IA 54-132 2020-2025 free printable template

Show details

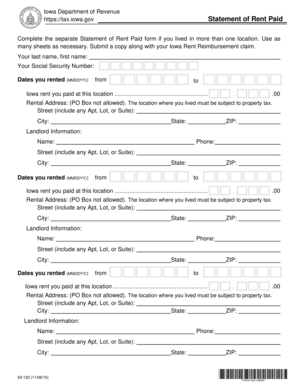

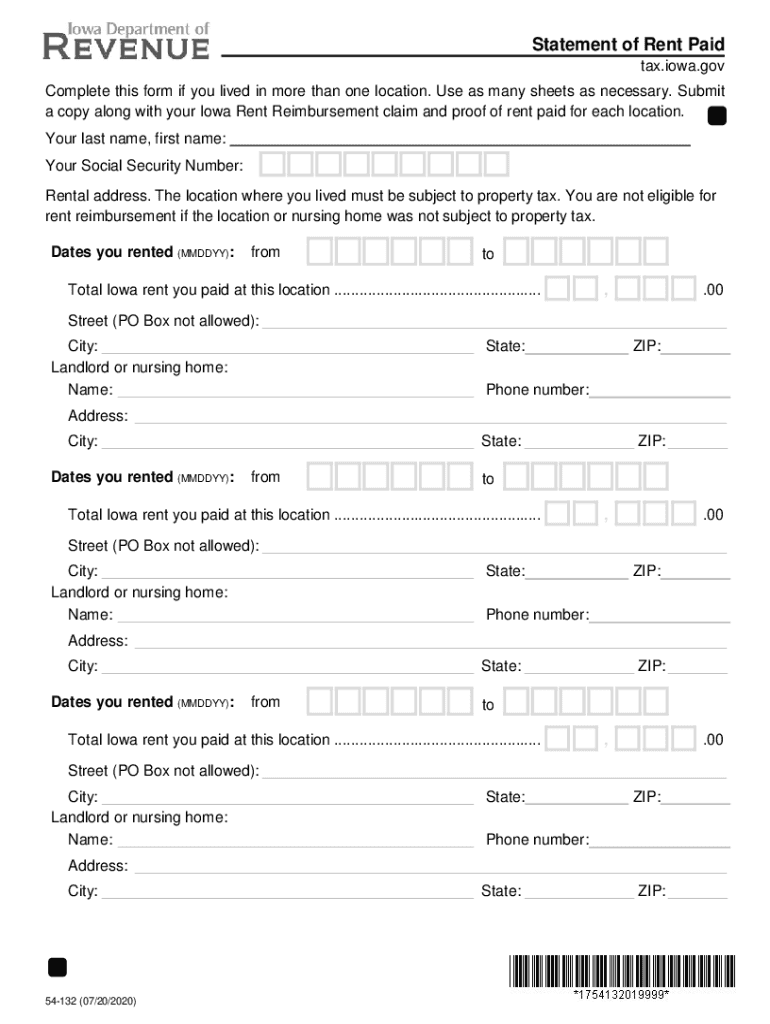

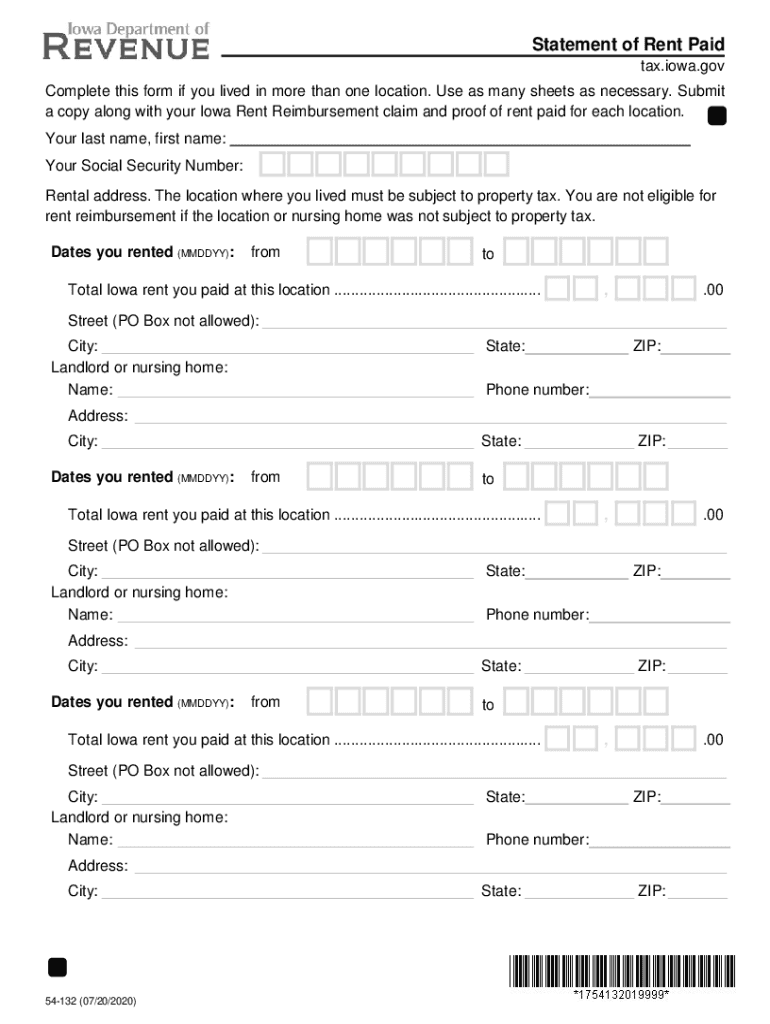

Clear Restatement of Rent Paid

tax.Iowa.gov

Complete this form if you lived in more than one location. Use as many sheets as necessary. Submit

a copy along with your Iowa Rent Reimbursement claim

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IA 54-132

Edit your IA 54-132 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IA 54-132 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IA 54-132 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IA 54-132. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IA 54-132 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IA 54-132

How to fill out IA 54-132

01

Obtain the IA 54-132 form from the relevant authority or website.

02

Read the instructions carefully before starting to fill out the form.

03

Provide personal information in the designated sections, including name, address, and contact details.

04

Enter your identification number if applicable.

05

Fill out sections requiring your employment details and job title.

06

Include any relevant dates such as the period of employment or service.

07

Attach any necessary documentation that supports your application.

08

Review the entire form for accuracy before submission.

09

Sign and date the form as required.

Who needs IA 54-132?

01

Individuals applying for specific job positions within government or military agencies.

02

Personnel involved in reporting or requesting information related to their service.

03

Employees who need to provide proof of service for benefits or entitlements.

Fill

form

: Try Risk Free

People Also Ask about

What is line 26 on 1040?

Line 26 asks you to write in the total of any estimated tax payments you made for the tax year, plus the value of any tax payments you made in the previous tax year that carry over to this return's tax year. Line 27 is where you write in the value of your earned income tax credit, if you qualify.

What is a form IA 1040?

IA 1040 Individual Income Tax Return, 41-001. Page 1.

What is line 9 on 1040?

On line 9 of your 1040, add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income. On line 10, fill in your total adjustments to income from line 26 of Schedule 1 (if applicable). On line 11 of your 1040, subtract line 10, your total adjustments to income, from line 9, your total income.

