Get the free Delinquent Tax - Offices - County of Florence

Show details

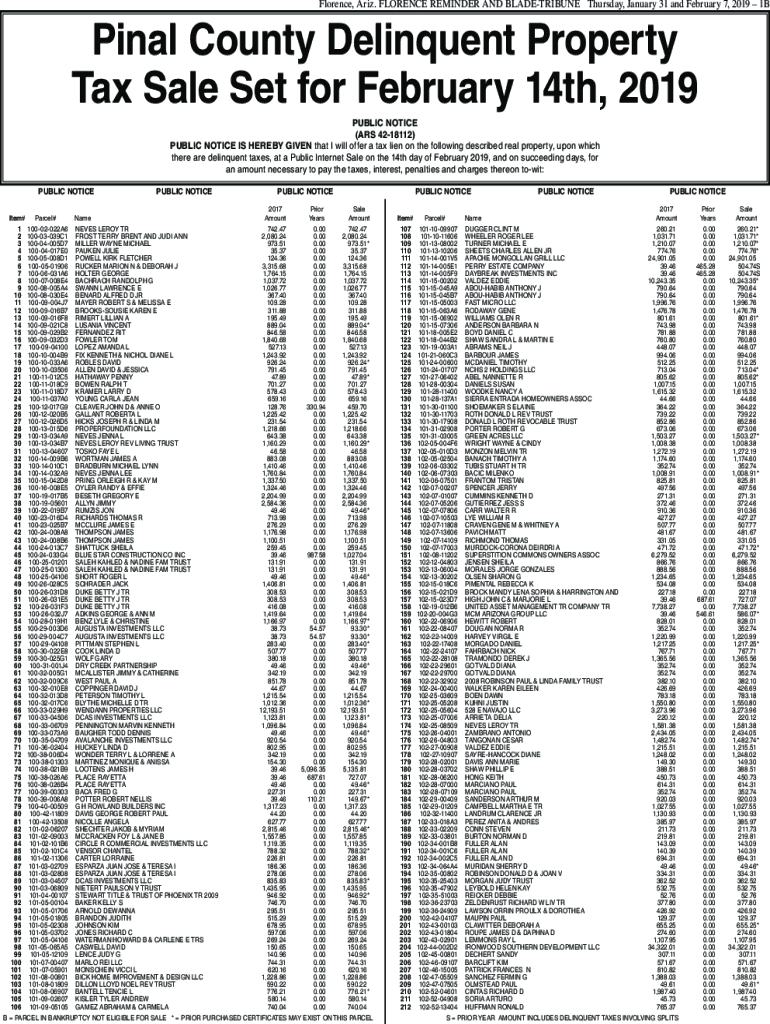

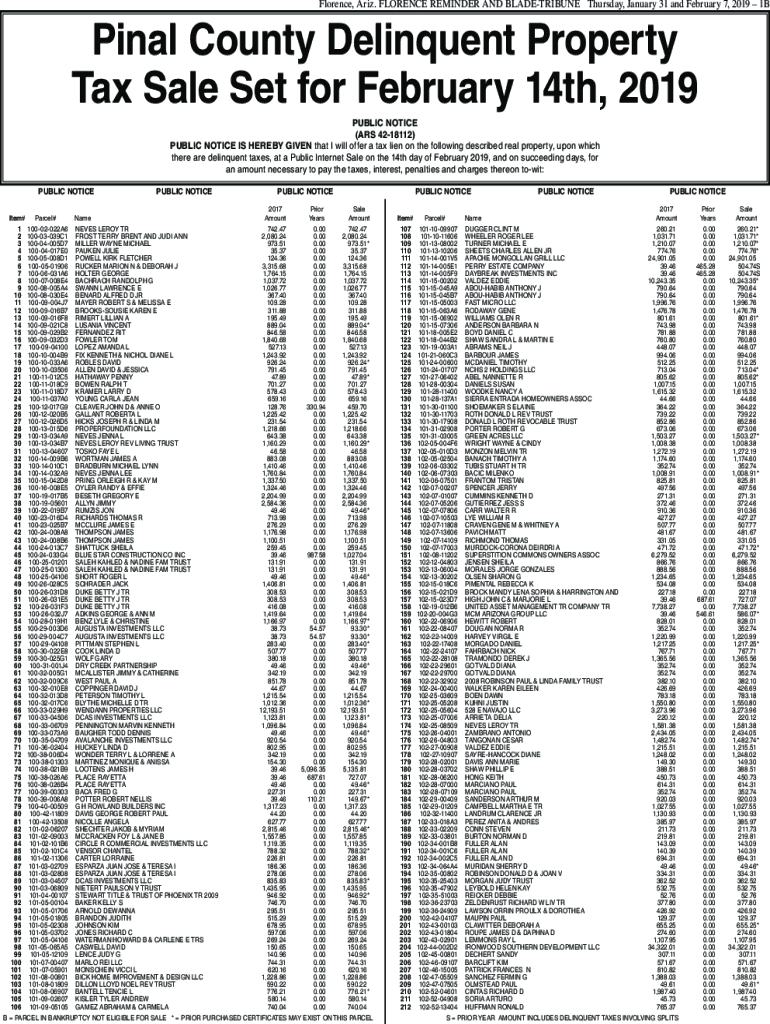

Florence, Ariz. FLORENCE REMINDER AND BLADETRIBUNE Thursday, January 31 and February 7, 2019 1BPinal County Delinquent Property Tax Sale Set for February 14th, 2019 PUBLIC NOTICE (AS 4218112) PUBLIC

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign delinquent tax - offices

Edit your delinquent tax - offices form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delinquent tax - offices form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing delinquent tax - offices online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit delinquent tax - offices. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out delinquent tax - offices

How to fill out delinquent tax - offices

01

Collect all documents and information related to your delinquent taxes, such as tax forms, payment records, and any correspondence with the tax office.

02

Visit the local delinquent tax office in your area. You can find the nearest office by searching online or contacting your local government's tax department.

03

Ensure you have sufficient identification and proof of ownership or responsibility for the taxes being addressed. This may include identification documents, property deeds, or business licenses.

04

Arrive at the office during the designated business hours and be prepared to wait in a queue if necessary.

05

Approach the counter or representative at the office and explain your situation regarding the delinquent taxes.

06

Provide all the necessary documents and information requested by the representative, and answer any additional questions they may have.

07

Listen carefully to the instructions or recommendations provided by the representative, and ask for clarification if needed.

08

Follow any prescribed steps or actions given by the representative to resolve your delinquent tax issue, such as filling out specific forms, making payment arrangements, or seeking further assistance.

09

Keep a record of any transactions, forms, or agreements made during your visit to the delinquent tax office for future reference.

10

Follow up on any commitments or deadlines set during the visit and ensure timely compliance with the tax office's requirements.

Who needs delinquent tax - offices?

