Get the free PDF Cash/In-kind Receipt - Special Olympics Kansas

Show details

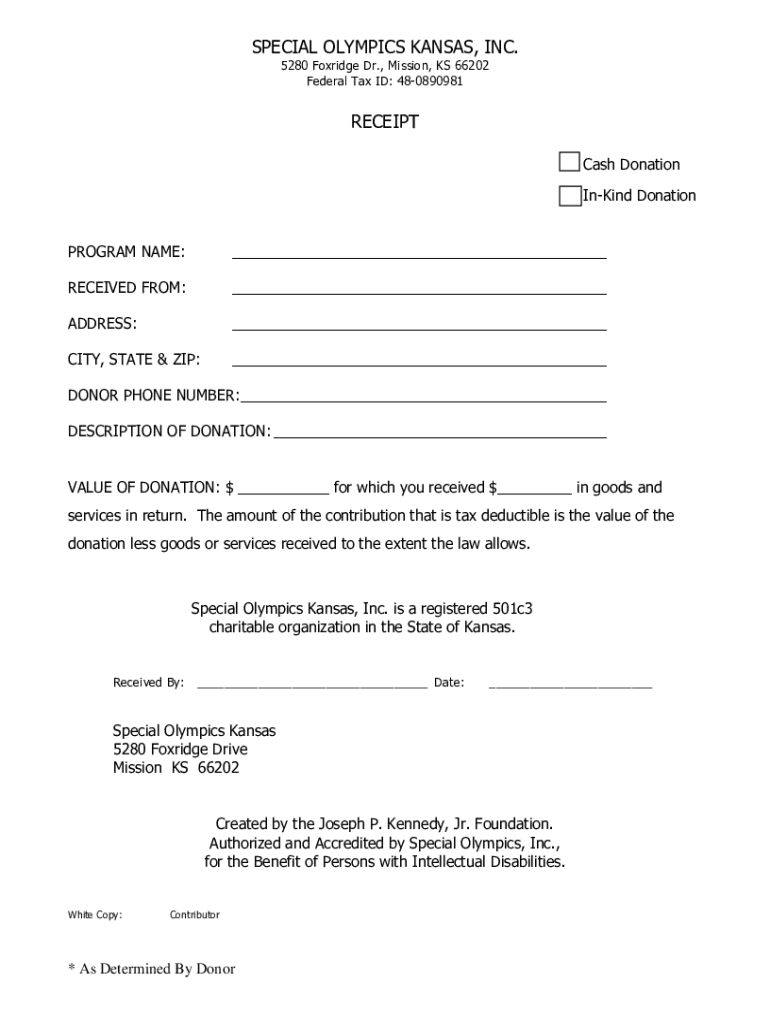

SPECIAL OLYMPICS KANSAS, INC. 5280 Fox ridge Dr., Mission, KS 66202 Federal Tax ID: 480890981RECEIPT Cash Donation Inking Donation PROGRAM NAME: RECEIVED FROM: ADDRESS: CITY, STATE & ZIP: DONOR PHONE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdf cashin-kind receipt

Edit your pdf cashin-kind receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdf cashin-kind receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdf cashin-kind receipt online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pdf cashin-kind receipt. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdf cashin-kind receipt

How to fill out pdf cashin-kind receipt

01

To fill out a PDF cash-in-kind receipt, follow these steps:

02

Open the PDF cash-in-kind receipt form using a PDF reader software.

03

Start by entering the date of the receipt in the designated field at the top.

04

Provide your full name and contact information such as address and phone number.

05

Enter the details of the donation (cash-in-kind) in the appropriate sections. This may include the description of the donated items, their estimated value, and any additional information required.

06

Make sure to include clear and accurate information about the receiving organization, such as their name, address, and contact details.

07

Double-check all the entered information for any errors or omissions.

08

Once you are satisfied with the entries, save the completed PDF cash-in-kind receipt form for your records.

09

Depending on the requirements of the receiving organization, you may need to submit the form in a specific manner, such as mailing a hard copy or sending a digital copy via email.

10

Retain a copy of the receipt for your own records for future reference or tax purposes.

Who needs pdf cashin-kind receipt?

01

A PDF cash-in-kind receipt is typically needed by individuals or organizations who have made a non-monetary donation or contribution in kind. Examples of those who may require a PDF cash-in-kind receipt include:

02

- Non-profit organizations and charities that rely on in-kind donations for their operations

03

- Individual donors who want to keep a record of their non-monetary contributions for personal or tax purposes

04

- Businesses or corporations that make in-kind donations as part of their corporate social responsibility initiatives

05

- Receiving organizations that need to provide documentation for auditing or accountability purposes

06

- Grant-making foundations or funding agencies that require proof of donated goods or services for grant reporting

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pdf cashin-kind receipt from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including pdf cashin-kind receipt, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit pdf cashin-kind receipt in Chrome?

pdf cashin-kind receipt can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out pdf cashin-kind receipt using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign pdf cashin-kind receipt. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is pdf cashin-kind receipt?

A PDF cash-in-kind receipt is a document that acknowledges the receipt of non-monetary contributions or donations of goods and services.

Who is required to file pdf cashin-kind receipt?

Organizations or individuals who receive cash-in-kind contributions for fundraising or tax deduction purposes are required to file this receipt.

How to fill out pdf cashin-kind receipt?

To fill out a PDF cash-in-kind receipt, include the date of receipt, description of the contributed items, fair market value, donor's information, and signature of the authorized representative.

What is the purpose of pdf cashin-kind receipt?

The purpose of a PDF cash-in-kind receipt is to provide documentation for tax purposes, confirming the value and nature of non-cash contributions received.

What information must be reported on pdf cashin-kind receipt?

The information that must be reported includes the date of the donation, description of the items, fair market value, donor's name and contact information, and the signature of the recipient.

Fill out your pdf cashin-kind receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdf Cashin-Kind Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.