Get the free Risk Management and Insurance Golf Outing 2014

Show details

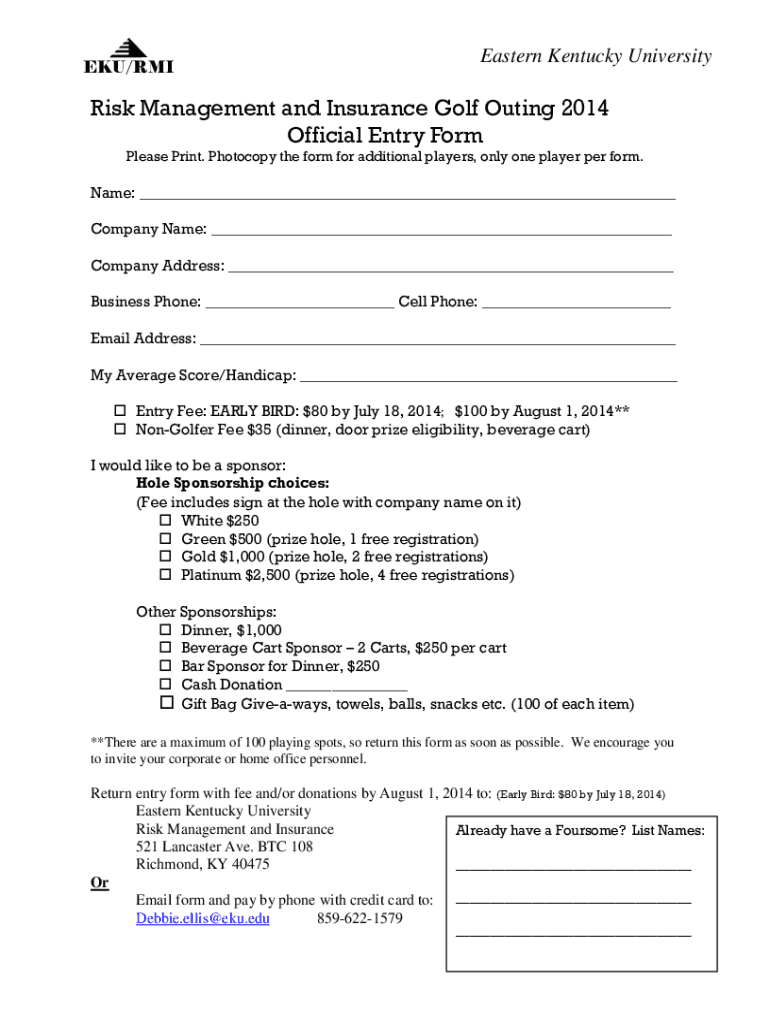

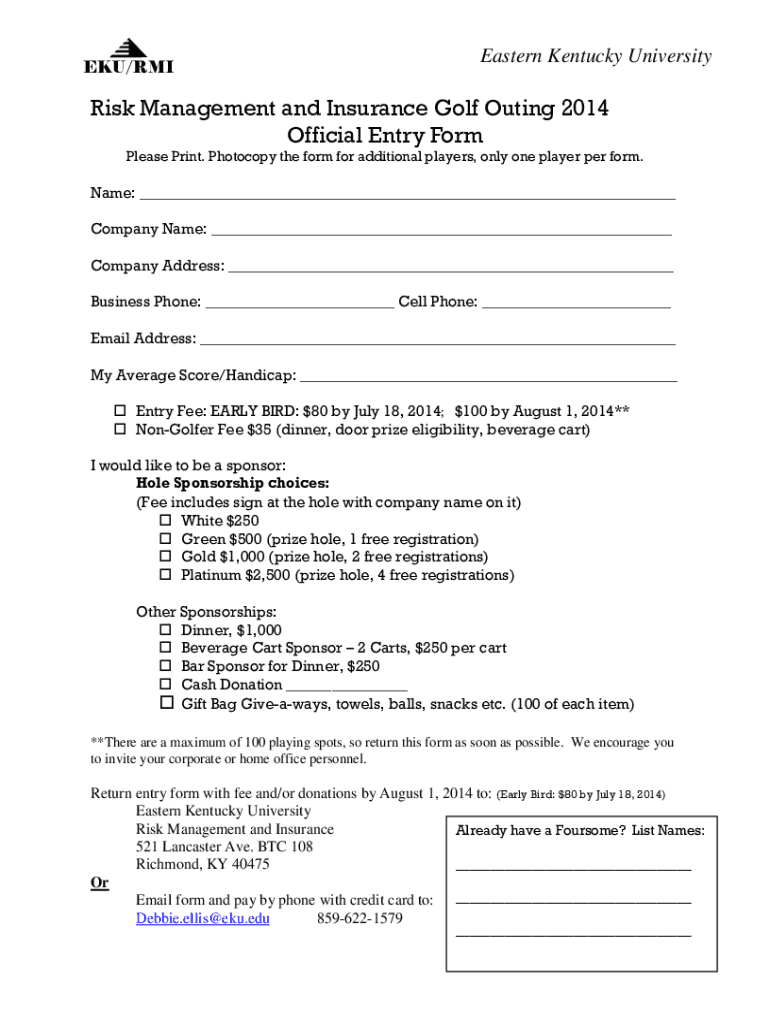

EU/RMI Eastern Kentucky UniversityRisk Management and Insurance Golf Outing 2014 Official Entry Formulas Print. Photocopy the form for additional players, only one player per form. Name: Company Name:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk management and insurance

Edit your risk management and insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk management and insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing risk management and insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit risk management and insurance. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk management and insurance

How to fill out risk management and insurance

01

Begin by identifying the specific risks that your business or organization may face. This can include various types of liabilities, property damage, natural disasters, employee injuries, or any other potential risks.

02

Assess the likelihood and potential impact of each identified risk. This involves evaluating the probability of each risk occurring and estimating the financial and operational consequences if they do occur.

03

Develop a risk management plan by establishing strategies and measures to mitigate or minimize the identified risks. This can include implementing safety measures, acquiring insurance coverage, creating emergency response plans, or establishing contingency funds.

04

Select the appropriate insurance policies to cover the specific risks. This may involve consulting with insurance brokers or agents to determine the most suitable coverage options for your business.

05

Carefully review and understand the terms and conditions of the insurance policies before purchasing them. Be aware of any exclusions, deductibles, coverage limits, and premium costs.

06

Monitor and regularly review your risk management and insurance strategies to ensure they remain effective and up to date. Regularly assess any changes in your business operations, industry regulations, or external factors that may require adjustments to your risk management approach.

07

Continuously educate and train employees about risk management and insurance best practices. Encourage a culture of risk awareness and equip employees with the necessary knowledge and skills to mitigate and respond to potential risks.

08

Finally, regularly evaluate the effectiveness of your risk management and insurance efforts by analyzing any incidents, claims, or losses that occur. Use this feedback to further refine your risk management strategies and improve your overall risk posture.

Who needs risk management and insurance?

01

Almost every individual, business, or organization can benefit from risk management and insurance. Here are some examples of who may need them:

02

Businesses: Small, medium, or large businesses across various industries need risk management and insurance to protect their assets, employees, and operations.

03

Individuals: Individuals may need insurance for personal assets, such as homes, vehicles, or personal liability coverage.

04

Non-profit organizations: Even non-profit organizations need risk management and insurance to protect their volunteers, beneficiaries, and assets.

