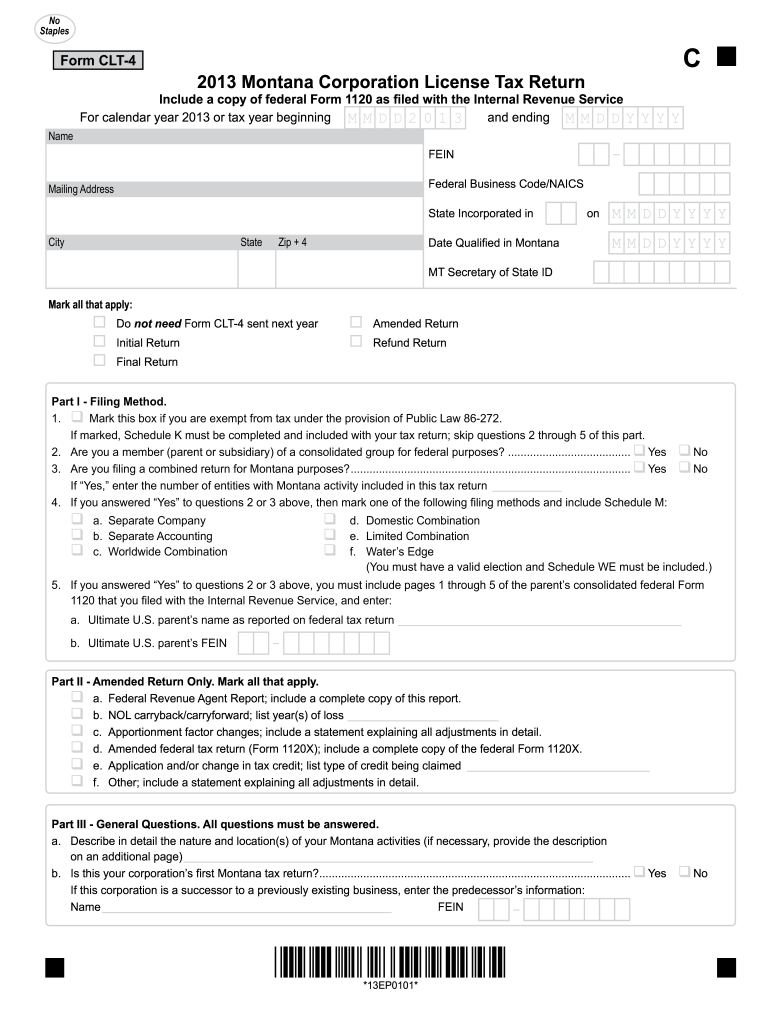

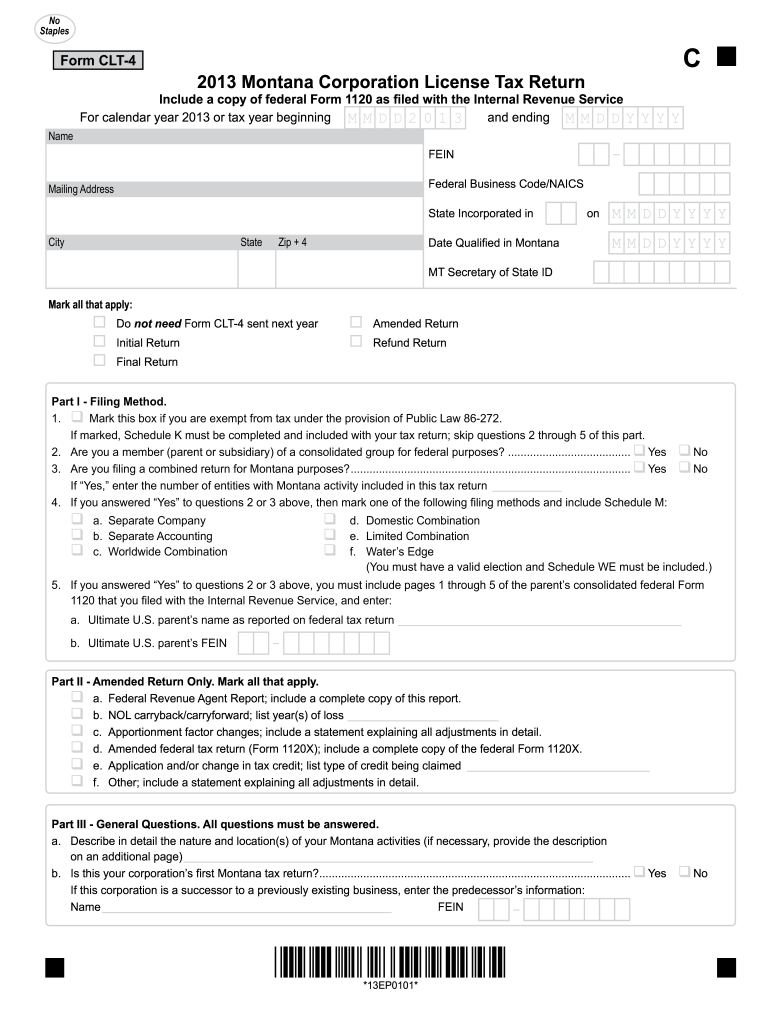

Get the free Form CLT-4 - Montana Department of Revenue - revenue mt

Show details

2013 Montana Corporation License Tax Return. Include a copy of federal Form 1120 as filed with the Internal Revenue Service ... Federal Business Code/NAILS ..... Combined filers must use the Schedule

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form clt-4 - montana

Edit your form clt-4 - montana form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form clt-4 - montana form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form clt-4 - montana online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form clt-4 - montana. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form clt-4 - montana

How to fill out Form CLT-4 - Montana:

01

Start by entering the name and contact information of the taxpayer. This includes the taxpayer's full name, mailing address, and phone number.

