Get the free State Median Income and Federal Poverty Level Calculation Tool

Show details

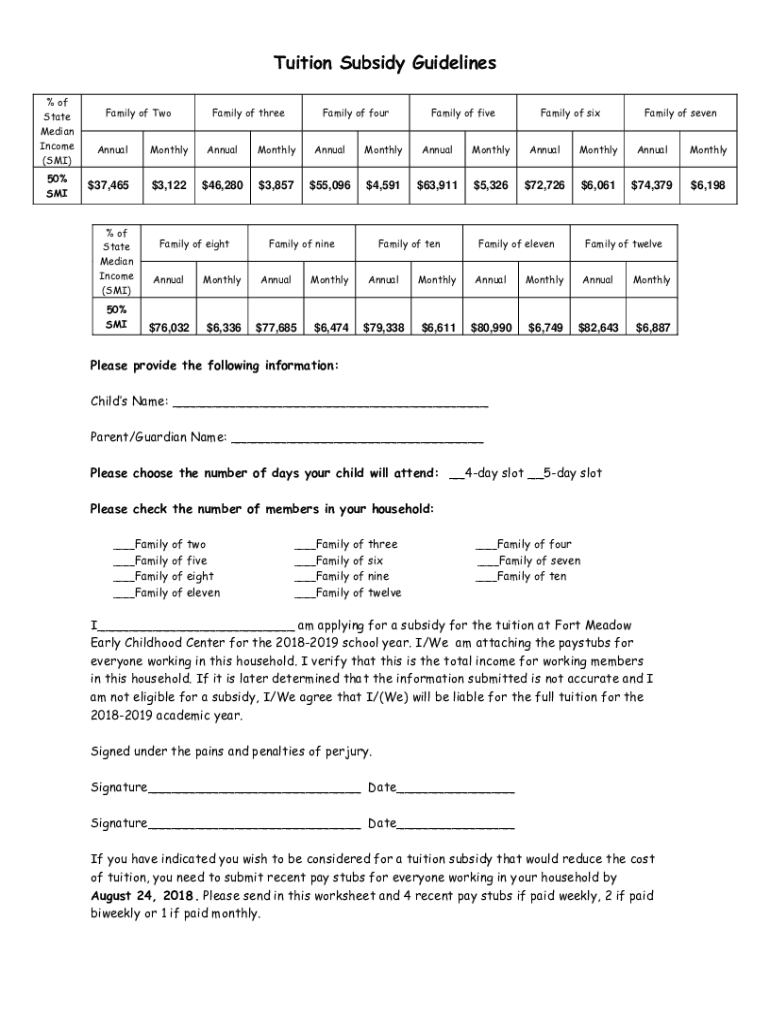

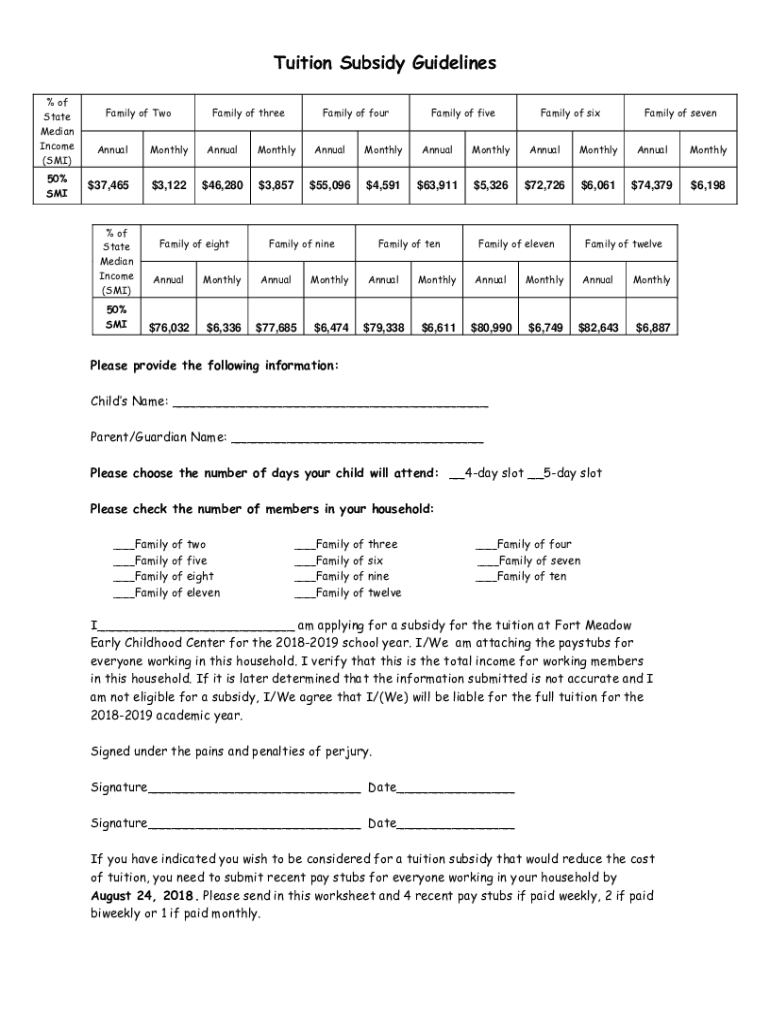

Tuition Subsidy Guidelines

% of

State

Median

Income

(SMI)

50%

Subfamily of Family of threeFamily of subfamily of fiveFamily of subfamily of sevenAnnualMonthlyAnnualMonthlyAnnualMonthlyAnnualMonthlyAnnualMonthlyAnnualMonthly$$$$$$$$37,4653,122$$46,2803,857$$55,0964,59163,9115,32672,7266,06174,3796,198%

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state median income and

Edit your state median income and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state median income and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state median income and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit state median income and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state median income and

How to fill out state median income and

01

To fill out state median income, you need to gather the necessary financial information such as individual or household income, deposits, investments, and assets.

02

Next, you should consult the guidelines provided by your state's government or relevant authority to understand the specific requirements and calculations for determining state median income.

03

Carefully enter the data into the designated fields on the provided form or online platform.

04

Review the filled-out information for accuracy and completeness before submitting it.

05

Make sure to follow any additional instructions or provide supporting documentation as requested.

06

Finally, submit the completed state median income form through the prescribed channels, such as mail or electronically.

Who needs state median income and?

01

State median income is needed by various entities and individuals for different purposes:

02

- Government agencies may require state median income data to determine eligibility for public assistance programs, tax calculations, or economic policy evaluation.

03

- Researchers and academics utilize state median income statistics for socio-economic studies, demographic analysis, or policy research.

04

- Nonprofit organizations may utilize state median income information to assess community needs and develop targeted interventions or programs.

05

- Individuals may need state median income data when applying for certain benefits, scholarships, grants, or loans.

06

- Businesses and employers may use state median income as a benchmark for salary or wage determinations, market analysis, or business planning.

