Get the free T32016REI PR A.xls

Show details

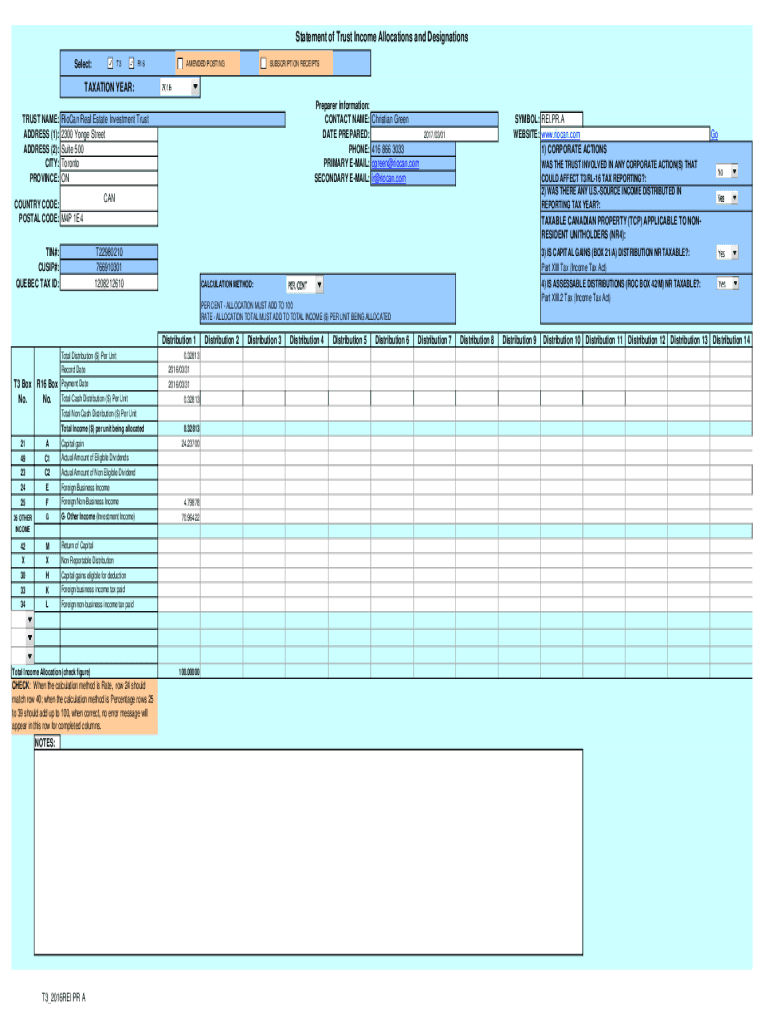

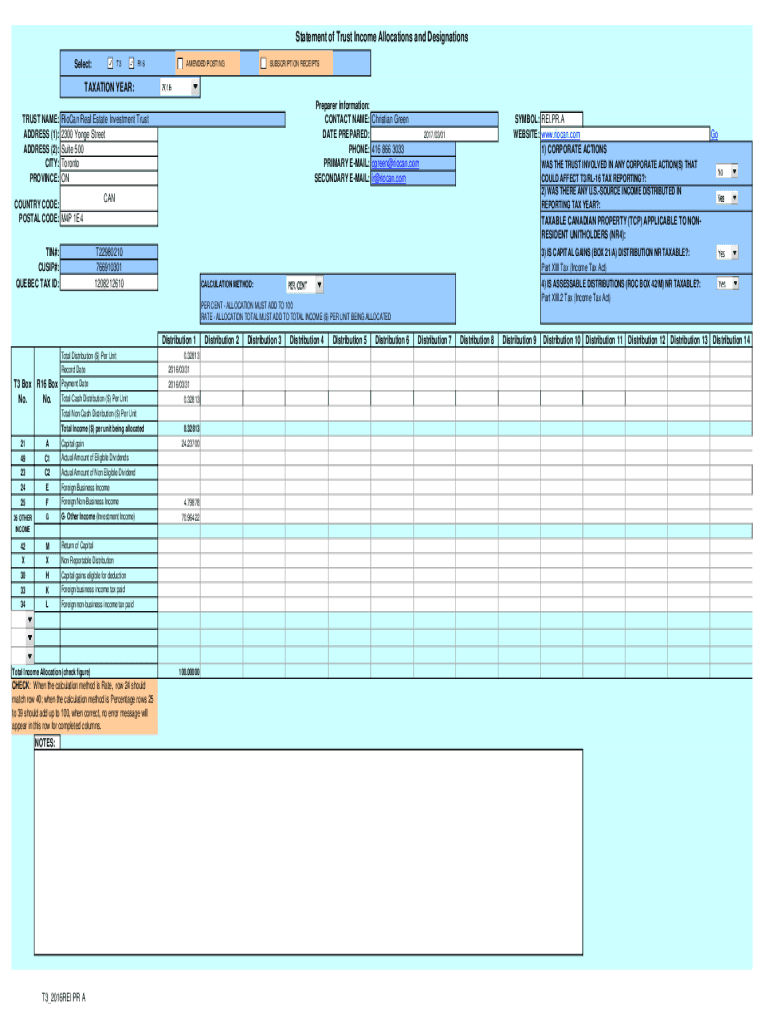

Statement of Trust Income Allocations and Designations

T3Select:R16SUBSCRIPTION RECEIPTSAMENDED POSTINGTAXATION YEAR:

TRUST NAME:

ADDRESS (1):

ADDRESS (2):

CITY:

PROVINCE:Preparer information:

CONTACT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t32016rei pr axls

Edit your t32016rei pr axls form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t32016rei pr axls form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t32016rei pr axls online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit t32016rei pr axls. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t32016rei pr axls

How to fill out t32016rei pr axls

01

To fill out t32016rei pr axls, follow these steps:

02

Start by entering your personal information at the top of the form, including your name, address, and contact information.

03

Next, specify the type of claim or request you are making by selecting the appropriate checkbox or writing it in the designated space.

04

Provide any necessary details or explanations related to your claim or request in the designated sections or boxes. Be sure to be clear and concise.

05

If there are any supporting documents or attachments that need to be included with your form, make sure to attach them securely.

06

Review the completed form to ensure all information is accurate and complete.

07

Sign and date the form in the appropriate spaces to certify the accuracy of the provided information.

08

Finally, submit the completed form by the specified method, whether it is through mail, fax, or electronically.

09

Please note that the exact requirements and instructions may vary depending on the specific version of t32016rei pr axls and the organization or agency requiring it. It's always best to refer to the provided instructions and guidelines for the most accurate and up-to-date information.

Who needs t32016rei pr axls?

01

T32016rei pr axls is typically needed by individuals or organizations who are making a claim or requesting a certain action from an organization or agency. This may include but is not limited to:

02

- Individuals seeking reimbursement or compensation for a specific expense or loss

