Get the free American Home Mortgage - Keller Williams Realty

Show details

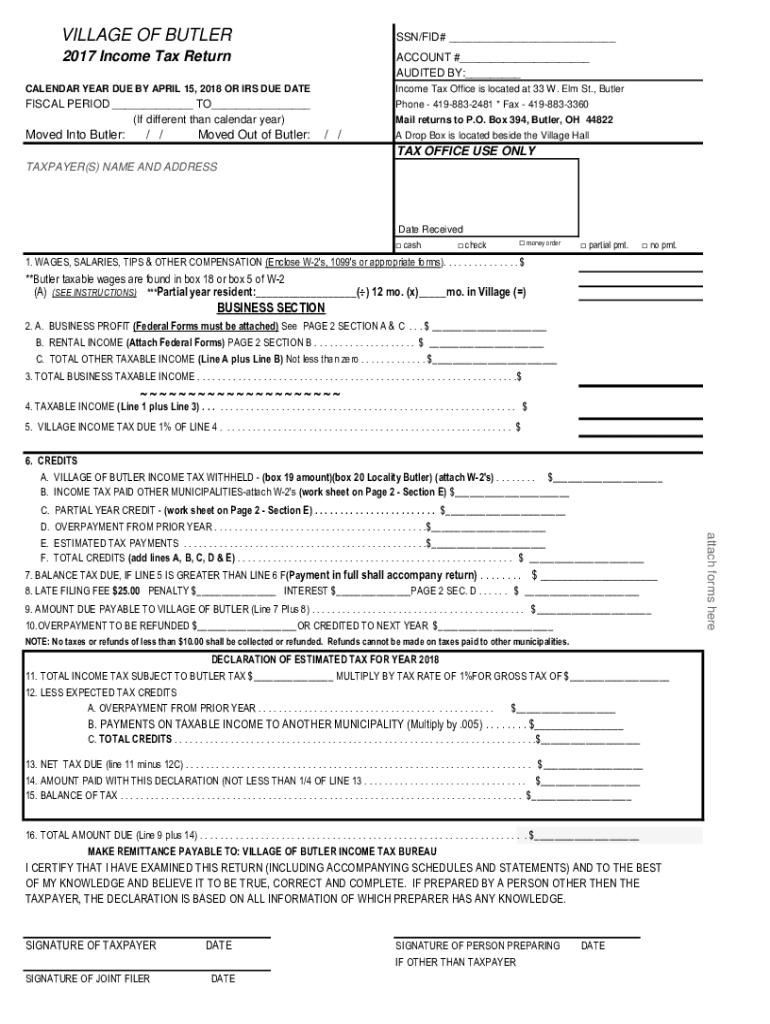

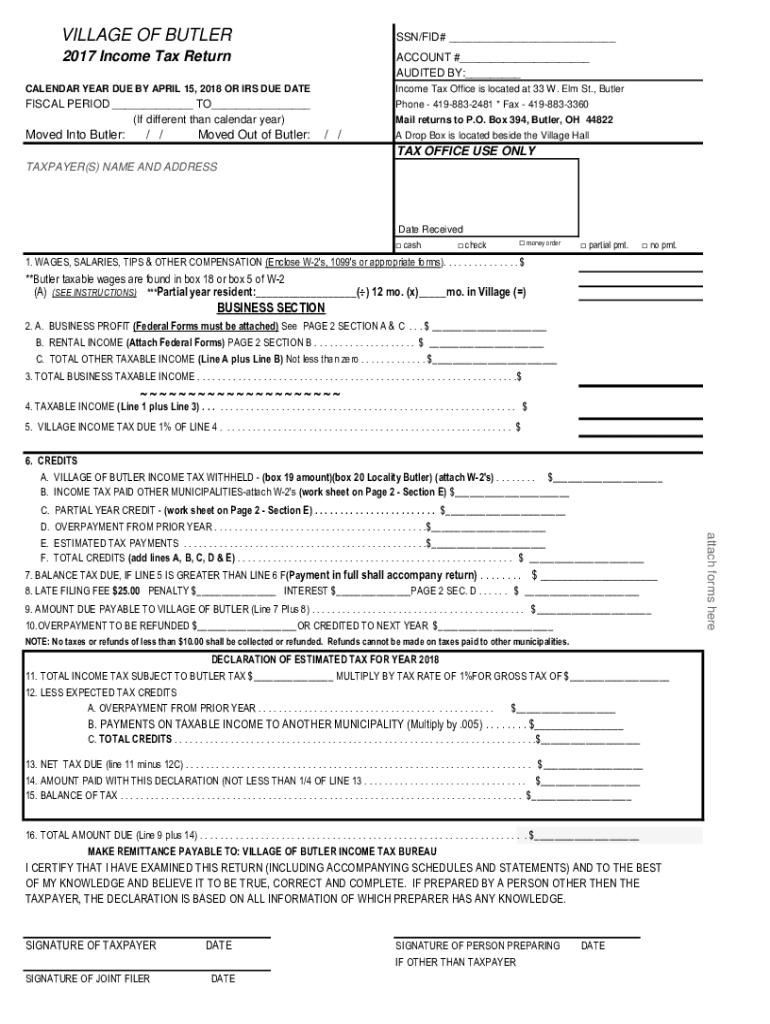

VILLAGE OF BUTLERS SN/FID# 2017 Income Tax ReturnACCOUNT # AUDITED BY: CALENDAR YEAR DUE BY APRIL 15, 2018, OR IRS DUE DATEIncome Tax Office is located at 33 W. Elm St., ButlerFISCAL PERIOD TO (If

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign american home mortgage

Edit your american home mortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your american home mortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing american home mortgage online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit american home mortgage. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out american home mortgage

How to fill out american home mortgage

01

To fill out an American home mortgage, follow these steps:

02

Gather all the necessary documents: This includes your identification, income statements, tax returns, bank statements, and any other relevant financial information.

03

Research different mortgage lenders: Compare their interest rates, terms, and requirements to find the best fit for your needs.

04

Complete the loan application: Fill out all the sections accurately and provide all the requested information.

05

Submit the application: Send the completed application along with the required documents to the chosen mortgage lender.

06

Await approval: The lender will review your application and supporting documents to determine whether you qualify for the mortgage.

07

Provide additional information if requested: The lender might ask for further clarification or documentation during the review process.

08

Complete the underwriting process: If your application is approved, the lender will conduct a thorough evaluation of your financial situation before finalizing the mortgage terms.

09

Sign the loan documents: Once the mortgage terms are finalized, you will need to sign the loan documents to officially agree to the terms and conditions.

10

Close on the loan: Arrange for a closing meeting where you will pay any required fees and sign the final paperwork.

11

Begin making mortgage payments: After closing on the loan, start making monthly mortgage payments as specified in the loan agreement.

Who needs american home mortgage?

