FL Retirement System - Certification Form 2010 free printable template

Show details

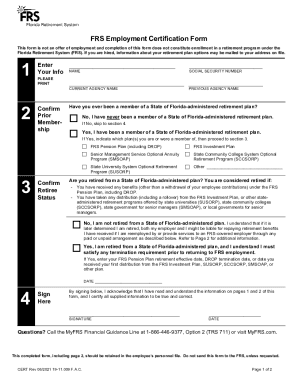

Florida Retirement System (FRS) Certification Form This form is not an offer of employment or an enrollment form. If hired, a Retirement Choice kit may be mailed to your home with an enrollment form.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL Retirement System - Certification Form

Edit your FL Retirement System - Certification Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL Retirement System - Certification Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL Retirement System - Certification Form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit FL Retirement System - Certification Form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL Retirement System - Certification Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL Retirement System - Certification Form

How to fill out FL Retirement System - Certification Form

01

Obtain the FL Retirement System - Certification Form from the Florida Division of Retirement website or your employer.

02

Read the instructions carefully provided with the form to understand the requirements.

03

Fill out the personal information section with your name, Social Security number, and contact information.

04

Provide employment details, including your job title, hire date, and agency name.

05

Complete the beneficiary designation section by providing the name and contact information of your chosen beneficiary.

06

Sign and date the form to certify the information is accurate and true to the best of your knowledge.

07

Submit the completed form to the designated office as instructed, either via mail or electronically if applicable.

Who needs FL Retirement System - Certification Form?

01

Employees who are participating in the Florida Retirement System.

02

Individuals applying for retirement benefits under the Florida Retirement System.

03

Beneficiaries of members of the Florida Retirement System who need to confirm their eligibility.

Fill

form

: Try Risk Free

People Also Ask about

What does FRS stand for retirement?

When you work for the state, the Florida Retirement System (FRS) offers two retirement options: The FRS Pension Plan provides a monthly benefit to you when you retire. The FRS Investment Plan lets you choose how your money is invested and how you want to receive payments.

What percentage does FRS take?

How Much is Contributed? As a member of the FRS Investment Plan, you contribute 3 percent of your gross monthly salary on a pre-tax basis to help fund your FRS Investment Plan account.

How is AFC calculated in FRS?

Your percentage value is determined by your service classification(s) over your career. For members initially enrolled in the FRS before July 1, 2011, your Average Final Compensation (AFC) is the average of your highest five fiscal year salaries.

Can I borrow from my FRS pension?

Borrowing Basics Federal law allows borrowing from 401(k) (including solo), 403(b) and profit-sharing plans, but not from simplified employee pension (SEP) plans, SIMPLE plans, Keoghs or individual retirement accounts.

Can I contribute more than 3% to FRS?

Neither the employee nor the employer can change contribution rates. Based on Florida law, employees contribute 3% of their pretax salary, beginning with their first paycheck, regardless of which FRS retirement plan they choose.

When can I collect my FRS?

For normal retirement and to receive your full monthly benefit, you must be age 62 with at least 6 years of service or have 30 years of service regardless of age.

Is FRS the same as 401k?

The FRS Investment Plan is similar to a 401(k) plan. Members own all employer contributions and earnings in their Investment Plan account after completing 1 year of service. Employee contributions are immediately vested.

What is the formula for FRS pension?

For example, Regular Class members receive 1.60% and Special Risk members receive 3% for each year of service.)FRS Investment Plan. Step 1:13 X 1.60% = .208Step 3:.208 X $34,549 = $7,186 Annual Option 1 Retirement Benefit at Age 62 (or $598.83 per month)1 more row

Is a pension the same as a 401k?

A pension plan is funded and controlled by the employer, while a 401(k) is primarily funded by the employee, who may choose how the money is invested. Some employers will match a portion of your 401(k) contributions.

What is the FRS for?

The Basic Retirement Sum (BRS), Full Retirement Sum (FRS), and Enhanced Retirement Sum (ERS) serve as guideposts in helping you set aside savings for your desired retirement payouts. The BRS is meant to provide you with monthly payouts in retirement that cover basic living expenses.

What is FRS form?

If hired, a Retirement Choice kit may be mailed to your home with an enrollment form. Florida Retirement System (FRS) - Certification Form. Name. SSN.

What is FRS money?

The FRS Investment Plan features 19 funds you can choose, including 9 funds spread across five asset classes, and 10 retirement date funds that are mixtures of various asset classes. A Self-Directed Brokerage Account is also available. Select an investment fund to see additional information about the fund.

What is FRS deduction?

As a member of the FRS Investment Plan, you contribute 3 percent of your gross monthly salary on a pre-tax basis to help fund your FRS Investment Plan account. The state also contributes a percentage of your gross monthly salary based on your membership class.

What happens to my frs if I quit?

If you do not return to work for an FRS employer within five years, you forfeit your account balance.

Can you take a lump sum from the FRS?

Payout Options — Investment Plan. You can take a full or partial lump sum distribution of your account balance. You have a lump sum cash payment that you can use to pay health expenses or other necessary expenses (review the Tax Implications).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in FL Retirement System - Certification Form without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your FL Retirement System - Certification Form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my FL Retirement System - Certification Form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your FL Retirement System - Certification Form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I edit FL Retirement System - Certification Form straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing FL Retirement System - Certification Form.

What is FL Retirement System - Certification Form?

The FL Retirement System - Certification Form is a document used by employers to certify information related to their employees' participation in the Florida Retirement System, ensuring compliance with state regulations.

Who is required to file FL Retirement System - Certification Form?

Employers participating in the Florida Retirement System are required to file the FL Retirement System - Certification Form for all employees who are members of the system.

How to fill out FL Retirement System - Certification Form?

To fill out the FL Retirement System - Certification Form, employers should provide accurate employee information as requested on the form, including personal details and employment status, and ensure it is signed and submitted by the designated authority.

What is the purpose of FL Retirement System - Certification Form?

The purpose of the FL Retirement System - Certification Form is to verify employee eligibility and participation in the retirement system and ensure that employer contributions are properly calculated and reported.

What information must be reported on FL Retirement System - Certification Form?

The information that must be reported on the FL Retirement System - Certification Form includes the employee's name, Social Security number, dates of employment, salary information, and retirement plan details.

Fill out your FL Retirement System - Certification Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL Retirement System - Certification Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.