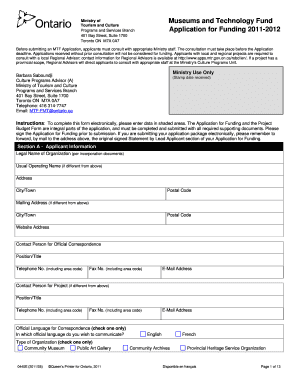

Get the free Final Client Copy Return for STARFOUN

Show details

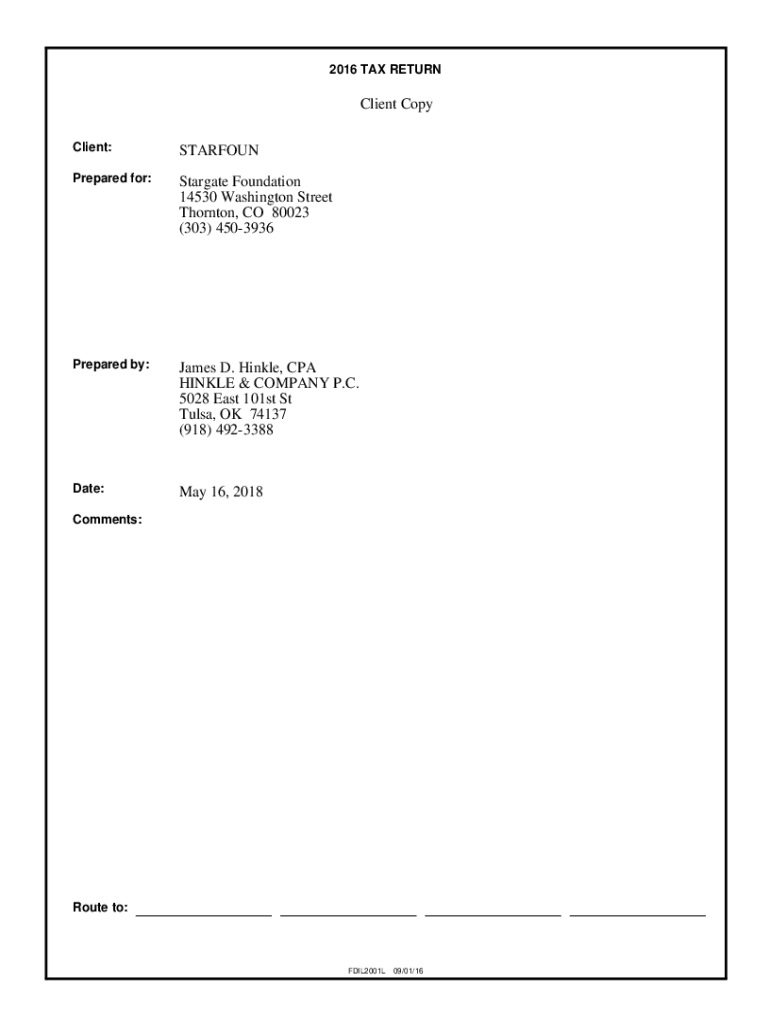

2016 TAX RETURNClient Copy Client:STARFOUNPrepared for:Stargate Foundation 14530 Washington Street Thornton, CO 80023 (303) 4503936Prepared by:James D. Winkle, CPA WINKLE & COMPANY P.C. 5028 East

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final client copy return

Edit your final client copy return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final client copy return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing final client copy return online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit final client copy return. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out final client copy return

How to fill out final client copy return

01

Begin by gathering all the necessary documents related to the client's tax return, such as income statements, expense receipts, and any other relevant financial records.

02

Review the client's information to ensure its accuracy and completeness. Make any necessary corrections or updates before proceeding with the final copy.

03

Start filling out the final client copy return by entering the client's personal information, including their full name, social security number, and contact details.

04

Proceed to report the client's income by entering the relevant figures from their income statements. This may include wages, dividends, rental income, or any other sources of income.

05

Deduct any eligible expenses and deductions from the client's income. This may involve items such as business expenses, mortgage interest, charitable contributions, or medical expenses.

06

Calculate the client's tax liability by applying the appropriate tax rates and deductions based on their income bracket. Use any available tax software or reference materials to ensure accuracy.

07

Double-check all the entered information to avoid any errors or omissions. Review the completed return thoroughly before proceeding to the next step.

08

Once you are confident that all the necessary information has been included and accurately reported, print out the final client copy return.

09

Sign and date the client copy return as a preparer, if applicable, and provide clear instructions on what the client should do next.

10

Provide a copy of the final client return to the client for their records, along with any additional information or documents they may need for filing purposes.

Who needs final client copy return?

01

Any individual or entity who has filed a tax return with the IRS or relevant tax authorities and wishes to have a copy of their submitted return for their records can benefit from having a final client copy return.

02

This includes individual taxpayers, self-employed individuals, small business owners, and any other entity that is required or chooses to file a tax return.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send final client copy return for eSignature?

final client copy return is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in final client copy return?

With pdfFiller, the editing process is straightforward. Open your final client copy return in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit final client copy return on an iOS device?

Create, edit, and share final client copy return from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is final client copy return?

A final client copy return is a document submitted to tax authorities that summarizes the client's financial information for a specific tax period, serving as a verified account of income, deductions, and credits.

Who is required to file final client copy return?

Taxpayers who have taxable income or who are required to report certain transactions to tax authorities are typically required to file the final client copy return.

How to fill out final client copy return?

To fill out a final client copy return, gather all necessary financial documents, accurately report income, deductions, and credits, and ensure that the form is signed and dated before submission.

What is the purpose of final client copy return?

The purpose of the final client copy return is to provide a comprehensive report of a taxpayer's financial activities to ensure compliance with tax laws and to calculate tax liabilities.

What information must be reported on final client copy return?

The final client copy return must report information including total income, allowable deductions, tax credits, and any other relevant financial details pertinent to the tax year.

Fill out your final client copy return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Client Copy Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.