Get the free Note: Form 2553 begins on the next page.

Show details

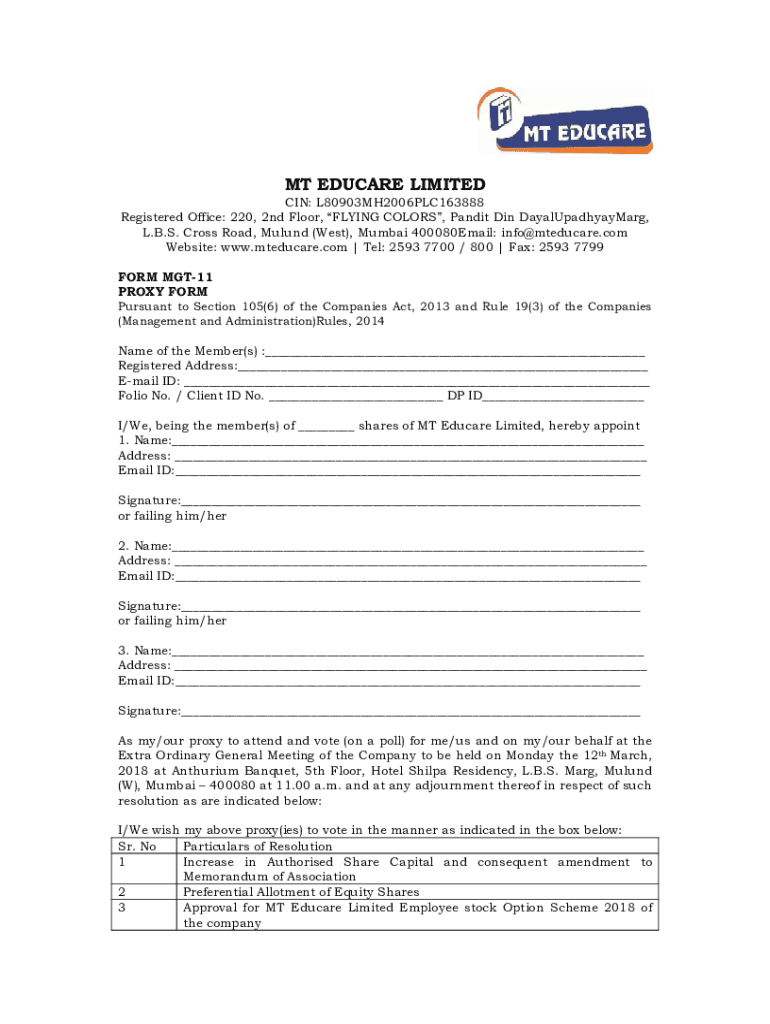

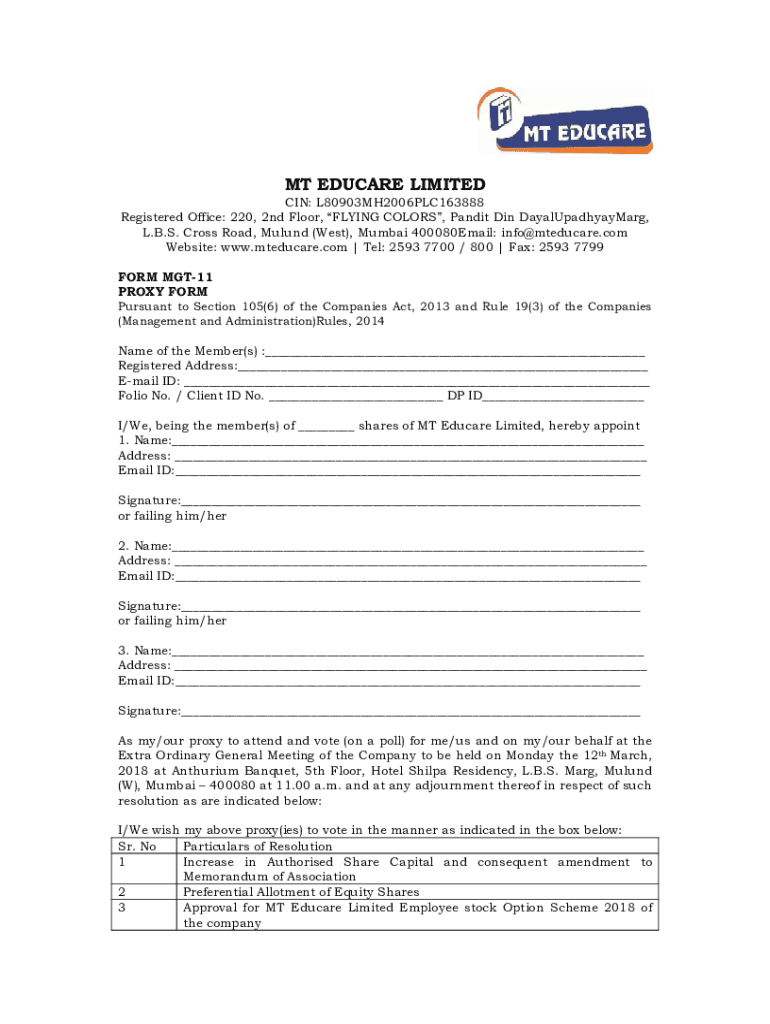

MT EDUCATE LIMITED IN: L80903MH2006PLC163888 Registered Office: 220, 2nd Floor, FLYING COLORS, Pandit Din DayalUpadhyayMarg, L.B.S. Cross Road, Mound (West), Mumbai 400080Email: info mteducare.com

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign note form 2553 begins

Edit your note form 2553 begins form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your note form 2553 begins form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing note form 2553 begins online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit note form 2553 begins. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out note form 2553 begins

How to fill out note form 2553 begins

01

To fill out Form 2553, follow these steps:

02

Provide basic information at the top of the form, such as the entity's name, EIN, and address.

03

Indicate the effective date of the election, which should be the first day of the tax year the election is intended to be effective.

04

Determine the type of entity seeking to become an S corporation, such as a domestic corporation, LLC, or partnership.

05

Complete Part I by checking the appropriate box that corresponds to the type of entity and its tax classification.

06

Fill out Part II if the entity has more than one shareholder. List the names, addresses, and Social Security numbers of all shareholders.

07

Provide a detailed explanation in Part III if the entity has any late filing or reasonable cause for not filing Form 2553 in a timely manner.

08

Have the entity's authorized officer sign and date the form.

09

Attach a statement to Form 2553 if the entity is seeking relief for a late election.

10

Keep a copy of the completed form for the entity's records.

11

Submit the form to the appropriate IRS address as instructed in the form's instructions.

12

Wait for the IRS to process the form and send a confirmation or request for additional information.

