Get the free IRREVOCABLE LETTER OF CREDIT I DIVISION OF ... - forms.in.gov - forms in

Show details

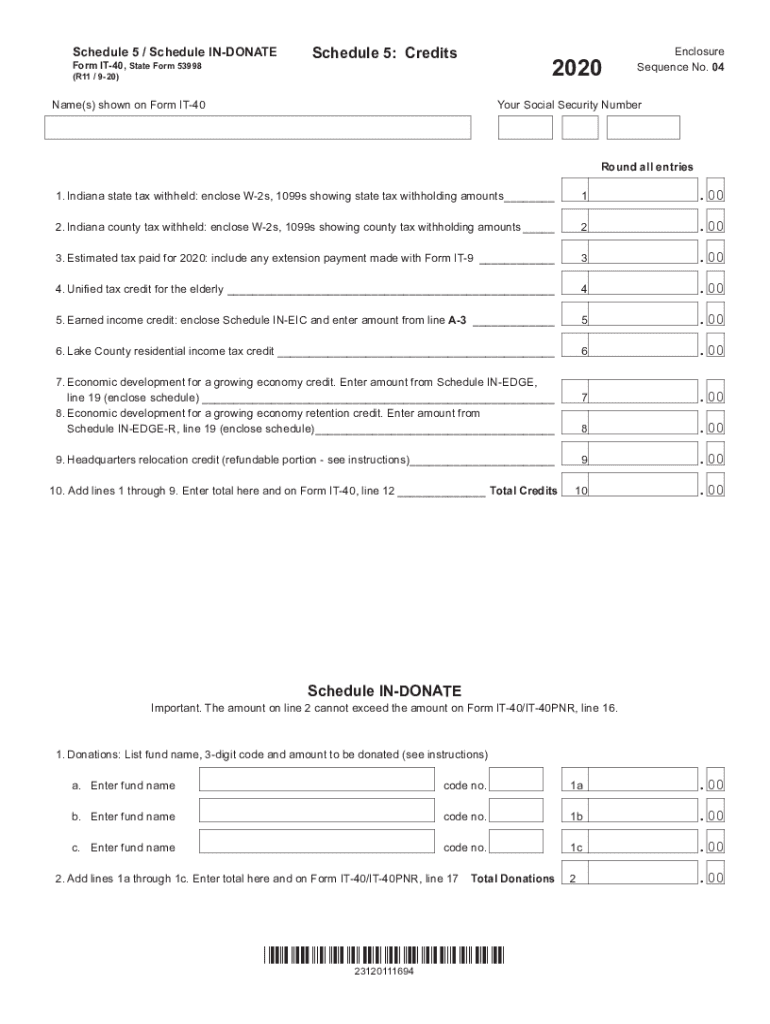

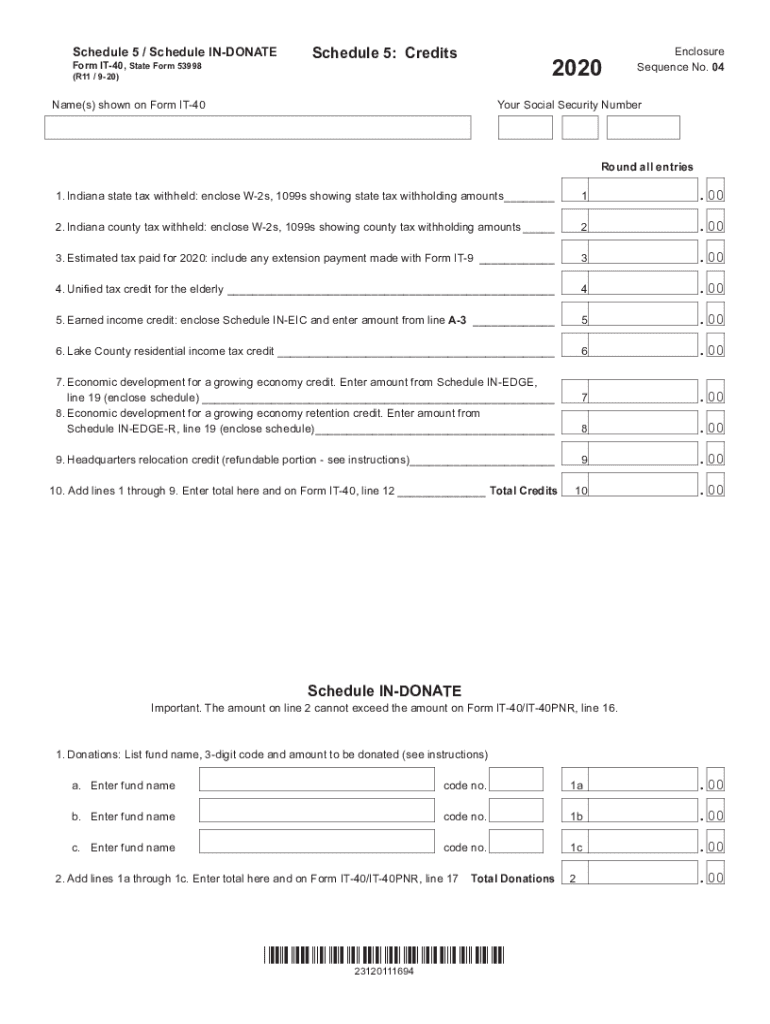

Schedule 5 / Schedule INDICATE Form IT40, State Form 53998Schedule 5: Credits2020(R11 / 920)Name(s) shown on Form IT40Enclosure Sequence No. 04Your Social Security NumberRound all entries 1. Indiana

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irrevocable letter of credit

Edit your irrevocable letter of credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irrevocable letter of credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irrevocable letter of credit online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irrevocable letter of credit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irrevocable letter of credit

How to fill out irrevocable letter of credit

01

Obtain a copy of the irrevocable letter of credit form from the issuing bank or financial institution.

02

Fill in the necessary details such as the name and address of the beneficiary (the party receiving the letter of credit) and the applicant (the party seeking the letter of credit).

03

Specify the amount of the credit and the currency in which it will be issued.

04

Include any specific conditions or instructions that need to be followed, such as required documents or shipping terms.

05

Sign the letter of credit and have it authenticated by a notary public or authorized officer.

06

Submit the completed letter of credit to the issuing bank along with any required fees or collateral.

07

Await confirmation and issuance of the irrevocable letter of credit by the bank.

08

Provide the beneficiary with a copy of the letter of credit and any additional instructions or documentation they may need to fulfill the credit terms.

09

Monitor the progress of the credit and ensure that all parties involved fulfill their respective obligations.

10

Upon completion of the transaction, the beneficiary can present the required documents to the bank to obtain payment.

11

The issuing bank will review the documents and make the necessary payment to the beneficiary.

12

The letter of credit will then be closed, and any remaining funds will be released or returned to the applicant.

Who needs irrevocable letter of credit?

01

Irrevocable letters of credit are commonly used in international trade.

02

They are particularly beneficial for exporters, as they provide a guarantee of payment from the importer's bank.

03

