Get the free Deferred Compensation Plan - City of Knoxville

Show details

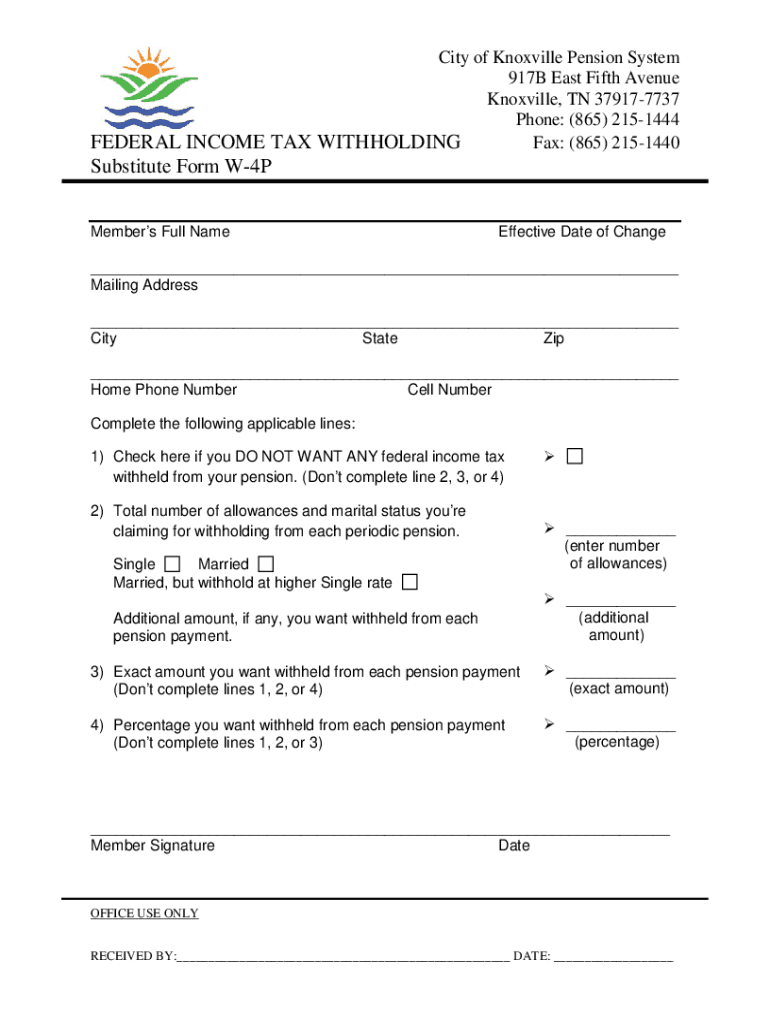

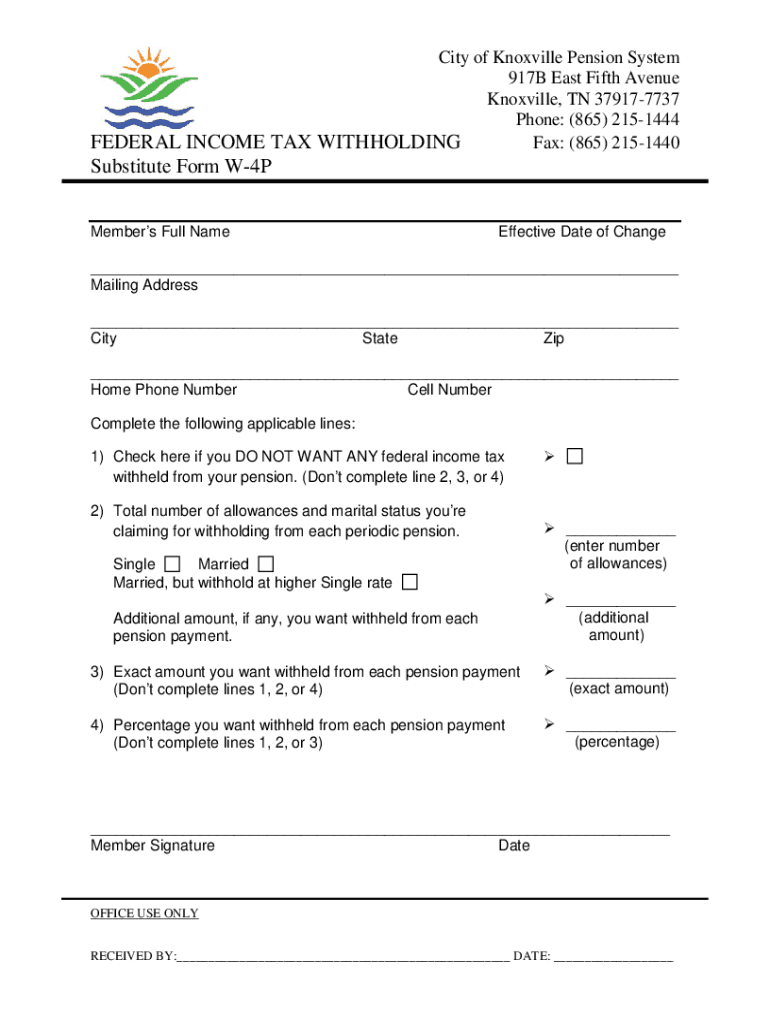

City of Knoxville Pension System 917B East Fifth Avenue Knoxville, TN 379177737 Phone: (865) 2151444 FEDERAL INCOME TAX WITHHOLDING Fax: (865) 2151440Substitute Form W4P Members Full Noneffective

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred compensation plan

Edit your deferred compensation plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred compensation plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deferred compensation plan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deferred compensation plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred compensation plan

How to fill out deferred compensation plan

01

Obtain the deferred compensation plan documents from your employer

02

Read and understand the terms and conditions of the plan

03

Determine the amount of money you want to contribute to the plan

04

Complete the enrollment form provided by your employer, providing necessary personal and financial information

05

Decide on the investment options for your contributions

06

Consider consulting with a financial advisor to determine the best investment strategy

07

Review and sign the completed enrollment form

08

Submit the form to your employer or the designated HR department

09

Keep a copy of the form for your records

10

Monitor your contributions and investment performance regularly

11

Make any necessary changes or adjustments to your plan as needed

12

Understand the withdrawal rules and penalties associated with the plan

13

Seek professional advice if you have any doubts or concerns

Who needs deferred compensation plan?

01

Deferred compensation plans are typically beneficial for:

02

- High-income individuals who want to defer income tax on a portion of their earnings

03

- Employees who anticipate being in a lower tax bracket in retirement

04

- Executives and highly compensated employees who want to supplement their retirement savings beyond traditional employer-sponsored plans

05