03

- Businesses or organizations requesting permits, licenses, or certifications

04

- Applicants for government benefits or assistance programs

05

- Individuals or organizations filing legal claims or complaints

06

- Any individual or organization required to provide specific information or documentation as part of a formal process or procedure.

07

It's important to note that the specific need for t32016rei pr axls may vary depending on the organization or agency involved and the purpose of the claim or request. It's always best to refer to the specific instructions or requirements provided by the organization or agency requiring the form.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my t32016rei pr axls in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your t32016rei pr axls and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find t32016rei pr axls?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the t32016rei pr axls in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit t32016rei pr axls on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing t32016rei pr axls.

What is t32016rei pr axls?

The T32016REI PR AXLS is a tax form used in Puerto Rico for reporting certain income and financial information by individuals and businesses.

Who is required to file t32016rei pr axls?

Individuals and entities in Puerto Rico that have certain types of income or financial activities are required to file the T32016REI PR AXLS.

How to fill out t32016rei pr axls?

To fill out the T32016REI PR AXLS, you need to provide your personal information, details of your income, deductions, and any applicable credits as outlined in the instructions for the form.

What is the purpose of t32016rei pr axls?

The purpose of the T32016REI PR AXLS is to gather information for tax purposes and to assess the tax liabilities of individuals and businesses in Puerto Rico.

What information must be reported on t32016rei pr axls?

Information that must be reported includes personal identification details, types of income earned, deductions being claimed, and tax credits to be applied.

Fill out your t32016rei pr axls online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t32016rei Pr Axls is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.