Get the free 501(c)(21) - Ballotpedia

Show details

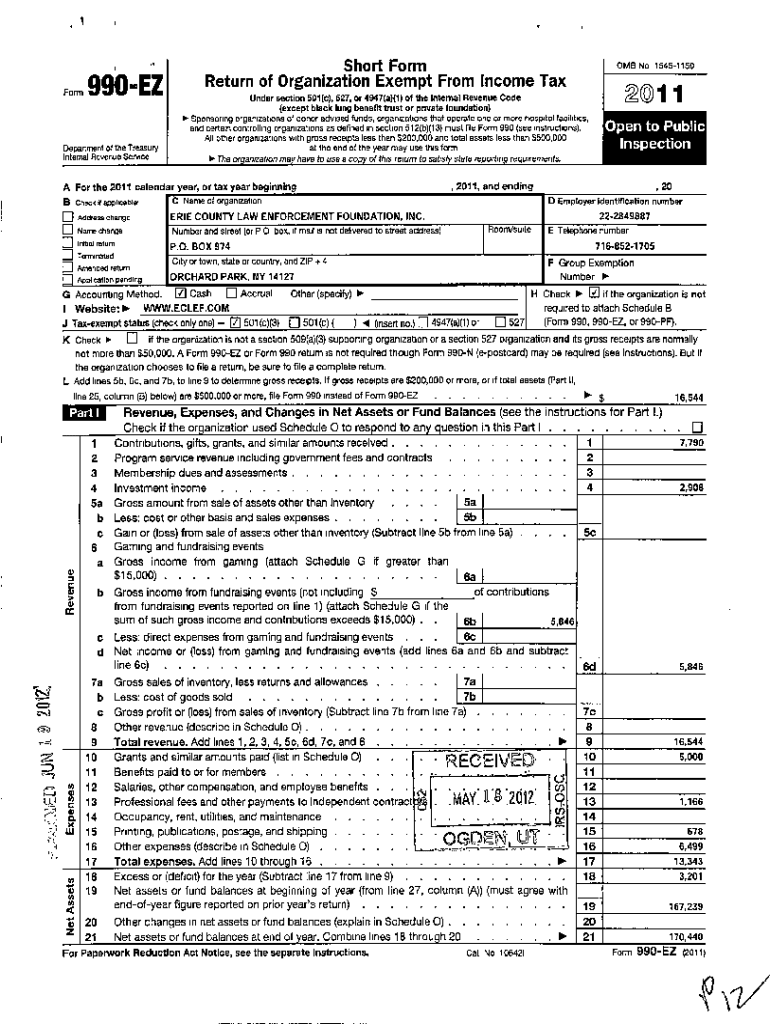

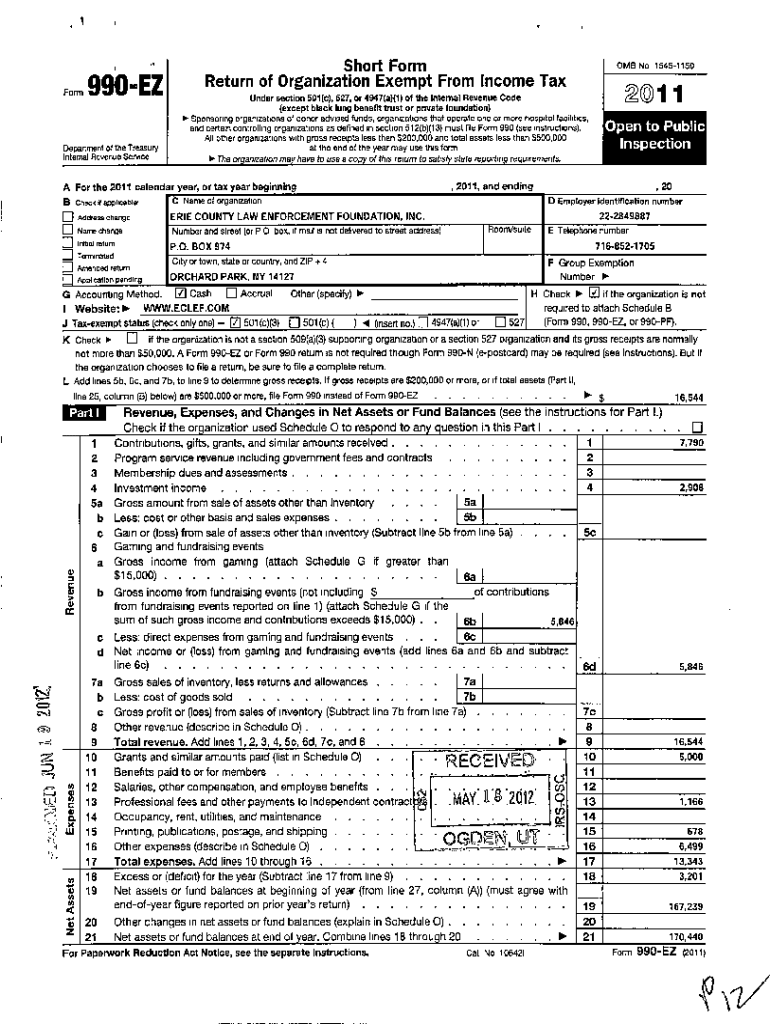

Form990EZShort Form Return of Organization Exempt From Income Tax OMB No 1545115020011Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 501c21 - ballotpedia

Edit your 501c21 - ballotpedia form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 501c21 - ballotpedia form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 501c21 - ballotpedia online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 501c21 - ballotpedia. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 501c21 - ballotpedia

How to fill out 501c21 - ballotpedia

01

To fill out Form 501(c)(21), also known as the Application for Recognition of Exemption Under Section 501(c)(21) of the Internal Revenue Code, follow these steps:

02

Obtain the form: You can download the form from the official website of the Internal Revenue Service (IRS) at www.irs.gov.

03

Review the instructions: Before you start filling out the form, carefully read the instructions provided with the form. This will help you understand the requirements and provide accurate information.

04

Provide organizational information: Fill in the required information about your organization, including its name, address, and contact details.

05

Describe the purpose and activities: Clearly describe the purpose for which your organization is being formed and the specific activities it will undertake. Provide detailed information about how your organization will fulfill the requirements of Section 501(c)(21) of the Internal Revenue Code.

06

Provide financial information: Fill in the financial information of your organization, including its sources of income, expenses, and assets.

07

Attach additional documents: If required, attach any additional documents that support your application, such as articles of incorporation, bylaws, or financial statements.

08

Review and submit: Double-check all the information you have provided and make sure it is accurate and complete. Sign and date the form, and submit it to the address mentioned in the instructions.

09

Follow up: After submitting the form, keep track of your application's progress and respond promptly if the IRS requests any additional information or documents.

10

It is advisable to consult with a tax professional or attorney who specializes in nonprofit law to ensure proper completion of Form 501(c)(21) and adherence to all applicable laws and regulations.

Who needs 501c21 - ballotpedia?

01

501(c)(21) is a specific type of tax-exempt status under section 501(c) of the Internal Revenue Code that applies to labor, agricultural, or horticultural organizations. These organizations are typically formed by groups of workers or farmers who come together to protect their economic interests and promote their common welfare.

