Get the free Home - MFSA

Show details

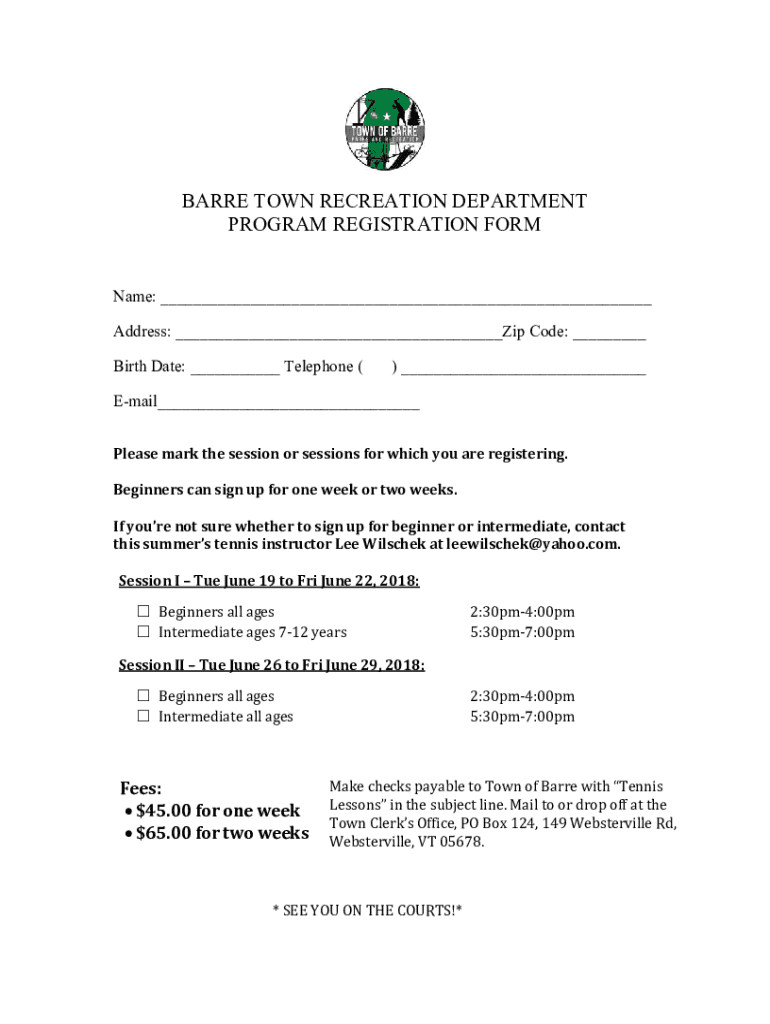

BARRE TOWN RECREATION DEPARTMENT PROGRAM REGISTRATION Forename: Address: Zip Code: Birth Date: Telephone () Email Please mark the session or sessions for which you are registering. Beginners can sign

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home - mfsa

Edit your home - mfsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home - mfsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home - mfsa online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit home - mfsa. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home - mfsa

How to fill out home - mfsa

01

To fill out home - mfsa, follow these steps:

02

Start by gathering all the required information and documents such as personal identification, address proof, and income details.

03

Visit the website of the relevant financial authority or housing agency that provides the home - mfsa form.

04

Download the home - mfsa form and carefully read the instructions and guidelines provided.

05

Fill in your personal information accurately, including your name, contact details, and social security number.

06

Provide details about your current residential address and mention if you are the owner or tenant.

07

Enter information about your monthly income and expenses, including any existing loans or debts.

08

Include information about the property you wish to purchase or finance through home - mfsa, such as its address and estimated cost.

09

Double-check all the entered information for accuracy and completeness.

10

Submit the filled-out home - mfsa form along with the required supporting documents to the designated authority or agency either physically or through an online submission portal.

11

Wait for the review and approval process to complete. You may be contacted for further information or clarification if needed.

12

Once approved, you will be notified about the next steps, such as signing the agreement or receiving the financial assistance.

Who needs home - mfsa?

01

Home - mfsa is needed by individuals or families who are looking for financial assistance or support to purchase or finance a home.

02

It is particularly helpful for those who may not have enough savings or access to traditional mortgage options.

03

People who are eligible for home - mfsa include first-time home buyers, low-income individuals or families, and those facing difficulties in securing affordable housing.

04

Government agencies, financial institutions, and non-profit organizations often provide home - mfsa programs to assist these individuals or families in achieving homeownership.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify home - mfsa without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including home - mfsa, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get home - mfsa?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the home - mfsa in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete home - mfsa online?

Filling out and eSigning home - mfsa is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

What is home - mfsa?

Home - MFSA refers to the 'Home Mortgage Disclosure Act - Mortgage Financing Services Agreement', which is a report that financial institutions must file to comply with regulatory requirements related to mortgage lending.

Who is required to file home - mfsa?

Financial institutions that originate mortgage loans are required to file home - MFSA, including banks, credit unions, and mortgage lenders.

How to fill out home - mfsa?

To fill out home - MFSA, institutions must gather and report detailed information about mortgage applications, originations, and denials, ensuring accuracy and compliance with the regulatory guidelines provided by the applicable authority.

What is the purpose of home - mfsa?

The purpose of home - MFSA is to promote transparency in mortgage lending and to ensure that lenders are working in a fair and non-discriminatory manner by tracking lending patterns and practices.

What information must be reported on home - mfsa?

Information required on home - MFSA includes data about the borrower, loan amount, property location, and details about the decision on the application (e.g., whether it was approved or denied).

Fill out your home - mfsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home - Mfsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.