Who needs note form 2553 begins?

01

Note form 2553 is needed by entities that want to elect to be treated as an S corporation for federal tax purposes.

02

This form is typically used by domestic corporations, limited liability companies (LLCs), or partnerships that meet the S corporation eligibility criteria.

03

By filing Form 2553, these entities can gain the advantage of pass-through taxation and avoid double taxation at the corporate level.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my note form 2553 begins directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your note form 2553 begins and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get note form 2553 begins?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the note form 2553 begins in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I edit note form 2553 begins on an iOS device?

Use the pdfFiller mobile app to create, edit, and share note form 2553 begins from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is note form 2553?

Form 2553 is a document used by small businesses to elect to be taxed as an S corporation in the United States.

Who is required to file note form 2553?

Any eligible small business corporation that wishes to be taxed as an S corporation must file Form 2553.

How to fill out note form 2553?

Form 2553 must be filled out by providing information such as the corporation's name, address, taxpayer identification number, and the consent of all shareholders.

What is the purpose of note form 2553?

The purpose of Form 2553 is to allow a corporation to officially choose S corporation status and benefit from pass-through taxation.

What information must be reported on note form 2553?

Information required includes the corporation name, address, EIN, date of incorporation, and the number of shareholders.

Fill out your note form 2553 begins online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Note Form 2553 Begins is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.