Get the free Business Credit Application - Barter Software

Show details

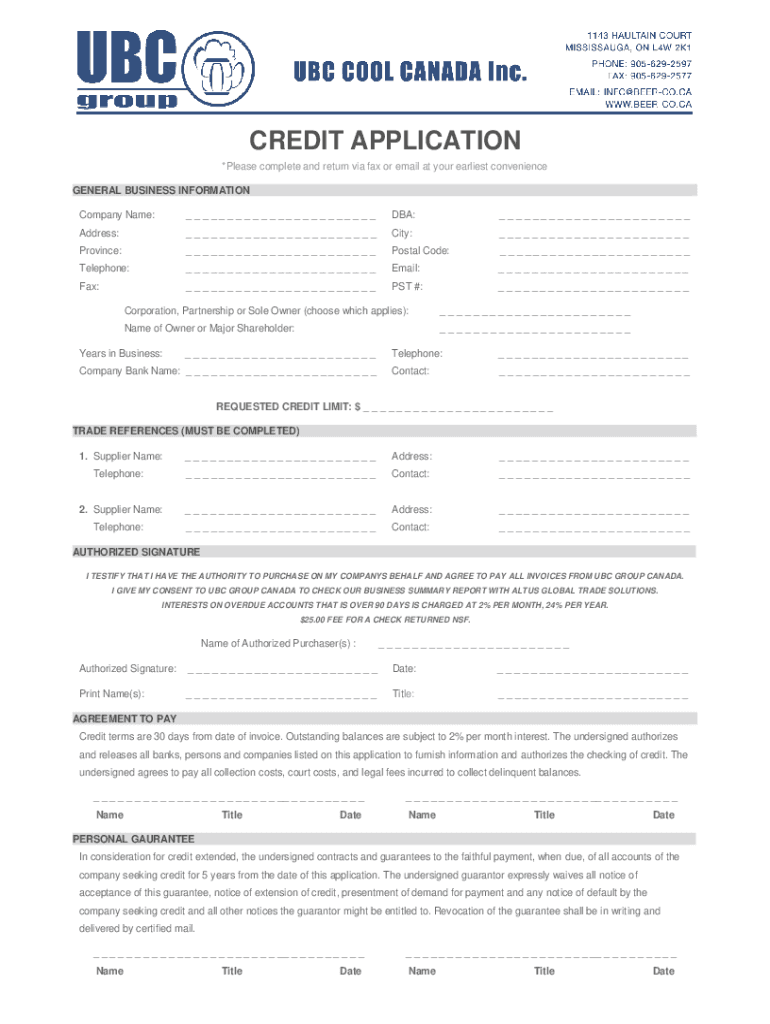

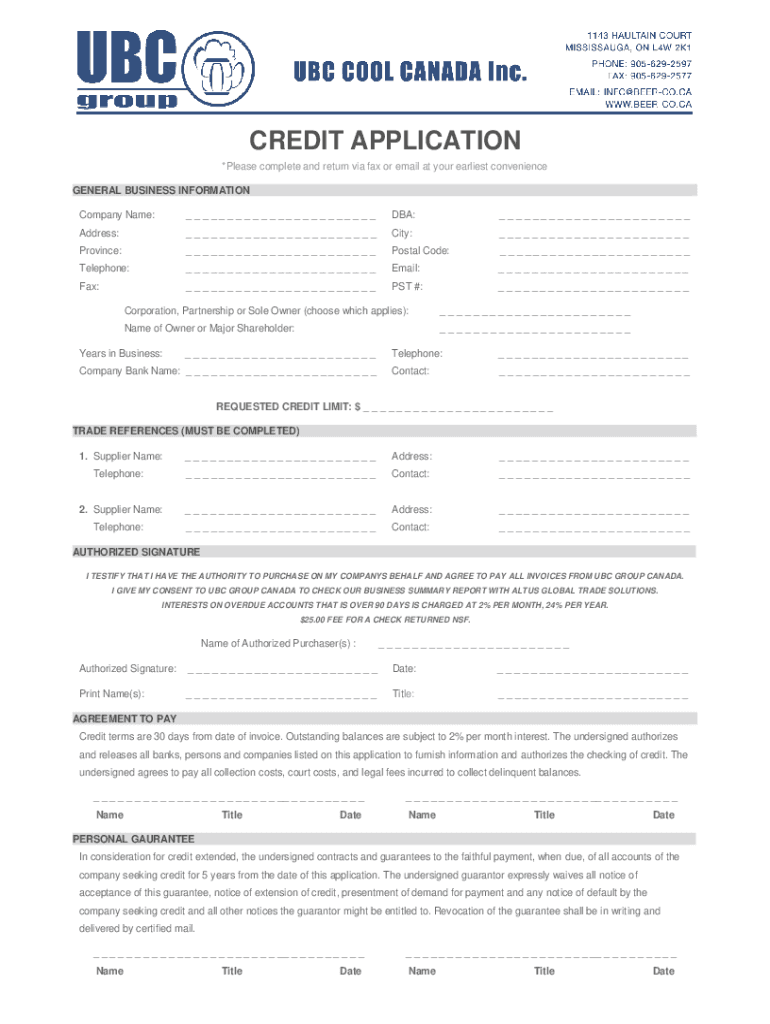

CREDIT APPLICATION *Please complete and return via fax or email at your earliest convenience GENERAL BUSINESS INFORMATION Company Name: DBA: Address: City: Province: Postal Code: Telephone: Email:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credit application

Edit your business credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business credit application online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business credit application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business credit application

How to fill out business credit application

01

Begin by gathering all necessary documents and information. This may include your business's legal name, address, phone number, tax identification number, financial statements, and business plan.

02

Research and choose a suitable lender for your business credit application. Consider factors such as interest rates, terms, and repayment options.

03

Complete the application form accurately and honestly. Provide all required information, including personal and business details, financial history, and credit references.

04

Double-check your application for any errors or omissions before submitting. Review all the supporting documents to ensure they are complete and meet the lender's requirements.

05

Submit the application along with the necessary documents to the chosen lender. Follow up with the lender if needed to ensure they have received your application.

06

Wait for the lender's response. This may take some time as they review your application, check your credit history, and assess your business's financial stability.

07

If approved, carefully review the terms and conditions of the credit offer. Ensure that you understand all the terms, fees, interest rates, and repayment schedules.

08

If you accept the offer, provide any additional documentation requested by the lender and sign the contractual agreements.

09

Start using your business credit wisely and responsibly. Make timely payments, monitor your credit usage, and maintain a good credit history.

10

Regularly review and update your business credit profile. This will help you track your progress and potentially qualify for better credit terms in the future.

Who needs business credit application?

01

Business owners who wish to establish credit for their business.

02

Entrepreneurs looking to obtain financing or loans for their business.

03

Startups or small businesses seeking to build a credit history and improve their chances of obtaining future funding.

