Get the free Foreign Account Tax Compliance Act (FATCA) Form

Show details

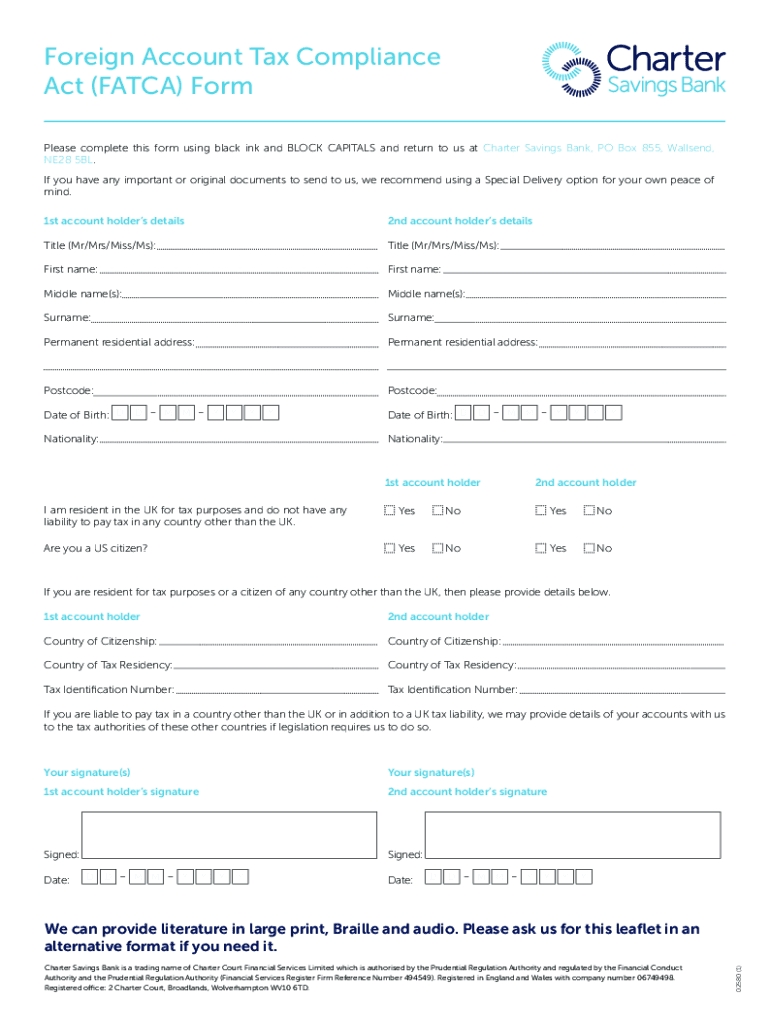

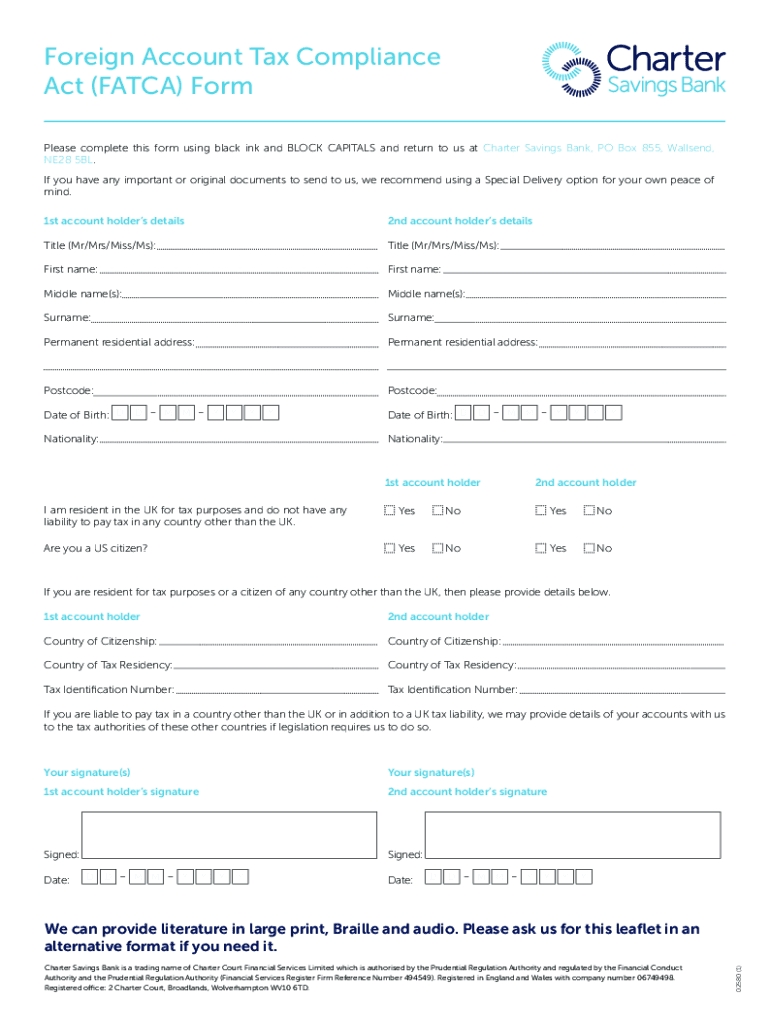

Foreign Account Tax Compliance

Act (FATWA) Form

Please complete this form using black ink and BLOCK CAPITALS and return to us at Charter Savings Bank, PO Box 855, Wall send,

NE28 5BL.

If you have

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foreign account tax compliance

Edit your foreign account tax compliance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foreign account tax compliance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing foreign account tax compliance online

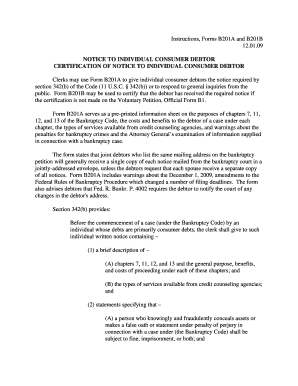

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit foreign account tax compliance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foreign account tax compliance

How to fill out foreign account tax compliance

01

Step 1: Gather all necessary information about your foreign accounts, including bank statements, investment statements, and other relevant documents.

02

Step 2: Download and fill out the necessary forms, such as Form 8938 (Statement of Specified Foreign Financial Assets) and Form 114 (Report of Foreign Bank and Financial Accounts).

03

Step 3: Provide accurate and complete information on the forms, including details of each foreign account, the maximum value of each account, and other required information.

04

Step 4: Ensure that you meet the deadline for filing the forms, which is typically on April 15th for individuals and June 30th for some foreign account reporting forms.

05

Step 5: Keep copies of all the forms and supporting documents for your records.

06

Step 6: If you have any doubts or need assistance, consider consulting a tax professional or utilizing resources provided by the Internal Revenue Service (IRS).

Who needs foreign account tax compliance?

01

Any individual or entity that qualifies as a United States person and has ownership or signature authority over foreign financial accounts must comply with foreign account tax compliance.

02

This includes U.S. citizens, residents, and domestic entities, as well as certain non-resident aliens, foreign trusts, and foreign corporations with a sufficient connection to the United States.

03

It is important to note that the specific requirements and thresholds may vary depending on factors such as the type of account, the taxpayer's filing status, and the total value of the foreign accounts.

