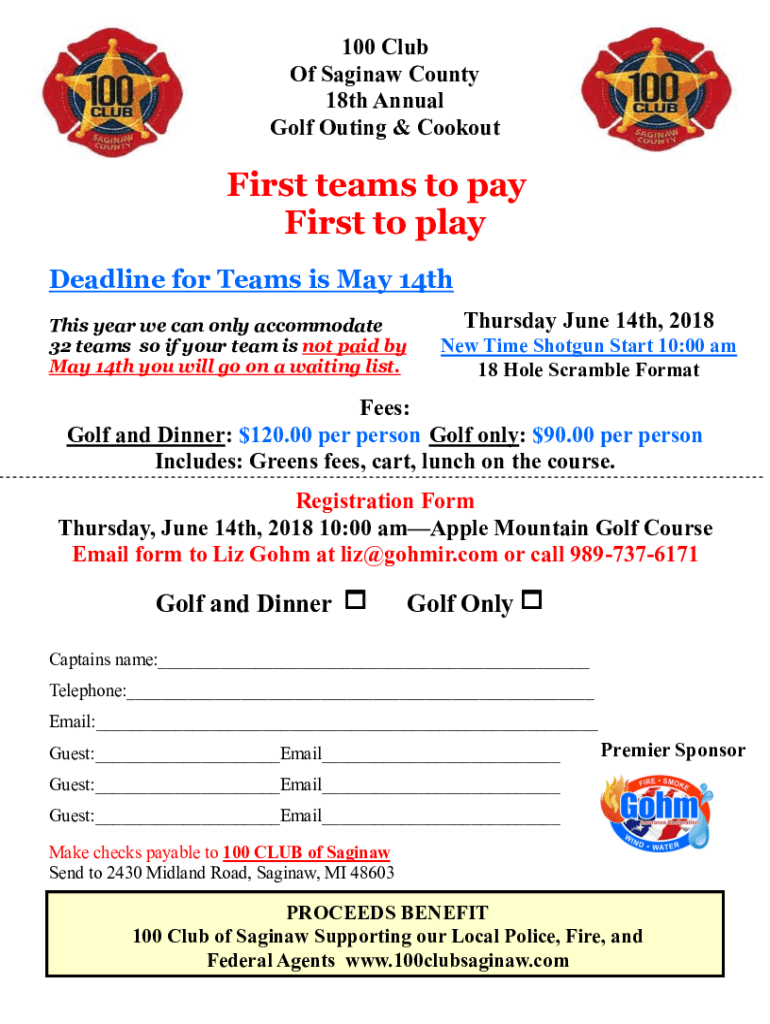

Get the free First teams to pay First to play - 100clubsaginaw.com

Show details

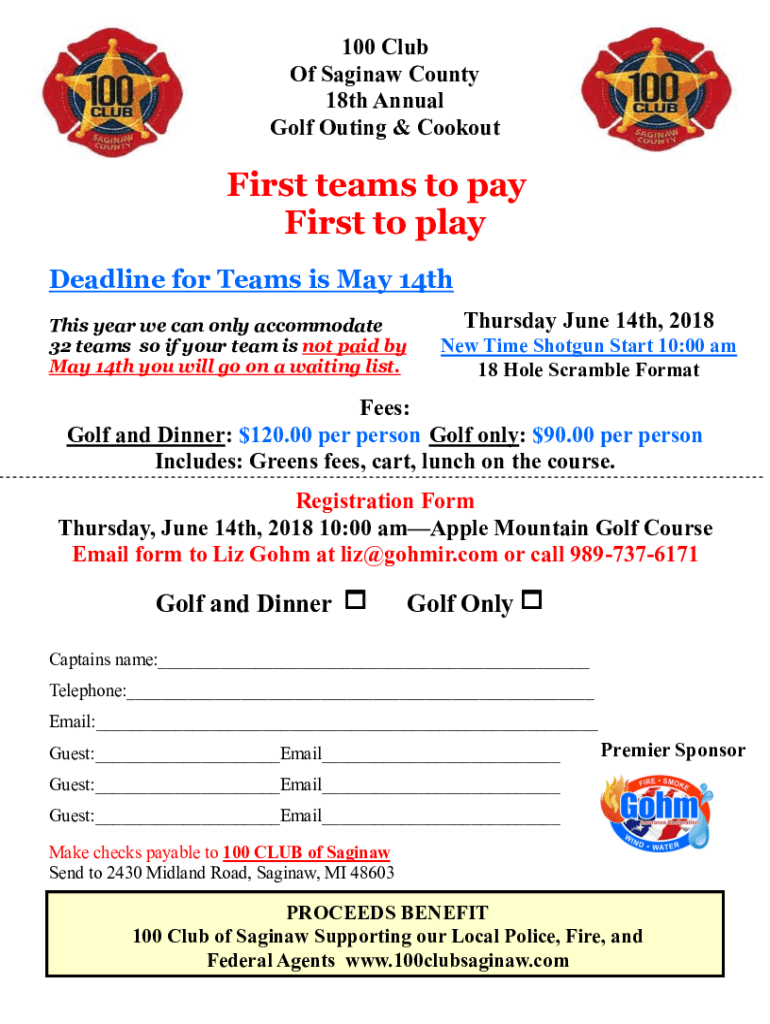

100 Clubs Of Saginaw County 18th Annual Golf Outing & CookoutFirst teams to pay First to play Deadline for Teams is May 14th This year we can only accommodate 32 teams so if your team is not paid

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign first teams to pay

Edit your first teams to pay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first teams to pay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing first teams to pay online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit first teams to pay. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out first teams to pay

How to fill out first teams to pay

01

Start by gathering all the necessary information about the first teams to pay, such as their names, contact details, and the amount they owe.

02

Prepare a list or spreadsheet to record this information. You can use software like Microsoft Excel or Google Sheets for this purpose.

03

Add a column for the payment status, where you can mark whether the payment has been made or is pending.

04

Contact each team individually and inform them about the amount they owe and the payment methods available.

05

Provide clear instructions on how they can make the payment, including any required bank account details or online payment links.

06

Follow up with each team to ensure they have received the payment instructions and assist them if they have any difficulties.

07

Regularly update the payment status in your list or spreadsheet as teams make the payments.

08

Maintain a record of all the payments received, including the date, method of payment, and any reference numbers.

09

If any teams fail to make the payment within the specified timeframe, send them reminders or follow your organization's policies for handling unpaid dues.

10

Once all the teams have paid, reconcile the payments received with the recorded amounts to ensure the accounts are balanced.

Who needs first teams to pay?

01

First teams to pay are needed by organizations or clubs that require individuals or groups to make an initial payment before participating in an event, competition, or program.