02

Next, provide the social security number or employer identification number (EIN) of the taxpayer. This is necessary for identification purposes.

03

Fill in the tax period for which the form is being filed. This could be a specific month and year, or it could cover an entire calendar year.

04

Indicate the type of return being filed. This could be an original return, an amended return, or a final return.

05

Include any extensions or previous filings related to this return. If there are any, provide the necessary details and attach supporting documentation if required.

06

Proceed to report the total wages, salaries, and tips during the tax period. Provide accurate figures and ensure that all sources of income are accounted for.

07

If there are any adjustments or deductions to be claimed, provide the appropriate information. This could include deductions for business expenses, educational expenses, or other applicable deductions.

08

Calculate the taxable income by subtracting the deductions from the total income amount. Ensure accuracy in calculations and double-check the figures.

09

Determine the tax liability based on the taxable income and the corresponding tax rates. Consult the applicable tax tables provided by the Montana Department of Revenue.

10

Include any tax credits or payments made towards the tax liability. This could be credits for child and dependent care expenses, education credits, or estimated tax payments made.

11

Calculate the final tax due or refund owed by subtracting the tax credits or payments from the tax liability. If a refund is due, provide the necessary bank account information for direct deposit.

12

Sign and date the form, certifying that the information provided is true and accurate to the best of your knowledge. If the taxpayer is represented by a tax professional, they should also sign the form.

Who needs Form CLT-4 - Montana?

01

Individuals who are residents of Montana and have earned income during the tax period need to file Form CLT-4.

02

Business entities that operate in Montana and generate income are also required to file this form.

03

Non-residents of Montana who have earned income from sources within the state may need to file this form if they meet certain criteria.

Note: It is always recommended to consult the official instructions provided by the Montana Department of Revenue or seek professional tax advice for specific filing requirements and instructions.

Fill

form

: Try Risk Free

People Also Ask about

Does Montana have pass-through entity tax?

S corporations and partnerships use the Montana Pass-Through Entity Tax Return to file their annual returns.

What is the pass-through withholding in Montana?

Pass-through entities generally do not pay income tax, but may be responsible for withholding tax on behalf of their owners or shareholders. Some owners may elect to have the pass-through entity pay a composite tax on their behalf.

Where do I send Montana state tax return?

(a) A return may be filed by personal delivery to the Montana Department of Revenue, 3rd Floor, Sam W. Mitchell Building, 125 North Roberts, Helena, Montana.

How do I pay my Montana withholding?

Payment and Filing Options Make payments online using the TransAction Portal. You can request a payment plan for making tax payments through TAP. Requesting a payment plan requires you to be logged in. Learn more about Requesting a payment plan.

What is the minimum tax for an LLC in Montana?

By default, LLCs in Montana are taxed as pass-through entities. Montana LLCs must pay the 15.3% federal self-employment tax (12.4% for social security and 2.9% for Medicare), state income tax, employer-specific taxes, local taxes, and industry taxes.

What is pass-through withholding?

Pass-Through Entity Annual Withholding Return A Pass-Through Entity (PTE) is generally an entity that passes its income or losses through to its owners instead of paying the related tax at the entity level.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form clt-4 - montana?

With pdfFiller, the editing process is straightforward. Open your form clt-4 - montana in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the form clt-4 - montana form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign form clt-4 - montana and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit form clt-4 - montana on an iOS device?

You certainly can. You can quickly edit, distribute, and sign form clt-4 - montana on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is form clt-4 - montana?

Form CLT-4 in Montana is the Coal Gross Proceeds Tax Return used by coal operators to report and pay the coal gross proceeds tax.

Who is required to file form clt-4 - montana?

Coal operators in Montana are required to file Form CLT-4 to report and pay the coal gross proceeds tax.

How to fill out form clt-4 - montana?

Form CLT-4 - Montana can be filled out by providing information such as coal production details, gross proceeds, and tax calculation. The completed form must be submitted to the Montana Department of Revenue.

What is the purpose of form clt-4 - montana?

The purpose of Form CLT-4 in Montana is to report and pay the coal gross proceeds tax, which is levied on coal operators based on their coal production and sales.

What information must be reported on form clt-4 - montana?

Information such as coal production details, gross proceeds from coal sales, and the calculation of the coal gross proceeds tax must be reported on Form CLT-4 in Montana.

Fill out your form clt-4 - montana online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Clt-4 - Montana is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.