Get the free Business Interruption (Loss of Profits) Proposal Form

Show details

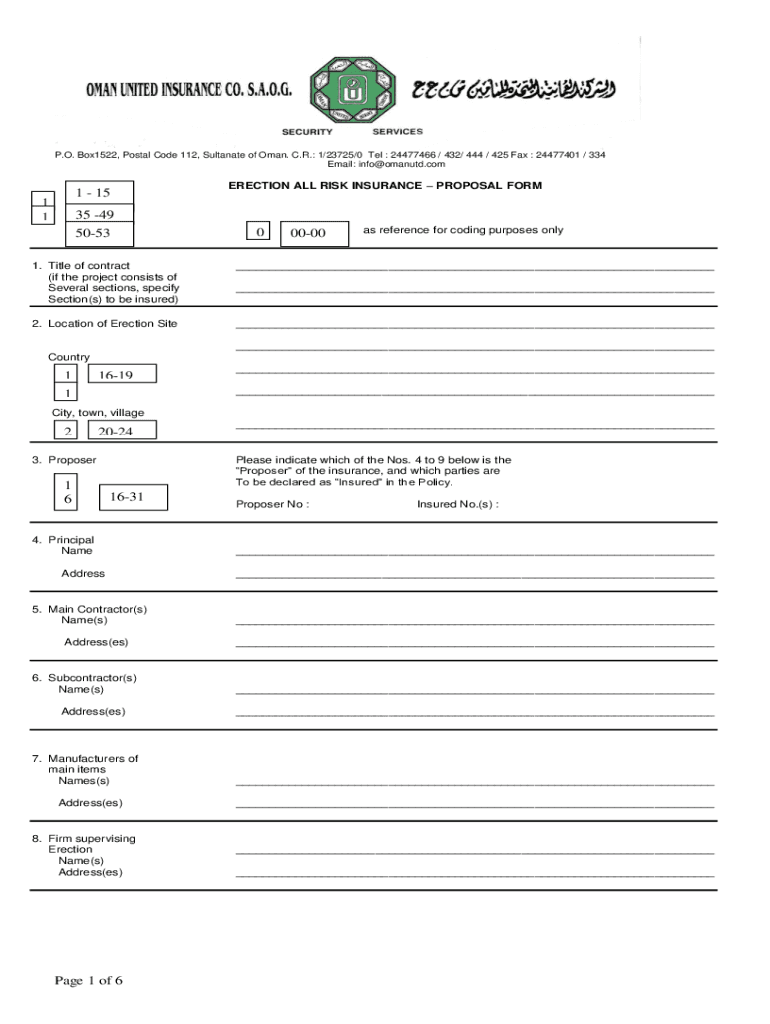

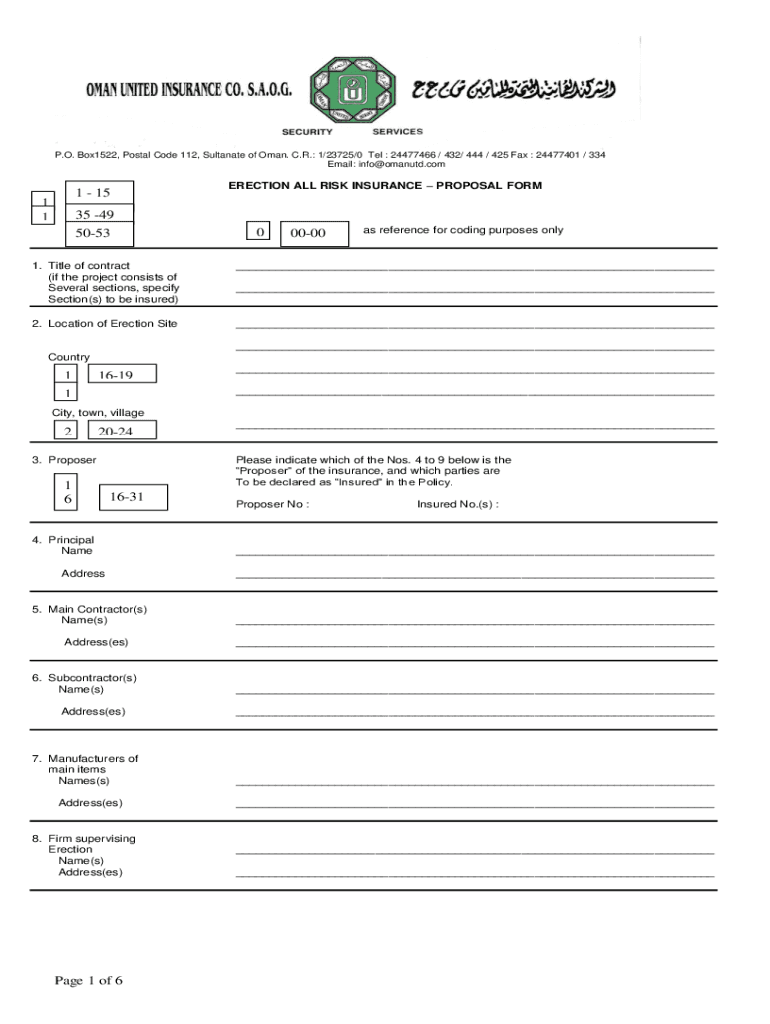

P.O. Box1522, Postal Code 112, Sultanate of Oman. C.R.: 1/23725/0 Tel : 24477466 / 432/ 444 / 425 Fax : 24477401 / 334 Email: info minute.com1 11 15 35 49 5053ERECTION ALL RISK INSURANCE PROPOSAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business interruption loss of

Edit your business interruption loss of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business interruption loss of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business interruption loss of online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit business interruption loss of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business interruption loss of

How to fill out business interruption loss of

01

To fill out a business interruption loss form, follow these steps:

02

Start by providing the necessary basic information, such as the name and contact details of the insured business.

03

Specify the policy number and effective dates of the insurance policy you are filing the claim under.

04

Describe the cause of the interruption or loss, such as a fire, natural disaster, or other covered incident.

05

Document the date and time when the interruption or loss occurred.

06

Provide a detailed account of the damages or losses suffered by the business due to the interruption.

07

Include any supporting documentation, such as photographs, videos, or witness statements, to substantiate the claim.

08

Calculate the financial impact of the interruption or loss on the business, including lost revenue, increased expenses, and additional costs incurred.

09

Submit the completed form along with all the necessary documents to the insurance company as instructed.

10

Keep copies of the completed form and documents for your records.

11

Follow up with the insurance company if you do not receive a response within a reasonable time frame.

Who needs business interruption loss of?

01

Any business that wants protection against financial losses resulting from interruptions to their normal operations should consider business interruption loss insurance.

02

This type of insurance is particularly relevant for businesses that heavily rely on physical assets or facilities, such as retail stores, restaurants, manufacturing plants, and service providers.

03

Business interruption loss insurance can benefit businesses of all sizes, from small startups to large corporations.

