Get the free 2018 form 5500 service provider codes Form 5500 Codes and ...

Show details

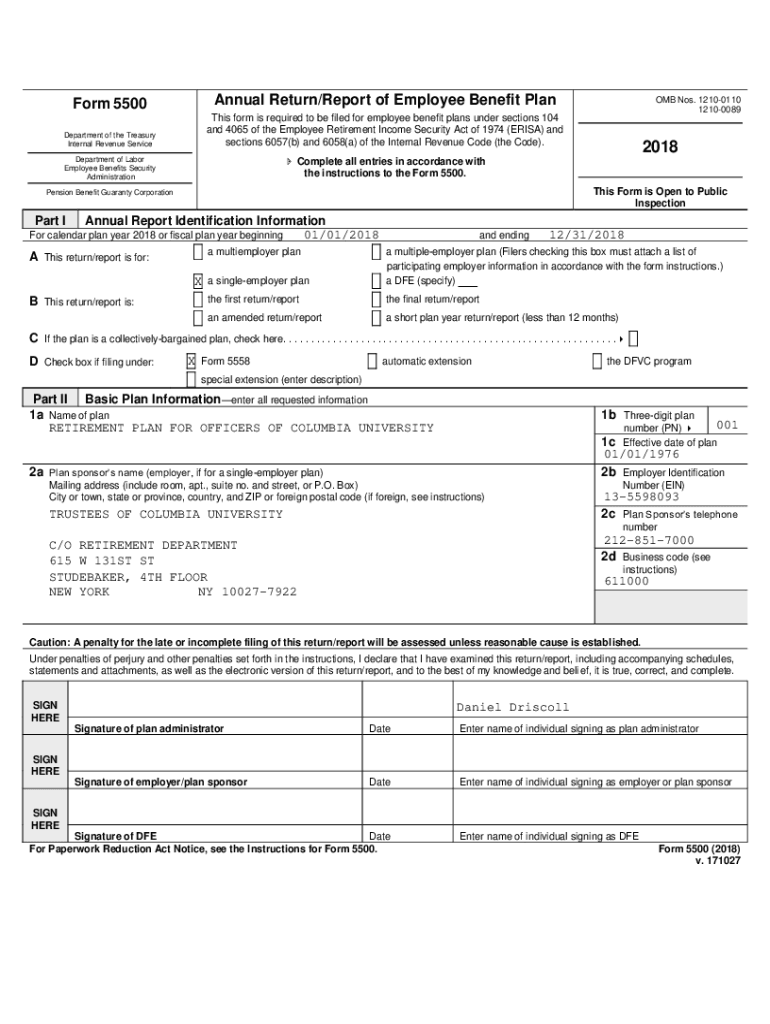

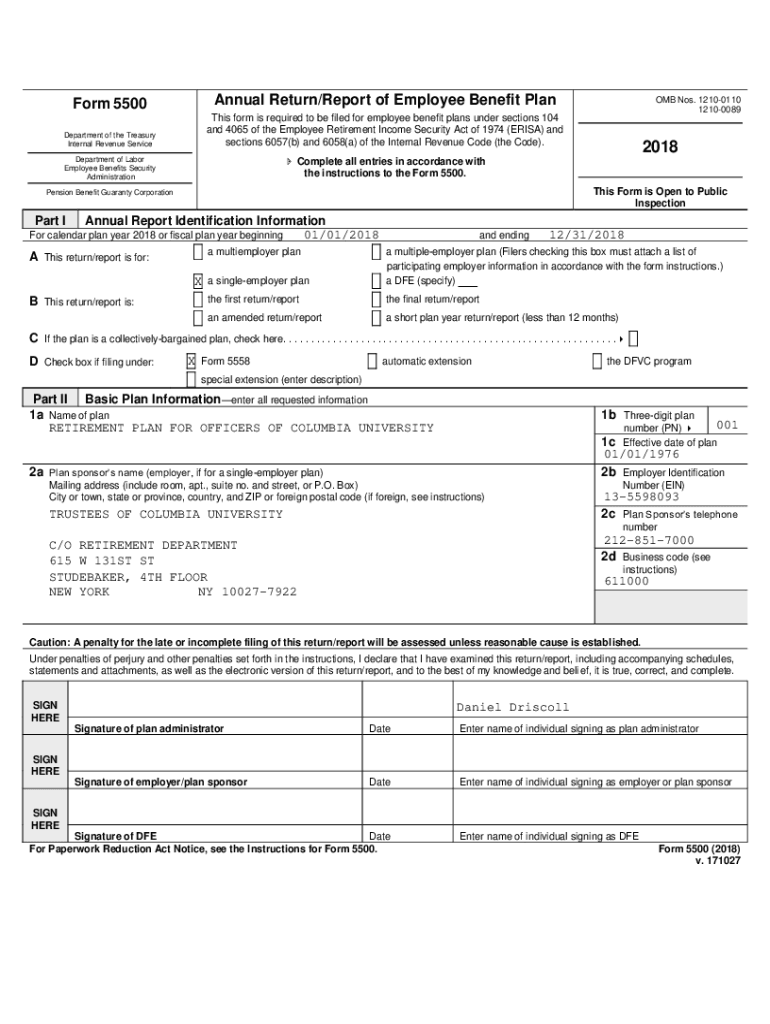

Form 5500Annual Return/Report of Employee Benefit PlanDepartment of the Treasury

Internal Revenue Services form is required to be filed for employee benefit plans under sections 104

and 4065 of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2018 form 5500 service

Edit your 2018 form 5500 service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2018 form 5500 service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2018 form 5500 service online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2018 form 5500 service. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2018 form 5500 service

How to fill out 2018 form 5500 service

01

To fill out the 2018 Form 5500 service, follow these steps:

02

- First, gather all the necessary information such as employer identification number, plan name, plan number, plan year, etc.

03

- Provide all the required details about the plan administrator, including their name, address, and contact information.

04

- Fill out the sections regarding the plan sponsor, including their name, business address, and other relevant information.

05

- Enter the details of the plan, such as the type of plan, plan characteristics, and contribution information.

06

- Provide information about the plan assets, including their total value and investment details.

07

- Complete the sections regarding plan funding and insurance, if applicable.

08

- Answer all the questions about compliance and administrative issues, such as reporting and auditing requirements.

09

- Submit the completed Form 5500 to the appropriate authority by the given deadline.

10

- Save a copy of the filled-out form for your records.

Who needs 2018 form 5500 service?

01

Various entities and organizations need the 2018 Form 5500 service, including:

02

- Employers who offer employee benefit plans, such as retirement plans or welfare benefit plans.

03

- Plan administrators who are responsible for managing and maintaining the employee benefit plans.

04

- Trustees and fiduciaries who have control over plan assets and decision-making.

05

- Professional service providers, such as accountants or consultants, who assist in preparing the form.