01

American home mortgage is typically needed by individuals or families who want to purchase a property in the United States but do not have sufficient funds to pay the full amount upfront.

02

It is also commonly used by individuals looking to refinance their existing mortgage to take advantage of lower interest rates or to adjust their loan terms.

03

In general, anyone who plans to buy a home and needs financial assistance to do so can benefit from an American home mortgage.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send american home mortgage for eSignature?

To distribute your american home mortgage, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I fill out the american home mortgage form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign american home mortgage. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete american home mortgage on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your american home mortgage. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is American home mortgage?

American home mortgage refers to a type of loan specifically designed for purchasing residential properties in the United States.

Who is required to file American home mortgage?

Individuals or entities that are applying for a home mortgage to finance the purchase of residential property are required to file for an American home mortgage.

How to fill out American home mortgage?

To fill out an American home mortgage, applicants need to provide personal information, financial details, employment history, and information about the property being purchased on the designated mortgage application form.

What is the purpose of American home mortgage?

The purpose of an American home mortgage is to provide borrowers with the funds necessary to purchase residential properties, allowing them to pay for the property over time through regular monthly payments.

What information must be reported on American home mortgage?

The information that must be reported includes borrower’s personal identification, income details, credit history, debts, and specific information regarding the property, such as its value and location.

Fill out your american home mortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

American Home Mortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.