Get the free Lump Sum On Death - The Pensions Advisory Service - 2015 sppa gov

Show details

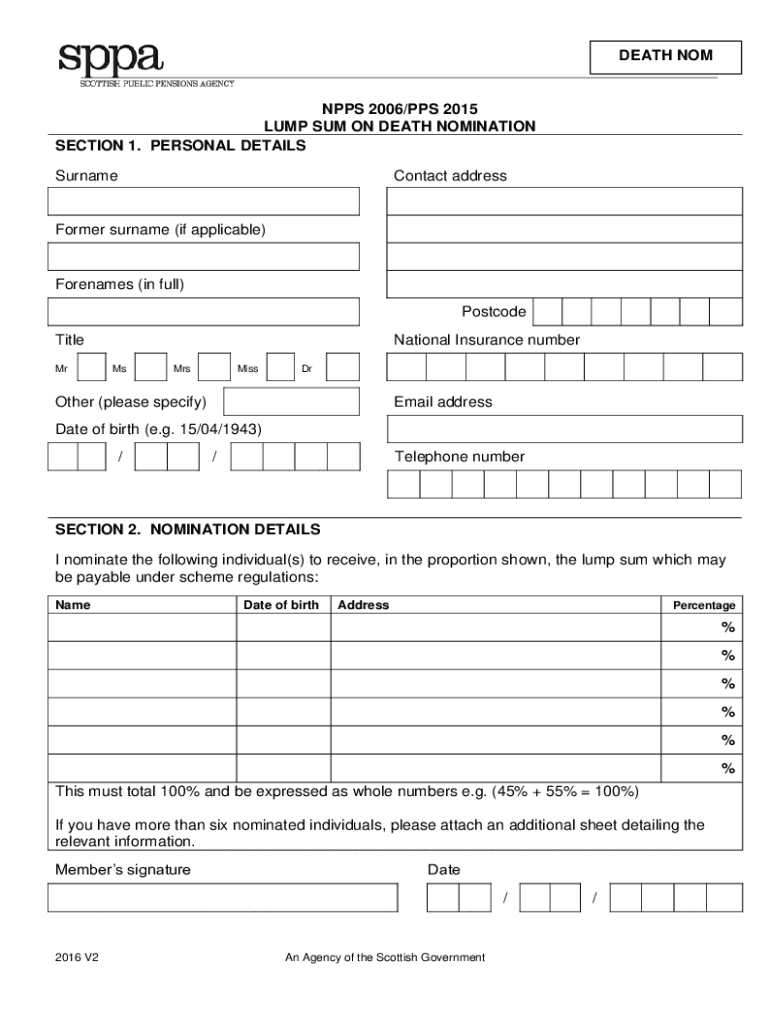

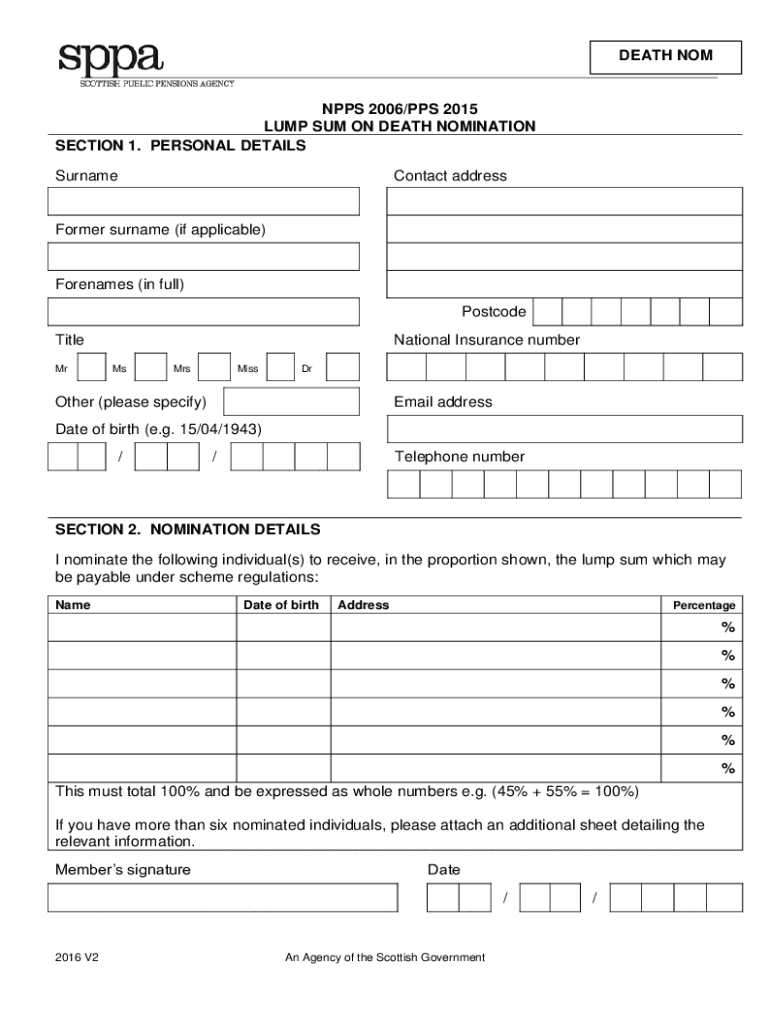

DEATH NOMINEES 2006/PPS 2015

LUMP SUM ON DEATH NOMINATION

SECTION 1. PERSONAL DETAILS

SurnameContact addressFormer surname (if applicable)Forenames (in full)

Postcode

Title

National Insurance number

MsMrsMissDrOther

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lump sum on death

Edit your lump sum on death form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lump sum on death form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lump sum on death online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit lump sum on death. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lump sum on death

How to fill out lump sum on death

01

To fill out a lump sum on death, follow these steps:

02

Obtain the necessary paperwork. Typically, you will need to fill out a claim form provided by the insurance company or the deceased person's employer.

03

Gather the required documents. You may need to provide proof of death, such as a death certificate, as well as any other supporting documentation requested by the insurance company.

04

Fill out the claim form accurately. Provide all the necessary information, such as the deceased person's name, policy number, and beneficiary details. Double-check the information to ensure it is correct.

05

Review and sign the claim form. Make sure you understand the terms and conditions mentioned in the form before signing it.

06

Submit the claim form and supporting documents to the insurance company or the appropriate authority. Follow any instructions provided by the company regarding submission methods and deadlines.

07

Wait for the claim to be processed. The insurance company will review the form and documents submitted. If everything is in order, they will proceed with processing the lump sum payment.

08

Receive the lump sum payment. Once the claim is approved, the insurance company will issue the payment as a lump sum to the designated beneficiary.

Who needs lump sum on death?

01

Lump sum on death is typically needed by the beneficiaries or dependents of the deceased person who had an insurance policy. This includes:

02

- Spouses or life partners who relied on the deceased person's income for financial support.

03

- Children or other dependents who were financially dependent on the deceased.