05

Professionals: Professionals like doctors, lawyers, architects, or consultants may require professional liability insurance to safeguard themselves against malpractice claims.

06

Contractors: Contractors working in construction, renovation, or other trades often need insurance to cover potential liabilities, property damage, or injuries at job sites.

07

Event organizers: Those organizing events, conferences, or festivals may need event liability insurance to protect themselves from financial loss due to accidents or property damage.

08

Homeowners associations: Homeowners associations require insurance to protect common areas, manage potential liabilities, and cover property damage.

09

Government agencies: Government entities at various levels may need risk management and insurance to safeguard public assets, provide essential services, and manage potential liabilities.

10

It is important to assess your specific needs and consult with insurance professionals to determine the appropriate risk management and insurance solutions for your situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my risk management and insurance in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your risk management and insurance and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I edit risk management and insurance from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your risk management and insurance into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute risk management and insurance online?

pdfFiller has made filling out and eSigning risk management and insurance easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

What is risk management and insurance?

Risk management is the process of identifying, assessing, and controlling risks to minimize their impact on an organization. Insurance is a financial mechanism that transfers the risk of loss from an individual or organization to an insurance provider, in exchange for a premium.

Who is required to file risk management and insurance?

Organizations that engage in activities or hold assets that expose them to potential financial losses are typically required to file risk management and insurance documentation. This includes businesses, nonprofits, and government entities.

How to fill out risk management and insurance?

To fill out risk management and insurance forms, one should gather all relevant information regarding the organization’s assets, liabilities, and risk exposures, complete the required sections accurately, and ensure supporting documents are included before submission.

What is the purpose of risk management and insurance?

The purpose of risk management and insurance is to protect individuals and organizations from unforeseen incidents that could result in financial losses, ensuring continuity of operations and financial stability.

What information must be reported on risk management and insurance?

Information that must be reported includes details about the organization, types of risks identified, current insurance coverage, claims history, and any risk mitigation strategies in place.

Fill out your risk management and insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Management And Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.