06

- Regulatory authorities who require the form for monitoring and oversight of employee benefit plans.

07

- Financial institutions and investment managers who handle plan assets or provide services related to the plans.

08

- Government agencies that collect and analyze data on employee benefit plans for statistical or regulatory purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2018 form 5500 service for eSignature?

Once your 2018 form 5500 service is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete 2018 form 5500 service online?

Completing and signing 2018 form 5500 service online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the 2018 form 5500 service form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 2018 form 5500 service and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is form 5500 service provider?

Form 5500 is a report that employee benefit plans are required to file with the Department of Labor to provide information about the plan's financial condition, investments, and operations.

Who is required to file form 5500 service provider?

Employers who maintain employee benefit plans, including pension and welfare benefit plans, that are subject to the Employee Retirement Income Security Act (ERISA) are required to file Form 5500.

How to fill out form 5500 service provider?

To fill out Form 5500, one must gather financial statements, information about plan operations, and data on plan participants, and then complete the form either electronically through the DOL's EFAST system or manually by following the instructions provided.

What is the purpose of form 5500 service provider?

The primary purpose of Form 5500 is to provide the federal government with information about the operation, funding, and investment of employee benefit plans to ensure compliance with ERISA regulations.

What information must be reported on form 5500 service provider?

Form 5500 requires reporting of plan assets, liabilities, income, expenses, the number of participants, and information regarding the plan's service providers and compliance with minimum funding standards.

Fill out your 2018 form 5500 service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2018 Form 5500 Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.