Get the free Sec. 197 How to apply for non/lower deduction certificate in ... - familycourt wa gov

Show details

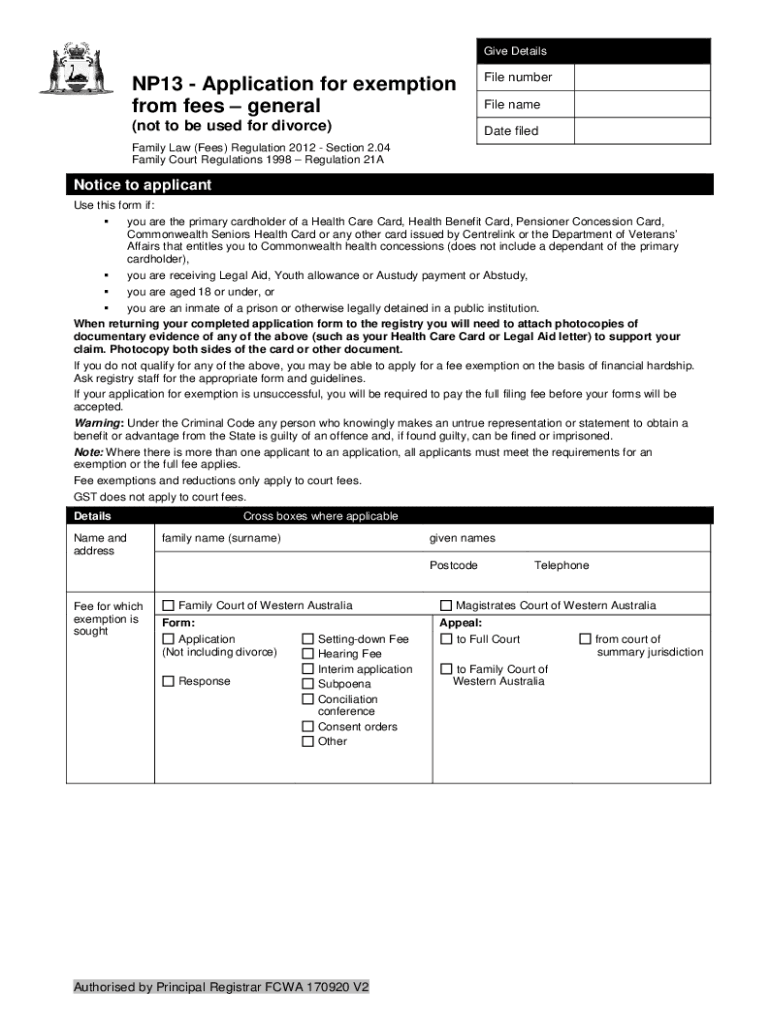

Give DetailsNP13 Application for exemption from fees general (not to be used for divorce)File number File name Date filedFamily Law (Fees) Regulation 2012 Section 2.04 Family Court Regulations 1998

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sec 197 how to

Edit your sec 197 how to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sec 197 how to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sec 197 how to online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sec 197 how to. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sec 197 how to

How to fill out sec 197 how to

01

To fill out SEC Form 197, please follow these steps:

02

Start by entering the basic information about yourself, such as your name, address, and contact details.

03

Provide details about the issuer of the security being offered or sold.

04

Indicate the type of security being offered or sold, including the classification and other relevant information.

05

Specify the exemption being relied upon for the offering or sale of the security.

06

Include any additional information or attachments required by the SEC.

07

Review the completed form and make sure all information is accurate and complete.

08

Sign and date the form, certifying the correctness and completeness of the information provided.

09

Submit the filled-out SEC Form 197 to the appropriate SEC office or authorized personnel.

10

Please note that the exact requirements and process may vary depending on your jurisdiction and the specific circumstances of the offering or sale of the security. It is advisable to consult with a legal or financial professional for guidance.

11

Who needs sec 197 how to?

01

SEC Form 197 is typically needed by individuals or entities who are offering or selling securities and are claiming an exemption from registration under the Securities Regulation Code (SRC) of their respective jurisdiction.

02

This form is commonly used by issuers, companies, and individuals engaged in private placements or exempt transactions in compliance with the applicable securities laws and regulations.

03

However, the specific requirements and circumstances may differ depending on the jurisdiction and specific exemptions being claimed. It is important to consult with legal or financial professionals to determine if SEC Form 197 is applicable in your situation.

04

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify sec 197 how to without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like sec 197 how to, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I get sec 197 how to?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the sec 197 how to in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my sec 197 how to in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your sec 197 how to right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is sec 197 how to?

Section 197 refers to the provisions in the Income Tax Act that allow taxpayers to obtain lower or nil tax deduction at source (TDS) on specific types of income. To use this section, individuals must apply to the assessing officer indicating their eligibility for lower TDS.

Who is required to file sec 197 how to?

Taxpayers who expect to earn income on which TDS is applicable and wish to claim a lower TDS rate or exemption from TDS need to file under Section 197.

How to fill out sec 197 how to?

To fill out Section 197, taxpayers must submit Form 13 to the assessing officer along with the requisite documentation supporting their claim for lower TDS. This includes details of income, estimated tax liability, and a declaration of the reasons for requesting a lower rate.

What is the purpose of sec 197 how to?

The purpose of Section 197 is to provide relief to taxpayers facing a high rate of TDS on their income. It allows them to potentially reduce their tax burdens and optimize their cash flow throughout the financial year.

What information must be reported on sec 197 how to?

Information required includes the taxpayer's details, income sources, estimated income for the financial year, the tax liability, and reasons for requesting a lower TDS deduction.

Fill out your sec 197 how to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sec 197 How To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.