Get the free Professional Year Program (Accounting PYP) - stanleycollege edu

Show details

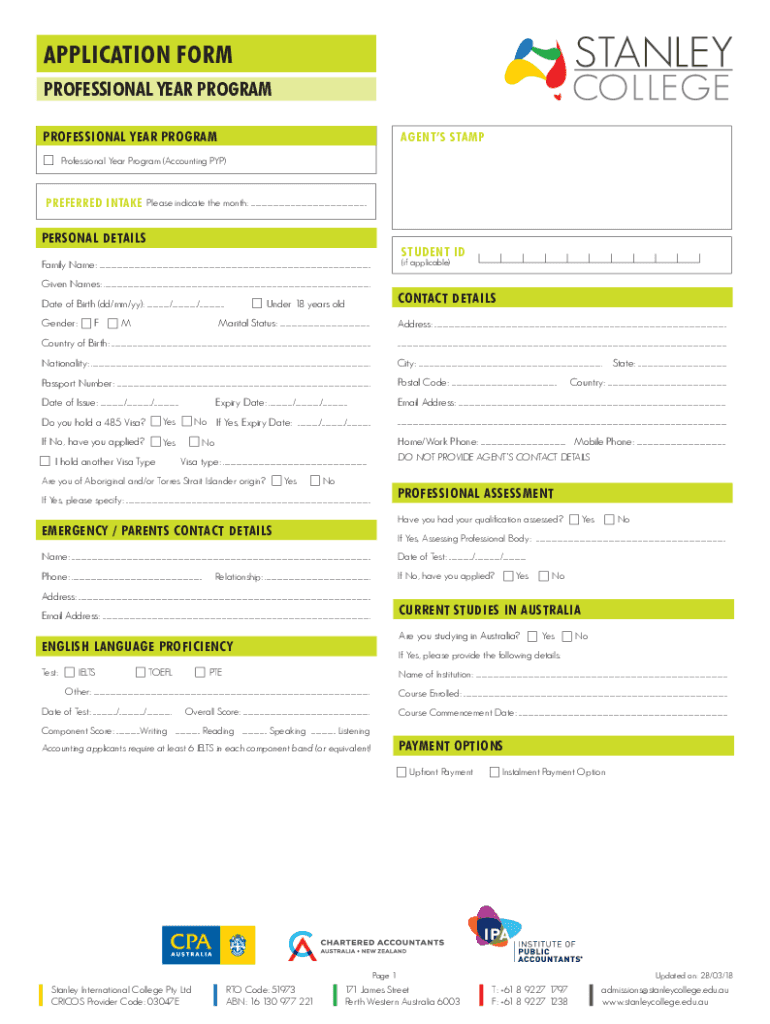

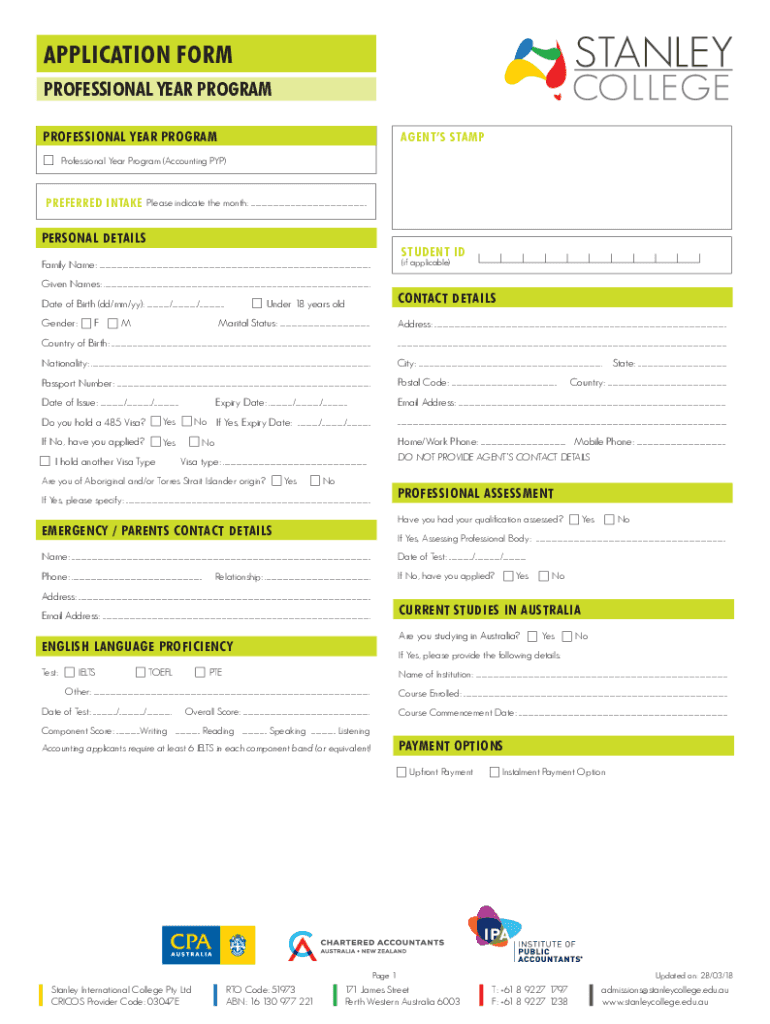

APPLICATION FORM

PROFESSIONAL YEAR PROGRAM

PROFESSIONAL YEAR PROGRAMAGENTS Semiprofessional Year Program (Accounting POP)PREFERRED INTAKEPlease indicate the month: ...................................................................................................PERSONAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign professional year program accounting

Edit your professional year program accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your professional year program accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing professional year program accounting online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit professional year program accounting. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out professional year program accounting

How to fill out professional year program accounting

01

To fill out the professional year program accounting, follow these steps:

02

Gather all the required documents, such as your identification documents, educational transcripts, and proof of English proficiency.

03

Research and select a registered professional year program provider that offers accounting as a specialization.

04

Contact the selected provider and inquire about their application process and any specific requirements.

05

Complete the application form provided by the program provider, ensuring that all information is accurate and up-to-date.

06

Attach all the required supporting documents to your application form, including your identification documents, educational transcripts, and proof of English proficiency.

07

Pay the program fee as specified by the provider.

08

Submit your completed application form and supporting documents to the program provider either through mail or online submission, following their instructions.

09

Wait for the program provider to review your application and inform you about the outcome.

10

If accepted, follow the program provider's instructions regarding enrollment, orientation, and any additional requirements.

11

Attend all the required sessions, classes, and assessments throughout the professional year program, ensuring compliance with the provider's rules and regulations.

12

Successfully complete all the program requirements, including practical work experience, formal training, and any assessments or examinations.

13

Obtain the completion certificate or any relevant documentation from the program provider upon successfully finishing the professional year program accounting.

Who needs professional year program accounting?

01

Professional year program accounting is beneficial for individuals who:

02

- Have completed a relevant accounting or finance degree in Australia.

