Get the free MS Excel Expense Claim Form TemplateWord & Excel TemplatesAccounting for Ins...

Show details

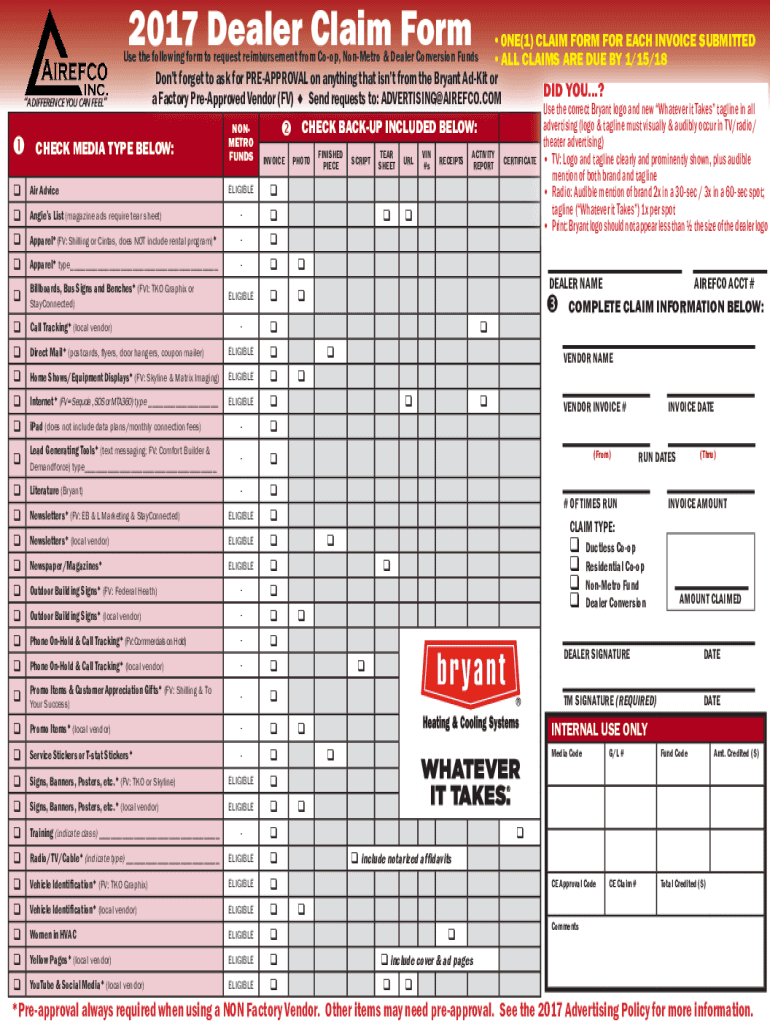

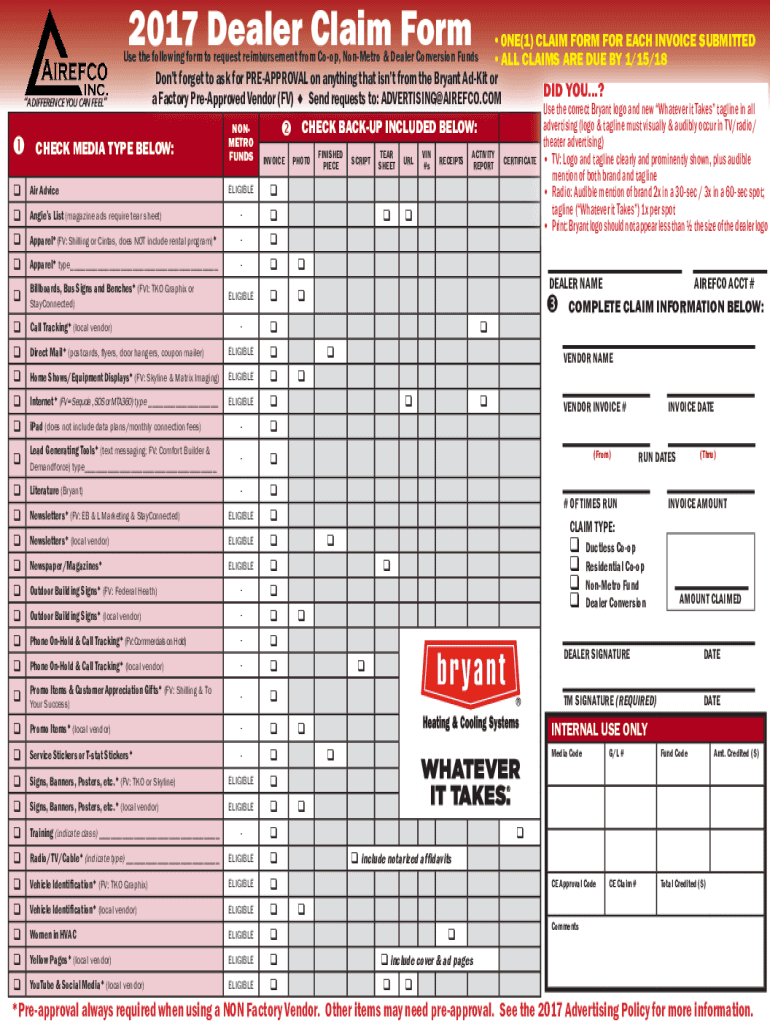

2017 Dealer Claim Form 0NE(1) CLAIM FORM FOR EACH INVOICE SUBMITTED ALL CLAIMS ARE DUE BY 1/15/18 Don't forget to ask for PREAPPROVAL on anything that isn't from the Bryant Admit or DID YOU...? A

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ms excel expense claim

Edit your ms excel expense claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ms excel expense claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ms excel expense claim online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ms excel expense claim. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ms excel expense claim

How to fill out ms excel expense claim

01

Open Microsoft Excel.

02

Go to the 'File' tab and click on 'New' to open a new workbook.

03

Click on the first cell of the worksheet where you want to enter the expense claim details, usually it is cell A1.

04

Enter the necessary information such as date, description, amount, etc. for each expense in separate rows.

05

Format the cells as needed, such as applying currency formatting to the amount column or date formatting to the date column.

06

Sum up the total expenses by using the SUM function in a separate cell.

07

Save the Excel file with a relevant name and location.

08

Review the filled out expense claim before submitting it.

Who needs ms excel expense claim?

01

Anyone who wants to keep track of their expenses in a structured and organized manner can use MS Excel expense claim.

02

Employees who need to submit expense claims to their employers.

03

Freelancers or self-employed individuals who want to track their business expenses.

04

Organizations and businesses that require their employees to use a standardized expense claim form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ms excel expense claim without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your ms excel expense claim into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute ms excel expense claim online?

Completing and signing ms excel expense claim online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit ms excel expense claim on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share ms excel expense claim on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is ms excel expense claim?

MS Excel expense claim is a document or spreadsheet created in Microsoft Excel that is used by employees to request reimbursement for out-of-pocket expenses incurred during business activities.

Who is required to file ms excel expense claim?

Employees who incur business-related expenses and seek reimbursement from their employer are required to file an MS Excel expense claim.

How to fill out ms excel expense claim?

To fill out an MS Excel expense claim, input the date of the expense, a description of the expense, the amount spent, and attach any relevant receipts to the claim form.

What is the purpose of ms excel expense claim?

The purpose of MS Excel expense claim is to provide a standardized method for employees to report and be reimbursed for expenses incurred during the course of business.

What information must be reported on ms excel expense claim?

Information that must be reported includes the date, description of the expense, amount spent, purpose of the expense, and any supporting documentation such as receipts.

Fill out your ms excel expense claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ms Excel Expense Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.