02

Specifically, 501(c)(21) applies to organizations that are created to represent their members in negotiating, dealing with, or promoting their collective bargaining agreements, better working conditions, improved wages, and other related labor or agricultural matters.

03

Any organization that falls within this category and meets the requirements set forth by the IRS can apply for 501(c)(21) status. This includes labor unions, agricultural cooperatives, farm bureaus, and similar organizations.

04

It is important to note that obtaining 501(c)(21) status provides tax-exempt benefits and certain legal protections to these organizations. It allows them to receive tax-deductible contributions, qualify for certain grants and exemptions, and participate in collective bargaining activities.

05

To determine if your organization qualifies for 501(c)(21) status and understand the specific requirements, consult with a tax professional or attorney who specializes in nonprofit law.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 501c21 - ballotpedia from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including 501c21 - ballotpedia, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send 501c21 - ballotpedia to be eSigned by others?

Once your 501c21 - ballotpedia is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I fill out 501c21 - ballotpedia on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your 501c21 - ballotpedia. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is 501c21 - ballotpedia?

501(c)(21) refers to a specific section of the Internal Revenue Code that pertains to 'Fraternal Beneficiary Societies and Associations' which provide for the payment of life insurance and other benefits to their members.

Who is required to file 501c21 - ballotpedia?

Organizations that operate under the 501(c)(21) classification are required to file Form 990 with the IRS to report their income, expenses, and activities.

How to fill out 501c21 - ballotpedia?

To fill out 501(c)(21), organizations must complete Form 990 or 990-EZ, providing information regarding their financial activities, governance, and compliance with IRS regulations.

What is the purpose of 501c21 - ballotpedia?

The purpose of 501(c)(21) is to allow fraternal beneficiary societies and associations to provide insurance and other benefits to their members in a tax-exempt manner.

What information must be reported on 501c21 - ballotpedia?

Organizations must report income, expenses, membership information, governance policies, and details about their facilities and activities on Form 990.

Fill out your 501c21 - ballotpedia online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

501C21 - Ballotpedia is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.