Get the free Tax Incentives for Energy Efficiency Upgrades in Commercial ...

Show details

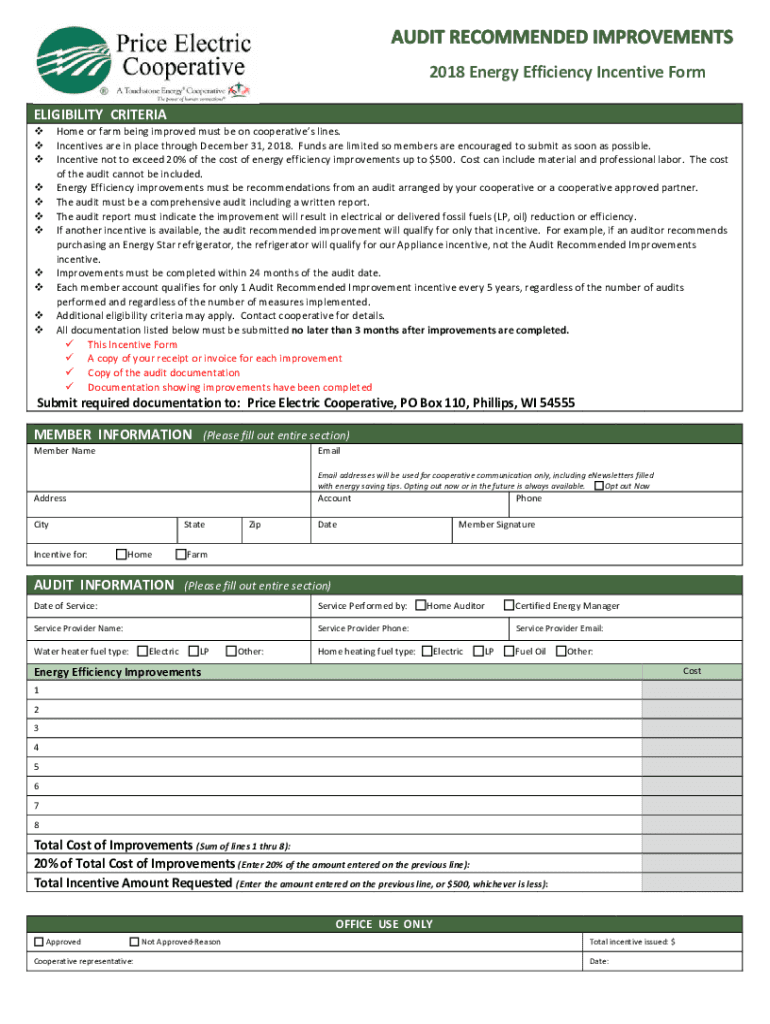

2018 Energy Efficiency Incentive Form

ELIGIBILITY CRITERIAHome or farm being improved must be on cooperatives lines.

Incentives are in place through December 31, 2018. Funds are limited, so members

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax incentives for energy

Edit your tax incentives for energy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax incentives for energy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax incentives for energy online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax incentives for energy. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax incentives for energy

How to fill out tax incentives for energy

01

Gather all necessary documentation, including information about your energy production, consumption, and efficiency measures taken.

02

Determine which tax incentives are applicable to your situation. This may include federal, state, or local incentives.

03

Consult with a tax professional or accountant familiar with energy tax incentives to ensure you are eligible and understand the requirements.

04

Fill out the necessary tax forms, providing accurate and complete information.

05

Attach any required documentation or supporting evidence to substantiate your claim for the incentives.

06

Review your completed tax incentives form for accuracy and completeness before submitting it.

07

Submit the form according to the instructions provided by the relevant tax authority.

08

Keep copies of all documentation and forms submitted for your records.

09

Monitor for any updates or changes to tax incentives for energy in subsequent years to ensure ongoing compliance.

Who needs tax incentives for energy?

01

Individuals or households that engage in energy-efficient practices and make eligible investments in renewable energy systems may benefit from tax incentives for energy.

02

Businesses that implement energy-saving measures, invest in renewable energy technologies, or provide energy-efficient products and services may also qualify for these incentives.

03

Government entities, including federal, state, and local agencies, may utilize tax incentives for energy to promote and support energy efficiency and renewable energy initiatives.

04

Energy producers, such as wind farms, solar power plants, and other renewable energy projects, may be eligible for tax incentives to encourage increased production and reduce reliance on fossil fuels.

05

Researchers, innovators, and entrepreneurs involved in the development and commercialization of clean energy technologies may also benefit from tax incentives for energy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax incentives for energy for eSignature?

When you're ready to share your tax incentives for energy, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit tax incentives for energy on an iOS device?

Create, modify, and share tax incentives for energy using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

How do I edit tax incentives for energy on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share tax incentives for energy on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is tax incentives for energy?

Tax incentives for energy are financial benefits provided by the government to encourage the development and use of renewable energy sources and energy-efficient technologies. These incentives may include tax credits, deductions, exemptions, and rebates for individuals and businesses that invest in or use energy-efficient products and renewable energy systems.

Who is required to file tax incentives for energy?

Individuals and businesses that have invested in energy-efficient technologies or renewable energy systems and wish to claim tax incentives must file the relevant forms with their tax returns. This may include taxpayers who own solar panels, energy-efficient appliances, and other qualifying energy investments.

How to fill out tax incentives for energy?

To fill out tax incentives for energy, taxpayers should obtain the necessary forms from the IRS or their country's tax authority. They will need to provide information about their energy investments, including installation dates, costs, and eligibility requirements. Proper documentation, such as receipts and certifications, should also be attached.

What is the purpose of tax incentives for energy?

The purpose of tax incentives for energy is to promote the adoption of clean energy practices, reduce reliance on fossil fuels, stimulate economic growth in the renewable energy sector, encourage energy conservation, and help address climate change by lowering greenhouse gas emissions.

What information must be reported on tax incentives for energy?

Taxpayers must report information such as the type of energy-efficient technology or renewable energy system installed, the total cost of the installation, the date of installation, and any relevant certifications or documentation that prove eligibility for the tax incentive.

Fill out your tax incentives for energy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Incentives For Energy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.