04

Companies looking to separate their personal and business finances.

05

Businesses interested in accessing better credit terms, higher credit limits, or special financing options.

06

Established businesses looking to expand their operations or invest in new opportunities.

07

Any business that needs to make larger purchases or manage cash flow effectively.

08

Businesses looking to strengthen their financial position in the market.

09

Companies aiming to establish credibility and reliability in their industry.

10

Business owners wishing to take advantage of business-specific perks and benefits offered by credit card companies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business credit application without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your business credit application into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete business credit application on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your business credit application from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit business credit application on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute business credit application from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is business credit application?

A business credit application is a formal request submitted by a business to obtain credit from a lender or supplier. It includes information about the business's financial status, credit history, and other relevant details to assess creditworthiness.

Who is required to file business credit application?

Businesses seeking to establish credit relationships with lenders or suppliers, or those wishing to increase their credit limits are required to file a business credit application.

How to fill out business credit application?

To fill out a business credit application, a business should provide accurate information about its legal structure, ownership, financial statements, business history, and references. It often requires signature authorization for credit checks.

What is the purpose of business credit application?

The purpose of a business credit application is to evaluate a business's creditworthiness and determine its eligibility for credit. It helps lenders or suppliers make informed decisions regarding credit limits and terms.

What information must be reported on business credit application?

Key information reported on a business credit application includes the business's legal name, address, tax identification number, financial statements, ownership details, credit history, and business references.

Fill out your business credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.