Get the free 2018 Whole-Farm Revenue Protection Pilot Handbook ...

Show details

Farm

e

l

b

a

T

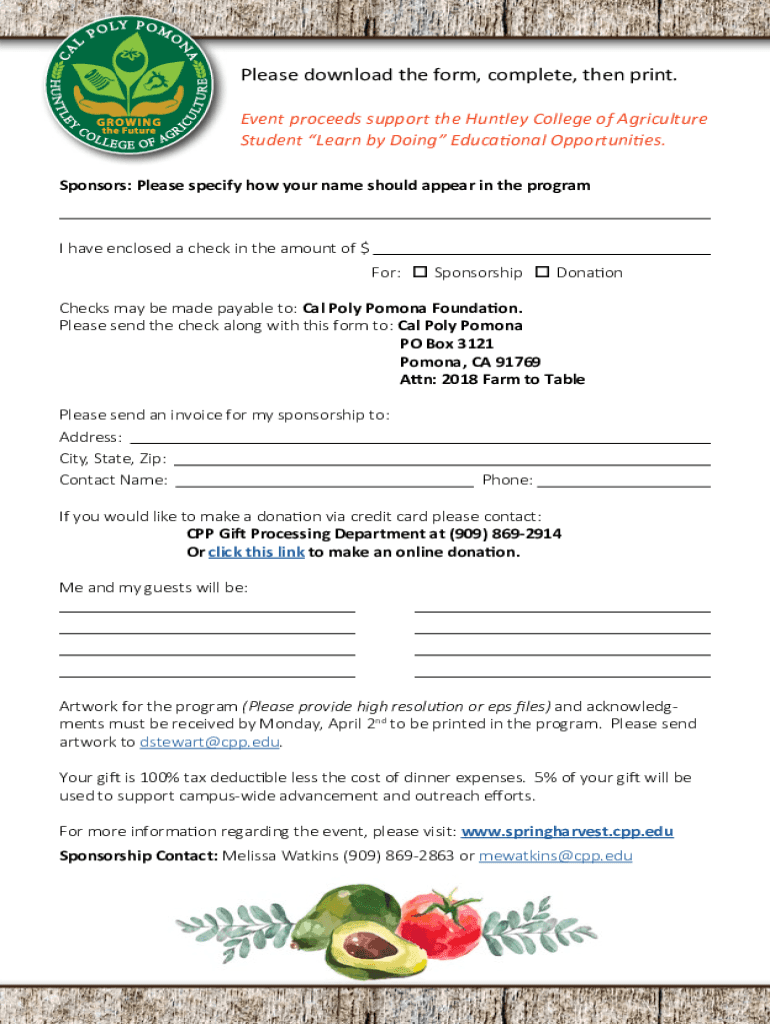

sponsorship Opportunitiesapril 14, $201810,000 Distinguished Sponsor

Two reserved tables with prominent placement and VIP Parking

Sixteen complimentary dinner tickets ($65 Fair Market

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2018 whole-farm revenue protection

Edit your 2018 whole-farm revenue protection form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2018 whole-farm revenue protection form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2018 whole-farm revenue protection online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2018 whole-farm revenue protection. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2018 whole-farm revenue protection

How to fill out 2018 whole-farm revenue protection

01

Step 1: Gather all necessary financial records, including income statements, balance sheets, and tax returns.

02

Step 2: Determine the total revenue generated by your farm in 2018 by adding up all sources of income.

03

Step 3: Calculate the average revenue of your farm over the past five years, if applicable.

04

Step 4: Determine the level of coverage you need based on your farm's revenue history and financial goals.

05

Step 5: Submit the necessary forms and paperwork to your insurance provider, including the completed Whole-Farm Revenue Protection application.

06

Step 6: Await approval and review any additional requirements or documentation requested by the insurance provider.

07

Step 7: Make the necessary premium payments as specified by the insurance provider.

08

Step 8: Keep detailed records of farm revenue throughout the coverage period in case of a claim.

09

Step 9: In case of a loss, submit a claim and follow the instructions provided by the insurance provider.

10

Step 10: Cooperate fully with any investigations or reviews requested by the insurance provider regarding your claim.

Who needs 2018 whole-farm revenue protection?

01

Farmers who want to protect their farm's revenue against unexpected losses

02

Farmers who have diversified sources of income

03

Farmers with revenue histories that may fluctuate significantly

04

Farmers who want to ensure their farm remains financially stable and viable

05

Farmers who want to access financial assistance in case of a loss

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 2018 whole-farm revenue protection?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your 2018 whole-farm revenue protection to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit 2018 whole-farm revenue protection on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 2018 whole-farm revenue protection.

Can I edit 2018 whole-farm revenue protection on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign 2018 whole-farm revenue protection right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is whole-farm revenue protection pilot?

The Whole-Farm Revenue Protection Pilot is a type of insurance program designed to protect farmers' revenue by providing coverage against a decline in whole-farm revenue, which can be impacted by various risks including price changes, natural disasters, and other unforeseen events.

Who is required to file whole-farm revenue protection pilot?

Farmers and ranchers who wish to enroll in the Whole-Farm Revenue Protection Pilot are required to file, especially those who produce multiple crops or livestock and are interested in insuring their entire farm's revenue.

How to fill out whole-farm revenue protection pilot?

To fill out the Whole-Farm Revenue Protection Pilot, applicants must gather necessary financial documents, provide information about farm operations and revenue sources, and complete the designated application forms provided by the insurance provider or the USDA.

What is the purpose of whole-farm revenue protection pilot?

The purpose of the Whole-Farm Revenue Protection Pilot is to provide comprehensive revenue insurance coverage that helps farmers mitigate risks to their income from various sources, ensuring financial stability and sustainability in farming operations.

What information must be reported on whole-farm revenue protection pilot?

Farmers must report information such as total farm revenue, the types of crops or livestock produced, historical revenue data, and any insurance coverage currently held for specific crops or operations.

Fill out your 2018 whole-farm revenue protection online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2018 Whole-Farm Revenue Protection is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.