- Individuals looking for a way to save and invest for the long term while enjoying potential tax advantages

06

- Anyone who wants to take advantage of the opportunity to accumulate earnings on a tax-deferred basis

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send deferred compensation plan for eSignature?

When you're ready to share your deferred compensation plan, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit deferred compensation plan in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing deferred compensation plan and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete deferred compensation plan on an Android device?

Use the pdfFiller Android app to finish your deferred compensation plan and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is deferred compensation plan?

A deferred compensation plan is a financial arrangement in which a portion of an employee's income is paid out at a later date, usually during retirement, to help reduce taxable income in the present and save for the future.

Who is required to file deferred compensation plan?

Employers that offer deferred compensation plans to their employees are required to file the necessary documentation with the IRS, along with other required forms and disclosures.

How to fill out deferred compensation plan?

To fill out a deferred compensation plan, employers should complete the necessary forms provided by the IRS or a similar authority, detailing the plan’s provisions, eligibility criteria, and participant information, ensuring all information is accurate and complete.

What is the purpose of deferred compensation plan?

The purpose of a deferred compensation plan is to provide employees with a tax-advantaged way to save for retirement or future expenses, while allowing employers to recruit and retain talented employees.

What information must be reported on deferred compensation plan?

Information that must be reported on a deferred compensation plan includes participant details, the amount deferred, the terms of the plan, and any distributions made to employees.

Fill out your deferred compensation plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Compensation Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.