Get the free federal reserve operating circular 1

Show details

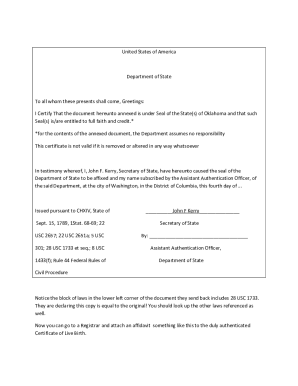

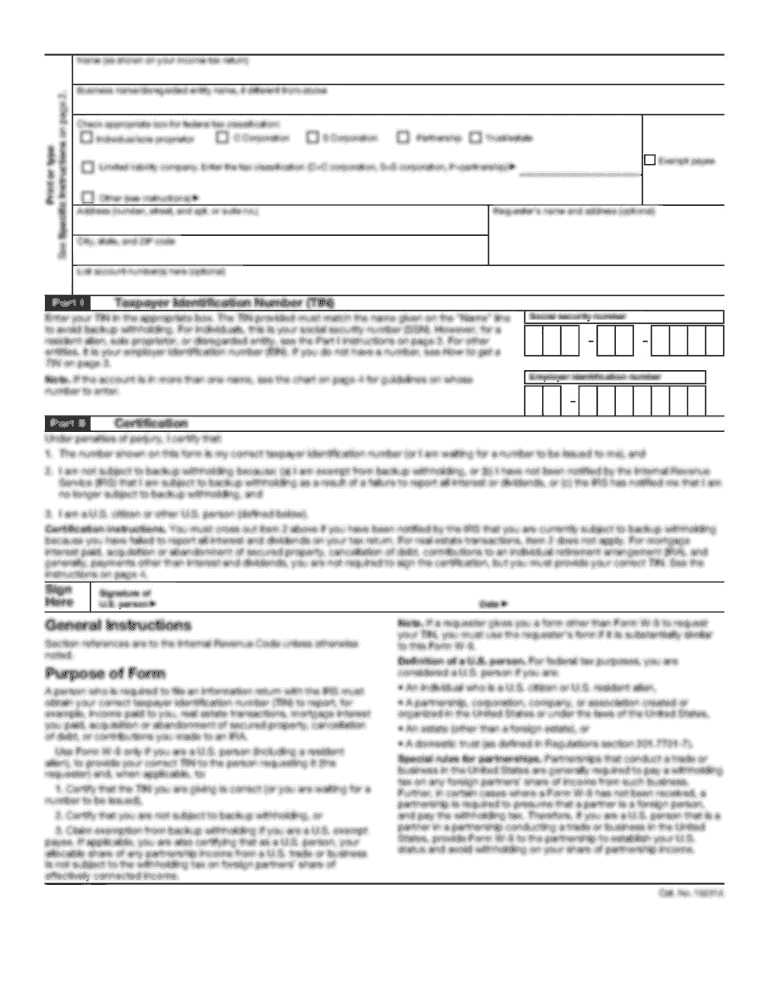

Operating Circular 1 Account Relationships Appendices Revised: September 2002 To: Federal Reserve Bank of Office Appendix 1 Attention: Department Master Account Agreement The Institution named below

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign operating circular 1 form

Edit your federal reserve operating circular form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal reserve operating circular form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal reserve operating circular online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit federal reserve operating circular. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal reserve operating circular

How to fill out operating circular 1?

01

Read through the operating circular carefully to understand its requirements and purpose.

02

Gather all the necessary information and documentation that is needed to fill out the operating circular accurately.

03

Follow the instructions provided in the operating circular to complete each section or form.

04

Pay close attention to any specific formatting or submission requirements mentioned in the operating circular.

05

Double-check your completed operating circular for any errors or missing information before submission.

06

Submit the filled-out operating circular according to the required method or deadline specified in the circular.

Who needs operating circular 1?

01

Various organizations or businesses that are subject to regulatory compliance may need to fill out operating circular 1.

02

Government agencies or departments may issue operating circular 1 to entities under their jurisdiction.

03

Specific industries or sectors may be required to fill out operating circular 1 to ensure compliance with specific guidelines or regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is an OC 10?

OxyContin Strength 10 mg Imprint OC 10 Color White Shape Round View details.

What is Section 16 of the Federal Reserve Act?

Any Federal Reserve bank may at any time reduce its liability for outstanding Federal Reserve notes by depositing with the Federal Reserve agent its Federal Reserve notes, gold certificates, Special Drawing Right certificates, or lawful money of the United States.

How does a master account work?

