Get the free New Markets Tax Credit ProgramCommunity Development ...

Show details

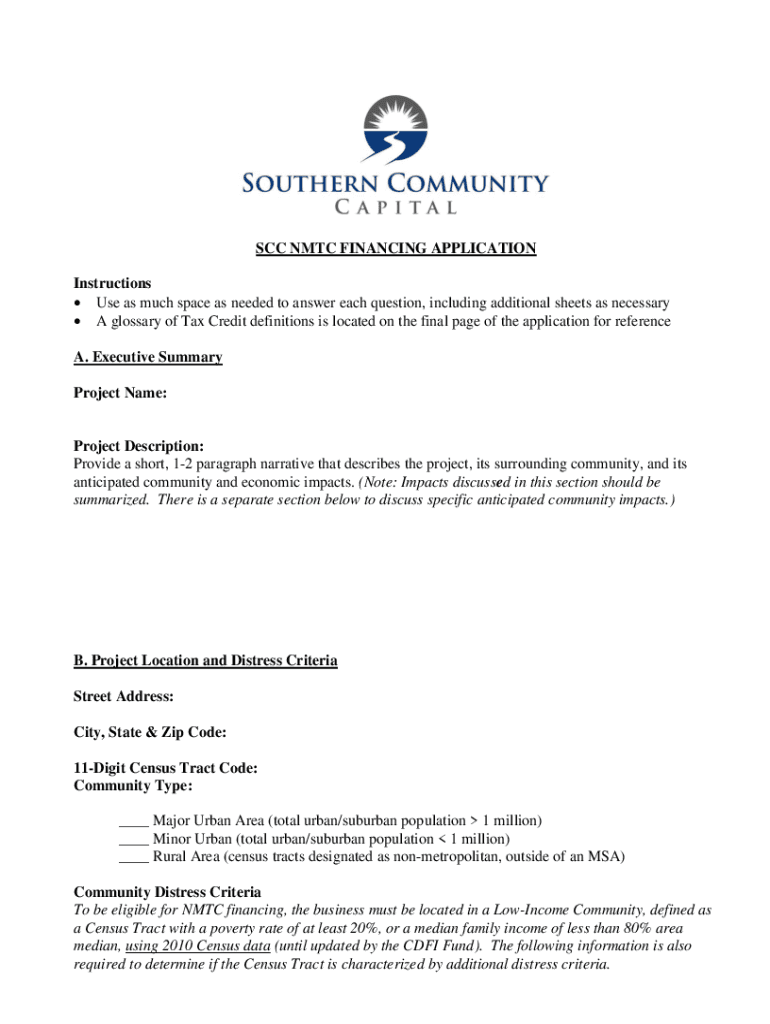

SCC MTC FINANCING APPLICATION Instructions Use as much space as needed to answer each question, including additional sheets as necessary A glossary of Tax Credit definitions is located on the final

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new markets tax credit

Edit your new markets tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new markets tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new markets tax credit online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new markets tax credit. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

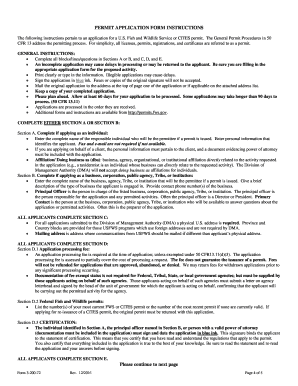

How to fill out new markets tax credit

How to fill out new markets tax credit

01

Step 1: Gather all necessary documentation, including financial records, project plans, and tax identification numbers.

02

Step 2: Determine if your business or project is eligible for the new markets tax credit. This typically involves meeting certain criteria, such as being located in a low-income community and having a substantial community impact.

03

Step 3: Fill out the necessary application forms, providing all required information accurately and completely.

04

Step 4: Submit the application and any supporting documents to the appropriate government agency or organization overseeing the new markets tax credit program.

05

Step 5: Wait for a response from the agency or organization. This may involve a review process and potential requests for additional information or clarification.

06

Step 6: If approved, follow any further instructions or requirements to successfully claim the new markets tax credit.

07

Step 7: Ensure compliance with all reporting and documentation obligations related to the new markets tax credit for the duration of the credit period.

08

Step 8: Consult with a tax professional or accountant to maximize the benefits of the new markets tax credit for your business or project.

Who needs new markets tax credit?

01

Businesses or projects located in low-income communities that aim to create jobs or provide services to underserved populations often benefit from the new markets tax credit.

02

Investors seeking tax incentives and opportunities to support community development may also have an interest in utilizing the new markets tax credit.

03

Nonprofit organizations involved in community revitalization, affordable housing, or other eligible activities can also take advantage of the new markets tax credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new markets tax credit for eSignature?

new markets tax credit is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit new markets tax credit on an iOS device?

Create, edit, and share new markets tax credit from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I edit new markets tax credit on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share new markets tax credit on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

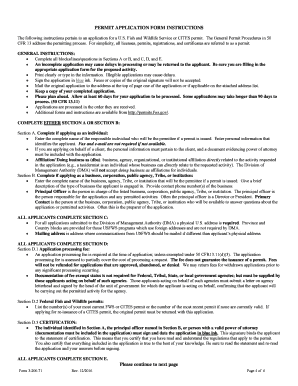

What is new markets tax credit?

The New Markets Tax Credit (NMTC) is a federal program aimed at stimulating economic growth and job creation in low-income communities by providing tax incentives to investors who invest in designated Community Development Entities (CDEs).

Who is required to file new markets tax credit?

Entities that receive New Markets Tax Credits from the IRS and allocate those credits to investors must file the NMTC application and corresponding forms. Generally, this includes Community Development Entities (CDEs) and their investors.

How to fill out new markets tax credit?

To fill out the New Markets Tax Credit, entities must complete IRS Form 8874 along with the relevant supporting documents such as the allocation agreement with the CDE and the necessary financial statements.

What is the purpose of new markets tax credit?

The purpose of the New Markets Tax Credit is to promote economic development in low-income areas by attracting private investment in these communities, ultimately fostering job creation and economic growth.

What information must be reported on new markets tax credit?

Investors must report their investment in the NMTC program, the amount of credits claimed, and any income or losses related to that investment. The CDE must also report how the funds were allocated and used in the qualified low-income community investments.

Fill out your new markets tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Markets Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.