Get the free Deparunmt of ire Treasury

Show details

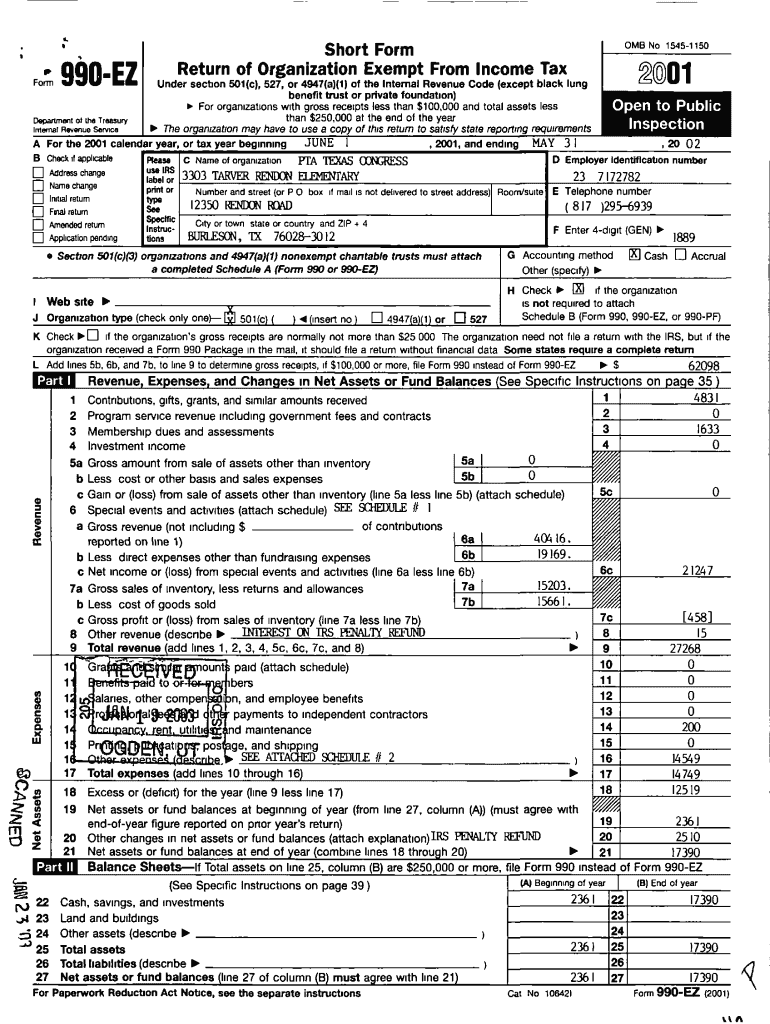

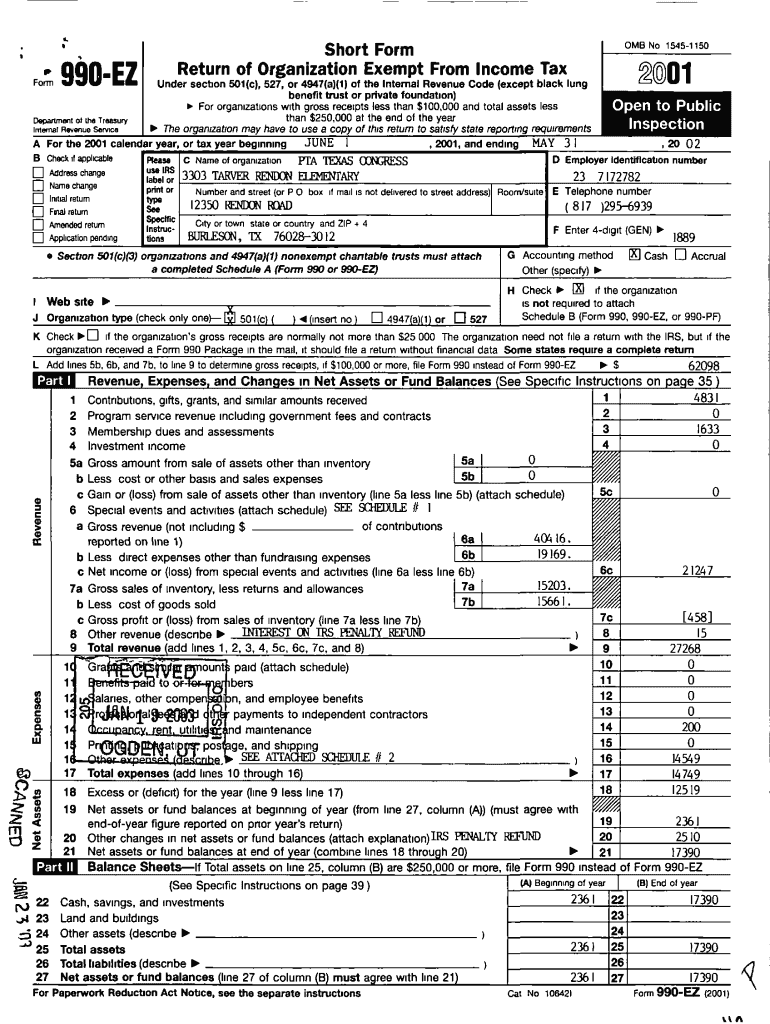

Short Form 990-EZ Depart of ire Treasury Metal Revenue Service 2001 Return of Organization Exempt From Income Tax 1 Under section 501(e), 527, or 4947(a)(1) of the Internal Revenue Code (except black

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deparunmt of ire treasury

Edit your deparunmt of ire treasury form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deparunmt of ire treasury form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deparunmt of ire treasury online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deparunmt of ire treasury. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deparunmt of ire treasury

How to fill out the department of ire treasury:

01

Start by gathering all the necessary documents and information required for the department of ire treasury. This could include identification documents, financial statements, tax information, and any other relevant paperwork.

02

Carefully read and understand the instructions or guidelines provided by the department of ire treasury. Make sure you have a clear understanding of the requirements and procedures involved in filling out the forms.

03

Begin filling out the forms by entering the requested information accurately and completely. Double-check the accuracy of details such as names, addresses, and numbers to avoid any discrepancies or errors.

04

If there are any specific sections or questions that you are unsure about, seek clarification from the department of ire treasury. It is essential to provide accurate and relevant information to ensure a smooth process.

05

Review and proofread the completed forms before submitting them. Check for any misspellings, missing information, or inconsistencies. Making sure everything is accurate can help prevent delays or complications in the review process.

06

Submit the filled-out forms and any supporting documents to the department of ire treasury using the recommended method. It is essential to follow any specific submission instructions provided to avoid any potential issues.

07