If you have a company with multiple different branches, a Master Account can be used to tie these branches together so when you do a search for the Master Account, a list of all the corresponding branches appear as well. For example, Bank of the World is a City Ledger Account in the PMS.

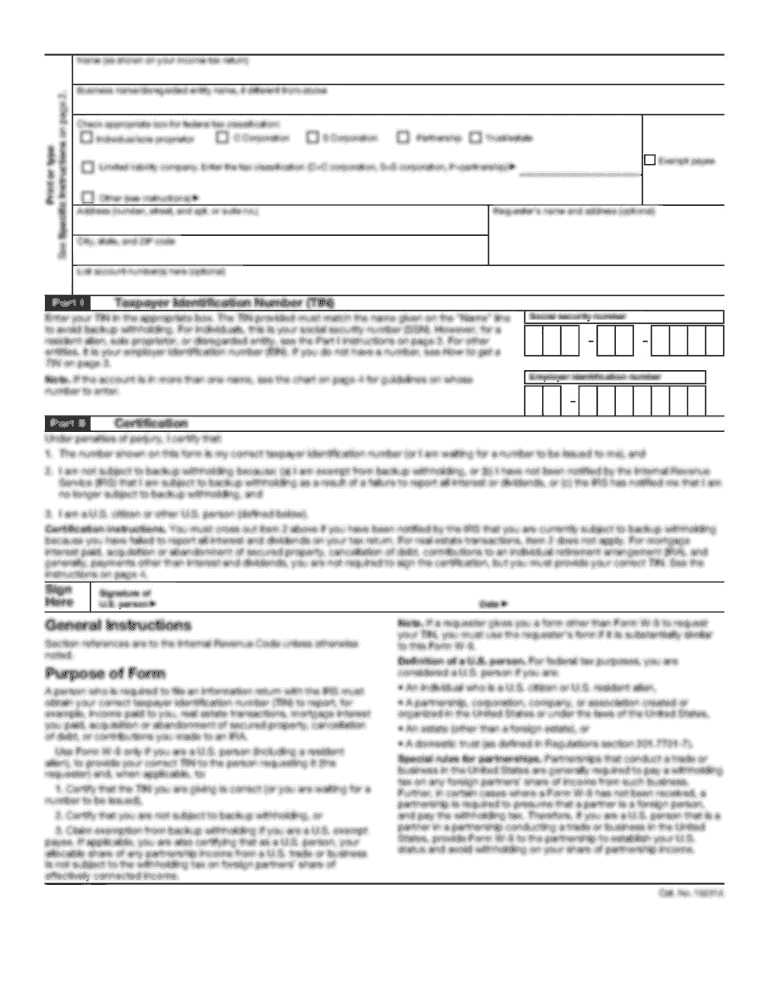

What is a Federal Reserve Master account?

For payment firms, a major motivation for seeking a bank charter is to obtain a Federal Reserve (Fed) “master account” to access wholesale payment systems and related Fed payment services (but not the Fed's discount window) without needing a bank to act as an intermediary.

What is Regulation J subpart C?

Regulation J, along with subpart C of Regulation CC and the Reserve Bank circulars, is binding on every party interested in an item handled by any Reserve Bank. States that a non-Reserve Bank sender may send any item to any Reserve Bank.

Can you put your money in the Federal Reserve bank?

Deposit Process and Standards. Federal Reserve Banks accept only genuine U.S. currency for deposit. Deposits of the following are NOT accepted at the Federal Reserve Banks: Foreign currency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify federal reserve operating circular without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your federal reserve operating circular into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit federal reserve operating circular in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your federal reserve operating circular, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How can I edit federal reserve operating circular on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing federal reserve operating circular.

What is operating circular 1?

Operating Circular 1 is a regulatory document that provides guidance on the operational policies and procedures of a specific financial institution, outlining the roles and responsibilities within its operations.

Who is required to file operating circular 1?

Institutions governed by specific regulatory frameworks, typically participating banks or financial entities, are required to file Operating Circular 1.

How to fill out operating circular 1?

To fill out Operating Circular 1, organizations must complete the required sections accurately, provide all necessary data, and submit the form according to the instructions provided by the regulatory body.

What is the purpose of operating circular 1?

The purpose of Operating Circular 1 is to establish clear guidelines and standards for operations, ensuring compliance with regulations and fostering accountability within financial institutions.

What information must be reported on operating circular 1?

Operating Circular 1 typically requires institutions to report operational data such as transaction volumes, compliance metrics, and any incidents or irregularities affecting operations.

Fill out your federal reserve operating circular online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Reserve Operating Circular is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.