04

It provides coverage for various interruption causes, including fire, natural disasters, equipment breakdowns, supplier disruptions, and other unforeseen events that could disrupt business activities and result in financial losses.

05

Ultimately, any business that values financial stability and wants to mitigate the risks associated with unexpected interruptions should consider business interruption loss insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business interruption loss of for eSignature?

When you're ready to share your business interruption loss of, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit business interruption loss of straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing business interruption loss of.

Can I edit business interruption loss of on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute business interruption loss of from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is business interruption loss of?

Business interruption loss refers to the financial losses a business suffers due to an interruption in its operations, typically resulting from events like natural disasters, accidents, or other unforeseen circumstances that hinder the ability to conduct business.

Who is required to file business interruption loss of?

Typically, businesses that suffer financial losses due to interruptions in their operations, such as those caused by property damage or natural disasters, are required to file for business interruption loss.

How to fill out business interruption loss of?

To fill out a business interruption loss claim, the business must provide detailed documentation regarding the period of interruption, the financial impact, and any relevant loss of income calculations, along with supporting evidence such as financial statements and operational details.

What is the purpose of business interruption loss of?

The purpose of business interruption loss is to compensate businesses for lost income and ongoing expenses during the period they are unable to operate due to covered events.

What information must be reported on business interruption loss of?

Information that must be reported includes the nature of the business, the duration of the interruption, calculations of lost income, ongoing expenses that were incurred during the interruption, and any measures taken to mitigate the losses.

Fill out your business interruption loss of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Interruption Loss Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.