03

- Are seeking to enhance their employability in the Australian job market.

04

- Wish to gain practical work experience in the accounting field to complement their academic qualifications.

05

- Plan to pursue a career in accounting or finance within Australia.

06

- Need to fulfill the eligibility criteria for certain skilled migration visas, such as the Temporary Graduate visa (subclass 485) or Skilled Independent visa (subclass 189).

07

By completing the professional year program accounting, individuals can improve their skills, expand their professional network, and increase their chances of securing a job or migrating to Australia.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit professional year program accounting online?

With pdfFiller, the editing process is straightforward. Open your professional year program accounting in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How can I edit professional year program accounting on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit professional year program accounting.

Can I edit professional year program accounting on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign professional year program accounting on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is professional year program accounting?

The professional year program accounting is a structured program designed to provide recent graduates with practical work experience in the accounting field, enabling them to apply their academic knowledge in a real-world setting.

Who is required to file professional year program accounting?

Individuals who have completed the professional year program in accounting and are seeking to gain professional certification or licenses in the accounting field are required to file professional year program accounting.

How to fill out professional year program accounting?

To fill out the professional year program accounting, candidates must provide details of their completed program activities, including internships or practical training, along with necessary documentation and verification of hours worked.

What is the purpose of professional year program accounting?

The purpose of the professional year program accounting is to bridge the gap between academic studies and professional practice, ensuring that graduates have the necessary skills and experience to succeed in their accounting careers.

What information must be reported on professional year program accounting?

The information that must be reported includes the duration of the program, the nature of work performed, skills acquired, and any certifications or licenses obtained during the program.

Fill out your professional year program accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Professional Year Program Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.