After submitting the paperwork, monitor the status of your application or request. This can be done by keeping track of any confirmation emails or reference numbers provided by the department. If there are any updates or requirements, promptly respond to them to avoid any delays.

08

If necessary, maintain copies of all the filled-out forms, documents, and any correspondence with the department of ire treasury for your records. Having a systematic filing system can be helpful if you need to refer back to any information in the future.

Who needs the department of ire treasury?

01

Individuals who are responsible for managing and reporting their financial and tax-related affairs.

02

Business owners or self-employed individuals who need to comply with tax obligations and ensure accurate financial reporting.

03

Organizations or entities who are subject to financial regulations and require assistance or guidance in managing their treasury functions.

04

Anyone who is involved in financial transactions or investments and seeks professional advice or services in maintaining compliance with ire treasury regulations and guidelines.

05

Those who need to access or apply for government grants, loans, or financial assistance programs that are overseen by the department of ire treasury.

06

Individuals or businesses who are facing tax-related issues, such as audits or disputes, and require the expertise and assistance of the department of treasury to resolve them.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find deparunmt of ire treasury?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific deparunmt of ire treasury and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit deparunmt of ire treasury online?

With pdfFiller, it's easy to make changes. Open your deparunmt of ire treasury in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the deparunmt of ire treasury electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your deparunmt of ire treasury in seconds.

Fill out your deparunmt of ire treasury online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deparunmt Of Ire Treasury is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.