04

- Individuals who had outstanding loans or debts jointly with the deceased and need to settle those obligations.

05

- Executors or administrators of the deceased person's estate who require funds to handle administrative expenses, such as funeral costs, legal fees, or other outstanding bills.

06

It is important to note that the eligibility for lump sum on death may vary depending on the specific terms and conditions of the insurance policy or employment benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get lump sum on death?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the lump sum on death in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How can I edit lump sum on death on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing lump sum on death right away.

Can I edit lump sum on death on an Android device?

With the pdfFiller Android app, you can edit, sign, and share lump sum on death on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is lump sum on death?

A lump sum on death is a one-time payment made to the beneficiaries of a deceased individual's estate. This amount is typically related to benefits such as pensions, life insurance, or other final distributions from a retirement plan.

Who is required to file lump sum on death?

The beneficiaries or the estate executor are typically required to file for a lump sum on death, depending on the type of benefits being claimed.

How to fill out lump sum on death?

To fill out a lump sum on death form, you usually need to provide personal information about the deceased, details regarding the benefits or retirement plans, and the identification of the beneficiaries. Each form will have specific guidelines, so it's essential to follow the instructions provided.

What is the purpose of lump sum on death?

The purpose of lump sum on death is to provide beneficiaries with a financial payout upon the passing of an individual, ensuring that they can cover expenses, settle debts, or utilize the funds as necessary.

What information must be reported on lump sum on death?

Information typically required includes the deceased's details (name, date of birth, date of death), information about the plan or benefits being claimed, and the names and contact information of the beneficiaries.

Fill out your lump sum on death online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lump Sum On Death is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.