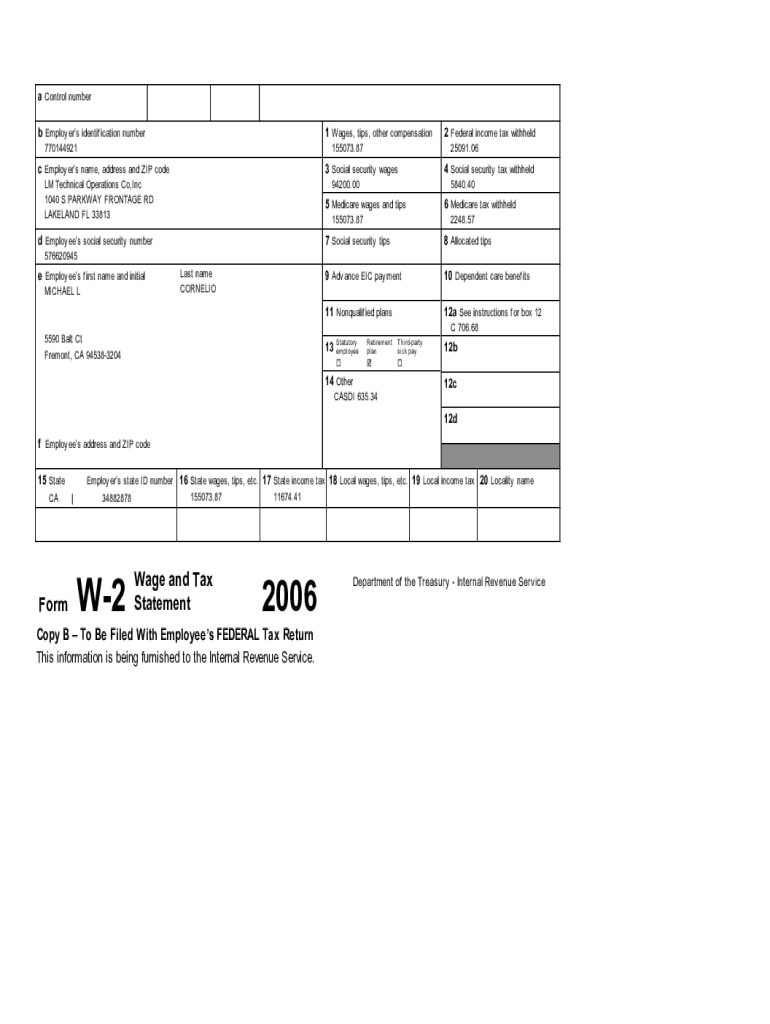

b Employers identification number1 Wages, tips, other compensation770144921155073.87c Employers name, address and ZIP code25091.063 Social security wages Technical Operations Co,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2019 tax sale listings

Edit your 2019 tax sale listings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2019 tax sale listings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2019 tax sale listings online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2019 tax sale listings. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2019 tax sale listings

How to fill out 2019 tax sale listings

01

Step 1: Gather all relevant documents such as 2019 income statements, tax forms, and receipts.

02

Step 2: Determine which tax deductions and credits you qualify for.

03

Step 3: Fill out the necessary forms, including the 2019 tax sale listing form.

04

Step 4: Provide accurate and detailed information about the properties being listed for sale, including their addresses, assessed values, and any liens or encumbrances.

05

Step 5: Submit the completed tax sale listing form to the appropriate tax authority before the designated deadline.

Who needs 2019 tax sale listings?

01

Real estate investors who are interested in purchasing properties through tax sales.

02

Homebuyers looking for potential bargain deals.

03

Municipalities or government agencies organizing tax sales.

04

Property owners who are delinquent on their taxes and want to sell their properties to satisfy the tax debt.

05

Financial institutions or lenders looking to acquire properties through tax sales.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2019 tax sale listings online?

The editing procedure is simple with pdfFiller. Open your 2019 tax sale listings in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit 2019 tax sale listings straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing 2019 tax sale listings.

How do I complete 2019 tax sale listings on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your 2019 tax sale listings. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is tax sale listings?

Tax sale listings are public records that detail properties that are scheduled for a tax sale due to unpaid property taxes. These listings typically include information about the property, the owner, and the tax amount owed.

Who is required to file tax sale listings?

Tax sale listings are typically filed by local government agencies or tax collectors who are authorized to sell properties for unpaid taxes. Property owners may also need to be aware of these listings.

How to fill out tax sale listings?

To fill out tax sale listings, you usually need to provide detailed information about the property including the owner's name, property address, tax amount owed, and any additional notes regarding the sale process.

What is the purpose of tax sale listings?

The purpose of tax sale listings is to inform the public about properties that are subject to tax sales, facilitating the recovery of unpaid taxes and to promote transparency in the tax collection process.

What information must be reported on tax sale listings?

Tax sale listings must typically report the property owner’s name, property location, the amount of tax owed, any penalties or interest accrued, and the date of the tax sale.

Fill out your 2019 tax sale listings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2019 Tax Sale Listings is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.