What is line 24 on 1040?

Line 24: The total tax due is what you owe in taxes for the year. Line 33: These are your total payments for the tax year (a combination of eligible credits and payments you've already made), including tax withheld from your income during the year.

What line is the taxable income on 1040?

Your total adjustments to income appear on line 10 of your 1040. Taxable income: Your AGI is then used to calculate your taxable income, or the portion of your income that will be taxed. Your taxable income is shown on line 15 of your 1040.

What is line 24 on 1040 Schedule 1?

Line 24 gives you space to tally any other adjustments to income. The more common adjustments — like deductible jury duty pay and the foreign housing deduction — are listed on lines 24a through 24k. There is also a line 24z where you can list and explain other adjustments you want to claim.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IA 54-132 to be eSigned by others?

Once your IA 54-132 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete IA 54-132 online?

Easy online IA 54-132 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit IA 54-132 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing IA 54-132, you can start right away.

What is IA 54-132?

IA 54-132 is a tax form used for reporting specific income and tax information to the state of Iowa.

Who is required to file IA 54-132?

Individuals and entities who have received income that must be reported to the state of Iowa are required to file IA 54-132.

How to fill out IA 54-132?

To fill out IA 54-132, gather all relevant income documents, complete the required sections on the form, and ensure all necessary signatures are provided before submission.

What is the purpose of IA 54-132?

The purpose of IA 54-132 is to report income and calculate the appropriate state tax liability for individuals and businesses in Iowa.

What information must be reported on IA 54-132?

IA 54-132 requires reporting of income types, taxpayer identification information, deductions, credits, and any tax payments made.

Fill out your IA 54-132 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IA 54-132 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.