07

- Financial institutions may consider state median income when evaluating loan applications or determining creditworthiness.

08

- Real estate professionals may reference state median income as a factor in property valuation, market research, or development planning.

09

- Policy advocacy groups may utilize state median income data to highlight income disparities, advocate for equitable policies, or promote social justice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my state median income and in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your state median income and along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit state median income and in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing state median income and and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the state median income and form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign state median income and and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is state median income?

State median income refers to the middle income value for residents of a specific state, which divides the population into two equal halves: one half earns more, and the other half earns less. It is often used to determine eligibility for various state and federal programs.

Who is required to file state median income?

Individuals and households seeking assistance or benefits based on income levels, such as housing assistance, food programs, or certain tax credits, may be required to report their income relative to the state median income.

How to fill out state median income?

To fill out a state median income form, individuals should provide their household income information, including wages, benefits, and any other income sources. They may need to compare their income to the state median figures provided in guidelines based on family size.

What is the purpose of state median income?

The purpose of establishing a state median income is to gauge economic well-being, assist in the allocation of resources, and determine eligibility for welfare programs. It serves as a standard for policymakers and agencies to assess financial needs.

What information must be reported on state median income?

Information that must be reported generally includes total household income, number of household members, sources of income, and sometimes personal identifying information for verification purposes.

Fill out your state median income and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Median Income And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.