01

Individuals who have outstanding tax payments or obligations that have not been fulfilled within the designated timeframe.

02

Property owners who are behind on property tax payments or have received delinquency notices.

03

Businesses or organizations that have accumulated unpaid taxes or require assistance in resolving tax-related issues.

04

Taxpayers who have received notifications from the tax office regarding delinquent taxes and need to address these matters to avoid further penalties or legal consequences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in delinquent tax - offices without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your delinquent tax - offices, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit delinquent tax - offices on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share delinquent tax - offices from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit delinquent tax - offices on an Android device?

You can make any changes to PDF files, like delinquent tax - offices, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is delinquent tax - offices?

Delinquent tax offices are governmental agencies responsible for collecting overdue taxes that have not been paid by taxpayers within the specified deadline.

Who is required to file delinquent tax - offices?

Individuals or businesses that have unpaid taxes for a particular tax year are required to file delinquent tax offices.

How to fill out delinquent tax - offices?

To fill out a delinquent tax office form, taxpayers should obtain the appropriate forms from their local tax office, provide detailed financial information, list all unpaid taxes, and submit any required documentation.

What is the purpose of delinquent tax - offices?

The purpose of delinquent tax offices is to ensure the collection of owed taxes and to maintain the financial health of local and state governments.

What information must be reported on delinquent tax - offices?

Taxpayers must report their personal information, tax identification number, details of the unpaid taxes, any previous correspondence regarding the delinquency, and relevant financial records.

Fill out your delinquent tax - offices online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Delinquent Tax - Offices is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.