Get the free NFIP Underwriting and Claims Materials Order Form - fema

Show details

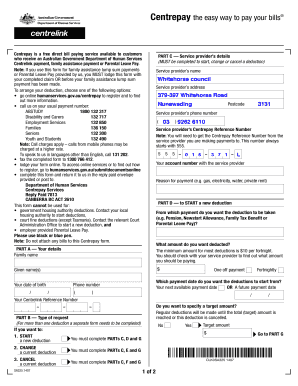

FEMA Distribution Center FIP Underwriting and Claims Materials Order Form 800-480-2520 FAX: 240-699-0525 QTY. IN. NO./FEMA FORM NO. TITLE QTY. UNDERWRITING 086-0-1/F-050 (12/13) Flood Insurance Application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nfip underwriting and claims

Edit your nfip underwriting and claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nfip underwriting and claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nfip underwriting and claims online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit nfip underwriting and claims. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nfip underwriting and claims

How to fill out NFIP underwriting and claims?

01

Understand the NFIP: Before filling out the NFIP underwriting and claims forms, it is important to have a thorough understanding of the National Flood Insurance Program (NFIP). Familiarize yourself with its purpose, requirements, and guidelines to ensure accurate and complete form submission.

02

Gather necessary information: Collect all the relevant information required to fill out the NFIP underwriting and claims forms. This includes property details, such as address, construction type, year built, and occupancy type, as well as policyholder information, such as name, contact details, and policy number.

03

Complete the underwriting form: Start by filling out the underwriting form, providing all the requested information accurately. This form typically asks for details regarding the property's flood risk, elevation, and any previous flood damage. Be sure to answer all questions and provide any additional information or documentation as required.

04

Submit supporting documents: Alongside the underwriting form, supporting documents may need to be submitted for a complete application. This may include elevation certificates, property surveys, and photos of the property. Ensure that all supporting documents are provided in the correct format and meet the NFIP's guidelines.

05

Review and double-check: Before submitting the underwriting form and supporting documents, thoroughly review all the information provided. Double-check for any errors or omissions to avoid delays or potential issues with the application. Take the time to verify that all the data is accurate and up-to-date.

Who needs NFIP underwriting and claims?

01

Homeowners in flood-prone areas: Anyone who owns a property in a flood-prone area may need NFIP underwriting and claims. The NFIP aims to provide flood insurance coverage to homes and businesses situated in high-risk flood zones, ensuring financial protection in the event of flood-related damages.

02

Real estate agents and lenders: Real estate agents and lenders may require NFIP underwriting and claims to facilitate property transactions in flood-prone areas. They need to assess the flood risk and insurance coverage of the property to make informed decisions and protect their interests.

03

Businesses and property owners seeking federal disaster assistance: When a flood event occurs, businesses or property owners looking to access federal disaster assistance for flood damage recovery may require NFIP underwriting and claims. The NFIP underwriting process helps determine the coverage and eligibility for financial assistance.

04

Insurance agents and brokers: Insurance agents and brokers play a crucial role in assisting policyholders with NFIP underwriting and claims. They help clients navigate the application process, assess flood risks, and ensure appropriate insurance coverage is obtained to meet their specific needs.

Overall, NFIP underwriting and claims are necessary for property owners, real estate agents, lenders, businesses, and insurance professionals involved in flood-prone areas or seeking flood insurance coverage and financial protection.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nfip underwriting and claims?

NFIP underwriting and claims refer to the process of evaluating and pricing flood insurance policies, as well as handling claims for flood damage.

Who is required to file nfip underwriting and claims?

Insurance companies participating in the National Flood Insurance Program (NFIP) are required to file underwriting and claims.

How to fill out nfip underwriting and claims?

NFIP underwriting and claims can be filled out online through the NFIP Direct Servicing Agent (NFIP-Direct).

What is the purpose of nfip underwriting and claims?

The purpose of NFIP underwriting and claims is to facilitate the availability of flood insurance coverage and ensure prompt payment of claims for flood damage.

What information must be reported on nfip underwriting and claims?

Information such as policyholder details, property location, coverage limits, and loss details must be reported on NFIP underwriting and claims.

How can I manage my nfip underwriting and claims directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your nfip underwriting and claims and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I edit nfip underwriting and claims on an iOS device?

You certainly can. You can quickly edit, distribute, and sign nfip underwriting and claims on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit nfip underwriting and claims on an Android device?

With the pdfFiller Android app, you can edit, sign, and share nfip underwriting and claims on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your nfip underwriting and claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nfip Underwriting And Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.