Importers may also utilize irrevocable letters of credit to establish trust and ensure that goods or services are delivered as agreed upon.

04

Other parties that may need irrevocable letters of credit include financial institutions, contractors, and suppliers involved in large-scale projects.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irrevocable letter of credit directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your irrevocable letter of credit and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit irrevocable letter of credit on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing irrevocable letter of credit.

How do I fill out irrevocable letter of credit on an Android device?

Use the pdfFiller mobile app to complete your irrevocable letter of credit on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is irrevocable letter of credit?

An irrevocable letter of credit is a financial instrument issued by a bank that guarantees payment to a seller, provided that the seller meets the terms and conditions set out in the letter. Once issued, it cannot be altered or canceled without the agreement of all parties involved.

Who is required to file irrevocable letter of credit?

Sellers or exporters who are looking to secure payment for goods or services rendered typically file an irrevocable letter of credit. Buyers or importers may also request its issuance to ensure that terms are met before payment is released.

How to fill out irrevocable letter of credit?

To fill out an irrevocable letter of credit, the applicant must provide detailed information including the name and address of the issuing bank, beneficiary's details, transaction details, amount guaranteed, expiry date, shipping terms, and necessary documentation required for payment.

What is the purpose of irrevocable letter of credit?

The purpose of an irrevocable letter of credit is to provide a secure payment mechanism that protects both buyers and sellers in a commercial transaction. It minimizes payment risk and ensures that sellers receive payment upon fulfilling specified conditions.

What information must be reported on irrevocable letter of credit?

Information required includes the issuer's bank details, beneficiary's name and address, description of goods, payment terms, amount, date of issuance, expiration date, and the required documents for drawing funds.

Fill out your irrevocable letter of credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irrevocable Letter Of Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.