02

This can be applicable to sports teams, recreational groups, educational institutions, or any other organization that charges fees or dues to its members.

03

By having first teams to pay, these organizations can ensure the financial commitment of the participants and cover the necessary costs associated with organizing and running the activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute first teams to pay online?

pdfFiller makes it easy to finish and sign first teams to pay online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in first teams to pay without leaving Chrome?

first teams to pay can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I fill out first teams to pay on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your first teams to pay by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is first teams to pay?

First teams to pay refers to the initial financial obligations or contributions that certain teams are required to fulfill, often related to employment taxes or organizational fees.

Who is required to file first teams to pay?

Employers and organizations that have employees or members who are subject to payroll and other relevant taxes are typically required to file first teams to pay.

How to fill out first teams to pay?

To fill out first teams to pay, organizations must gather necessary financial documents, calculate relevant taxes or fees, complete the designated forms accurately, and ensure all information is clearly reported.

What is the purpose of first teams to pay?

The purpose of first teams to pay is to ensure compliance with tax obligations and regulations, and to facilitate the proper collection of taxes owed to government entities.

What information must be reported on first teams to pay?

The information typically reported includes total payroll amounts, employee earnings, deductions, and taxes withheld, as well as identifying information about the organization and its employees.

Fill out your first teams to pay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

First Teams To Pay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.