04

To determine if you need to comply with foreign account tax compliance, it is advisable to consult a tax professional or refer to guidance provided by the IRS.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete foreign account tax compliance online?

Filling out and eSigning foreign account tax compliance is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the foreign account tax compliance in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your foreign account tax compliance and you'll be done in minutes.

How do I fill out the foreign account tax compliance form on my smartphone?

Use the pdfFiller mobile app to fill out and sign foreign account tax compliance. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is foreign account tax compliance?

Foreign account tax compliance refers to the regulations established to ensure that U.S. taxpayers report foreign financial accounts and assets to the Internal Revenue Service (IRS). This primarily involves compliance with the Foreign Account Tax Compliance Act (FATCA).

Who is required to file foreign account tax compliance?

U.S. citizens, green cardholders, and certain non-resident aliens who have foreign financial accounts or excess foreign financial assets that meet specific thresholds are required to file foreign account tax compliance.

How to fill out foreign account tax compliance?

To fill out foreign account tax compliance, individuals typically need to complete Form 8938 (Statement of Specified Foreign Financial Assets) and may also need to file FinCEN Form 114 (FBAR). This involves reporting detailed information about foreign accounts, including account numbers, balances, and types of assets.

What is the purpose of foreign account tax compliance?

The purpose of foreign account tax compliance is to prevent tax evasion by U.S. citizens and residents through the use of foreign accounts and to ensure that the IRS receives proper reporting of foreign financial interests.

What information must be reported on foreign account tax compliance?

On foreign account tax compliance, individuals must report information such as the names and addresses of foreign banks, the account numbers, the maximum values of the accounts during the reporting period, and any other specified foreign financial assets.

Fill out your foreign account tax compliance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foreign Account Tax Compliance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.