ME 1040ME Booklet 2020 free printable template

Show details

2020 MAINE

Resident, Nonresident, or Part year ResidentIndividual Income Tax Booklet

Form 1040MEMaine

Castile

Electronic filing and payment services

For more information, see www.maine.gov/revenue

Free

pdfFiller is not affiliated with any government organization

Instructions and Help about ME 1040ME Booklet

How to edit ME 1040ME Booklet

How to fill out ME 1040ME Booklet

Instructions and Help about ME 1040ME Booklet

How to edit ME 1040ME Booklet

To edit the ME 1040ME Booklet tax form, use a PDF editing tool like pdfFiller. Upload your form to the platform, enabling you to add information, make corrections, or update details. Save your edited document to ensure all changes are retained for filing.

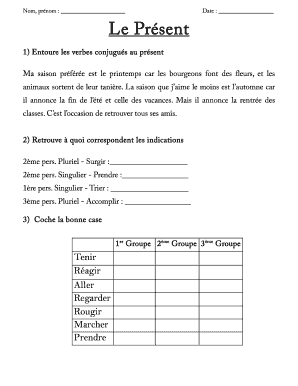

How to fill out ME 1040ME Booklet

Filling out the ME 1040ME Booklet requires a methodical approach. Gather all necessary financial documents first, including your W-2, 1099 forms, and any relevant receipts. Begin by entering your personal information, followed by income details, deductions, and credits as applicable.

Ensure each section is completed accurately to avoid complications during processing. Review the instructions provided with the form for specific guidelines on each entry to ensure compliance with Maine tax laws.

About ME 1040ME Booklet 2020 previous version

What is ME 1040ME Booklet?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About ME 1040ME Booklet 2020 previous version

What is ME 1040ME Booklet?

The ME 1040ME Booklet is the official tax form used by residents of Maine to report their state income and calculate their tax liability. This form is specifically designed for individual income tax filings and is issued by the Maine Revenue Services. It is essential for Maine taxpayers during the annual filing season.

What is the purpose of this form?

The primary purpose of the ME 1040ME Booklet is to allow taxpayers to report their income and calculate the state income tax they owe. This form helps the state ensure compliance with tax regulations and assess the total tax revenue. By completing this form, individuals inform the state of their financial activities for the year.

Who needs the form?

Any individual or resident of Maine who earns income during the tax year must use the ME 1040ME Booklet to file their state income tax return. This includes employees, self-employed individuals, and those with other income sources. If you have a filing requirement, this form is necessary to comply with Maine tax obligations.

When am I exempt from filling out this form?

Taxpayers may be exempt from filing the ME 1040ME Booklet if their income is below the state's filing threshold. Additionally, certain categories of individuals, such as minors or those with no taxable income, may not need to file. It's essential to review the Maine Revenue Services guidelines to determine your specific exemption criteria.

Components of the form

The ME 1040ME Booklet consists of several key components, including sections for reporting personal information, income details, deductions, and credits. Additionally, there are areas for inputting payment information and calculating taxes owed or refunds due. Each section aligns with relevant tax laws and guidelines.

Due date

The due date for submitting the ME 1040ME Booklet typically aligns with the federal tax deadline, which is usually April 15th. If the deadline falls on a weekend or holiday, taxpayers may have until the next business day to file. Timely submission is crucial to avoid penalties and interest on owed taxes.

What are the penalties for not issuing the form?

Failure to file the ME 1040ME Booklet by the due date can result in various penalties, including fines and interest on unpaid taxes. Maine Revenue Services may impose a late filing penalty, which can accumulate over time. It is advisable to file the form on time or seek an extension if necessary to mitigate these potential penalties.

What information do you need when you file the form?

When filing the ME 1040ME Booklet, gather crucial information such as personal identification details, income from various sources (W-2s, 1099s), and any deductions you plan to claim. Having this information readily available simplifies the filing process and promotes accuracy, reducing the chance of errors that could lead to delays or penalties.

Is the form accompanied by other forms?

Typically, the ME 1040ME Booklet is accompanied by several supporting documents, including schedules or addenda required for specific deductions or credits. Familiarize yourself with these accompanying forms to ensure that your tax return is complete and accurate, allowing for smooth processing by Maine Revenue Services.

Where do I send the form?

The completed ME 1040ME Booklet should be mailed to the address specified in the form instructions. Be sure to verify the correct address, as it may vary depending on whether you are expecting a refund or owe taxes. Submitting your form to the correct location ensures that it is processed promptly.

See what our users say